AMD’s 2025 Performance Highlights

Advanced Micro Devices (NASDAQ: AMD) reported a 36% year-over-year revenue growth, reaching $9.2 billion in its latest financial results, surpassing analyst expectations of $8.7 billion. The company’s adjusted earnings per share stood at $1.20 compared to the predicted $1.16. AMD’s stock soared by 77.3% in 2025, and as of January 29, it has increased by 121% over the past year, reflecting rising demand for its AI products.

Market Position and Future Growth Potential

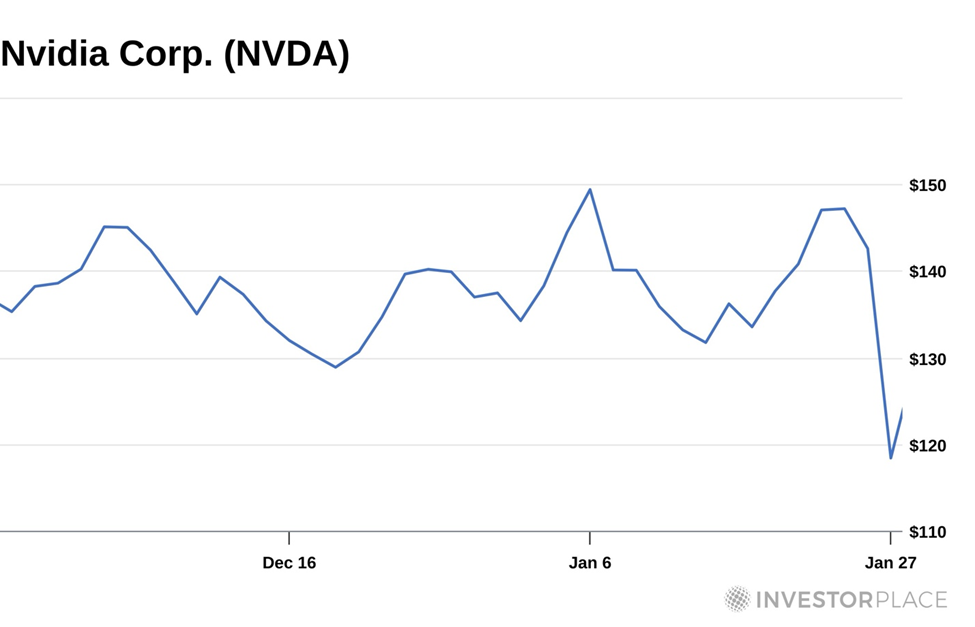

With a market capitalization of approximately $411 billion, AMD is significantly smaller than Nvidia, valued at $4.65 trillion, offering ample growth opportunity in the AI chip market projected to grow at a 15.7% compound annual growth rate, reaching $565 billion by 2032. AMD’s management anticipates fourth-quarter revenue of $9.6 billion, which would position the company for a full-year revenue of $34 billion, indicating a 31% growth rate.

Wall Street Sentiment

A consensus among 43 analysts rates AMD stock a moderate buy, with an average score of 4.4 out of 5 and a high target price raised to $380, suggesting a potential 50% upside over the next year.