Stanley Black & Decker: A Resilient Turnaround Story Amid Financial Challenges

Stanley Black & Decker (NYSE: SWK) is a leading manufacturer of tools, including popular brands like DeWalt, Craftsman, Irwin, and LENOX. Despite its strong brand recognition, the company’s stock has faced significant declines, plummeting 61.7% from its peak in 2021. This is a stark contrast to a more modest increase of less than 21% from its ten-year low, which was recorded on March 19, 2020, during the turmoil of the COVID-19 pandemic.

Surprisingly, this decline comes despite Stanley Black & Decker being a Dividend King, boasting a yield of 3.9% and 56 consecutive years of dividend increases. Typically, the companies in this category demonstrate dependable growth to support their rising dividends. While there are short-term pressures ahead, patient investors may find potential value here.

Image source: Getty Images.

A Turbulent Journey from Peaks to Recovery

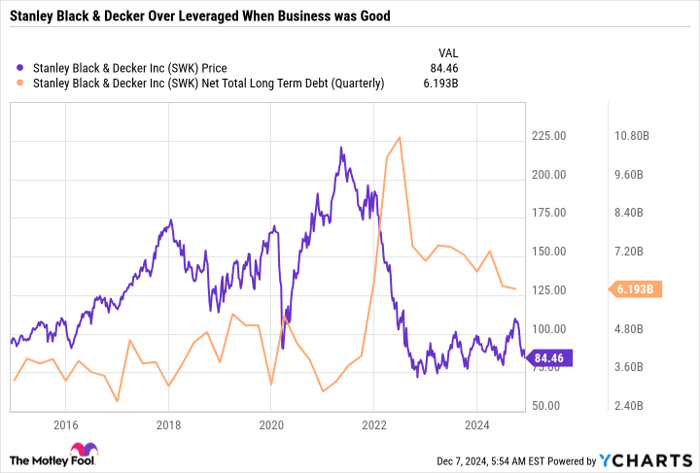

The past few years have been tumultuous for Stanley Black & Decker. During the COVID-19 pandemic, the company saw a boom in demand for home improvement tools as people tackled DIY projects, leading to aggressive investments with $1.9 billion spent on acquisitions in December 2021. This surge in business coincided with peaks in the company’s stock price and total long-term debt, reflecting a fleeting optimism among investors.

SWK data by YCharts.

Unfortunately, the initial spike in sales was not sustainable. It merely advanced revenue that should have been earned in future years. By overextending itself with debt, Stanley Black & Decker found itself struggling to cope when demand fell, leading to negative cash flow. In response, the company initiated a cost-cutting strategy and sold its STANLEY Infrastructure division in December 2023 for $760 million to reduce debt burden.

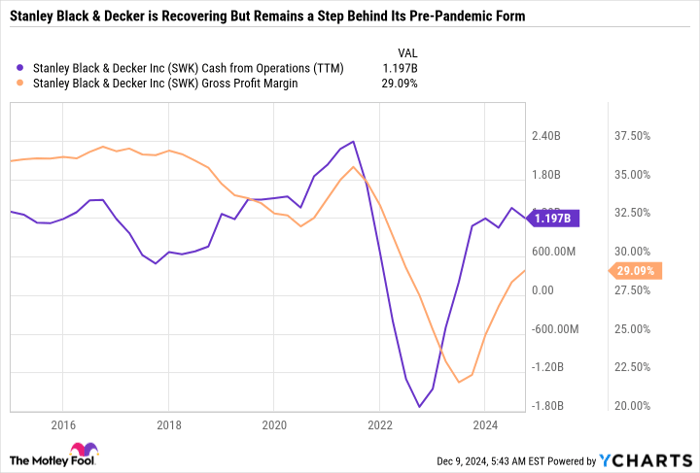

The recovery plan shows signs of progress. Recent charts reveal improvement in gross margins and operating cash flow. However, the company has not yet met its target of 35% gross margins, contributing to recent stock weakness.

SWK Cash from Operations (TTM) data by YCharts.

During its third-quarter 2024 earnings call, Stanley Black & Decker reported a 5% decrease in revenue compared to the same quarter last year, highlighting ongoing demand challenges. Nonetheless, the firm is working towards achieving $2 billion in pre-tax cost savings by the end of 2025, having reached $1.4 billion in savings so far.

Challenges Ahead in Achieving Growth Targets

Although there are signs of recovery, Stanley Black & Decker faces challenges in achieving its goal of 35% gross margin by 2025. On the third-quarter earnings call, CEO Donald Allan emphasized the influence of interest rates on margin improvement:

“I’d say what’s really going to affect it probably as much or more than anything is at what pace do interest rates start taking effect. And how quickly does auto correct because that’s a very profitable part of that Industrial business. And then how much fixed-cost reduction activity will be able to both implement and complete in time for it to roll off the balance sheet next year.”

In recent weeks, Stanley Black & Decker’s stock has declined by 8.2%. This downward trend may stem from concerns about interest rates. Federal Reserve Chair Jerome Powell recently noted the economy’s strength but cautioned that inflation is slightly above expectations, signaling that the Fed might maintain higher interest rates for a longer period. This situation poses a risk for rate-sensitive firms like Stanley Black & Decker.

Investment Considerations

Despite the setbacks, Stanley Black & Decker potentially represents a valuable turnaround stock. The current yield of 3.9% exceeds that of many other Dividend Kings. While the company has raised dividends by a modest one cent per share since 2021 just to maintain its streak, increases typically expected from companies in this category are between 5% to 10%. The present situation calls for caution until the business stabilizes.

Investors may find this stock appealing due to its turnaround timeline. After two years of stagnation in stock prices, substantial progress has been made. If targets are met, the turnaround could largely conclude within a year, although the company will still have challenges ahead. Interestingly, Stanley Black & Decker’s forward price-to-earnings ratio stands at 20.4, suggesting that strong earnings growth in 2026 could make the stock appear undervalued.

Taking all this into account, Stanley Black & Decker represents a compelling dividend investment for those willing to commit to a three- to five-year time frame, keeping in mind the uncertainties surrounding the company’s path to recovery.

Is Now the Right Time to Invest $1,000 in Stanley Black & Decker?

Before making any investment decision, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team has recently identified what they believe are the 10 best stocks to invest in right now, with Stanley Black & Decker not making the cut. The selected stocks have the potential to provide exceptional returns in the coming years.

For instance, if you had invested $1,000 in Nvidia back on April 15, 2005, when it was recommended, your investment would have grown to an impressive $841,692!*

Stock Advisor offers easy-to-follow guidance for investors on building a successful portfolio, with regular updates from analysts and two new stock picks each month. The program has more than quadrupledthe return of S&P 500 since 2002*.

Discover the 10 stocks »

*Stock Advisor returns as of December 9, 2024.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.