SoundHound AI Predicts Doubling Revenue: What Investors Should Know

When a management team forecasts that its revenue will double in the upcoming fiscal year, it’s a signal that investors should watch closely. Such predictions are relatively rare and may indicate broader industry trends, particularly when a company’s growth is projected to be significant.

SoundHound AI (NASDAQ: SOUN) has made just such a prediction, leading investors to respond positively after the company’s earnings release. With revenue anticipated to double, could there be even more growth potential?

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. Learn More »

SoundHound AI Positioned for Significant Growth

Although SoundHound is recognized as an artificial intelligence (AI) company, its approach differs from many competitors. Rather than relying on text input, it focuses on audio-based interactions.

This audio capability is valuable in various scenarios, including fast-food drive-thru orders and digital vehicle assistants. Additionally, any service involving phone communication could be optimized through SoundHound’s automation solutions.

While other digital assistants, like Amazon‘s Alexa and Apple‘s Siri, have been in the market for years, none match SoundHound’s performance, making it a noteworthy technology to follow.

Demand for its offerings has surged, with the company reporting a 101% revenue increase in the fourth quarter, totaling $34.5 million. This growth sets 2024 revenue at $84.7 million, with management projecting sales between $157 million and $177 million for 2025—essentially doubling last year’s figures.

Looking beyond 2025, prospects remain bright. The revenue backlog, which reflects the total contract value not yet realized, is nearly $1.2 billion—an increase of 75% year-over-year. Investors should anticipate that this figure will continue to grow as more contracts are secured throughout 2025.

While SoundHound is not currently profitable, the management forecasts adjusted profitability by the end of 2025. This milestone is crucial as the company possesses $200 million in cash and no debt, ensuring it can sustain its growth trajectory.

Despite the company’s solid fundamentals, the stock has become relatively pricey over recent months.

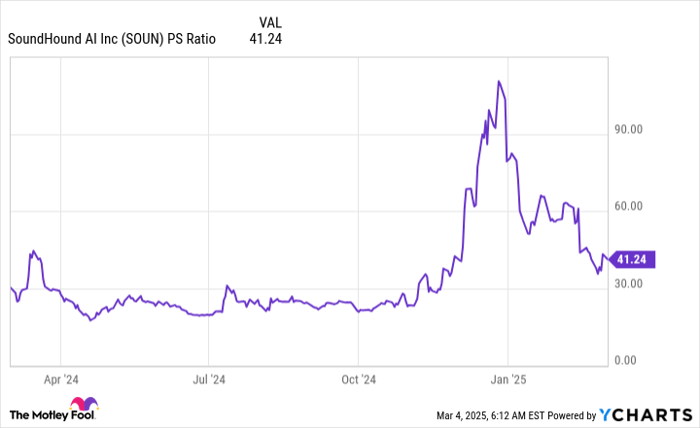

The Valuation of SoundHound Stock Has Declined Recently

Even though the company’s valuation has decreased from its peak, it remains on the higher side.

SOUN PS Ratio, data by YCharts; PS = price to sales.

With a ratio of 41.2 times sales, the stock commands a premium valuation, justified by the expectation that revenue will double over the next year. By the end of 2025, if the stock price remains stable, it may trade around 20 times sales, similar to many other software companies.

Moreover, with a substantial revenue backlog ensuring growth over the coming years, the business’s rapid expansion should continue. Therefore, it’s plausible that the stock price already accounts for a year or two of future growth. Investors considering a position in the stock should be comfortable with the following considerations:

- SoundHound’s growth potential will persist beyond 2026.

- Investors need to tolerate volatility, as the stock tends to fluctuate significantly.

- A holding period of three to five years is necessary.

For those aligned with these views, initiating a position in SoundHound AI may be a prudent move. However, patience will be essential due to potential price swings resulting from high valuation and rapid growth in a relatively small market cap.

Don’t Miss Out on a Potential Investment Opportunity

If you feel you’ve missed previous chances to invest in high-performing stocks, this might be your moment.

Occasionally, our team of analysts recommends a “Double Down” Stock for companies poised for growth. If you’re anxious about having missed your investment opportunity, now could be the optimal time to act before it’s too late. The following examples illustrate potential returns:

- Nvidia: If you invested $1,000 during our double-down in 2009, you’d have $292,207!*

- Apple: If you invested $1,000 during our double-down in 2008, you’d have $45,326!*

- Netflix: If you invested $1,000 during our double-down in 2004, you’d have $480,568!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and there may not be another opportunity like this soon.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.