Why Coupang Defies Market Trends with Strong Growth Potential

Technology, cryptocurrency, and artificial intelligence (AI) stocks have taken a hit in February. However, Coupang (NYSE: CPNG) has largely defied this trend. Following a solid report of fourth-quarter growth for 2024 after markets closed on Tuesday, the company is capitalizing on expansion into financial technology, new markets such as Taiwan, and food delivery services, contributing to robust growth on its platform.

The encouraging news is that Coupang has substantial growth potential ahead, having surpassed $30 billion in annual revenue. Nevertheless, as of Thursday’s market close, the stock was down 2.6% in the two days following the earnings release. It appears that the market may be undervaluing Coupang Stock. Here’s why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Strong Financial Performance

Coupang’s earnings report reflected positive results across various metrics. For the fourth quarter, revenue increased by 21% year over year, reaching $8 billion. This figure accounts for both organic growth and foreign currency stabilization. Although Coupang primarily operates in South Korea, it is headquartered in the U.S. and reports in U.S. dollars, meaning its growth can be influenced by fluctuations in currency exchange rates. Notably, Coupang also acquired the luxury platform Farfetch, which provided a temporary boost to revenue growth.

Even more impressive was the gross profit growth of 48% year over year, which remains at 29% if excluding Farfetch and an insurance payout related to a warehouse fire. Adjusted gross margin, an important measure focusing on core profitability, reached 29%, up from 25% the previous year. This indicates that Coupang is growing not only in revenue but also in profitability.

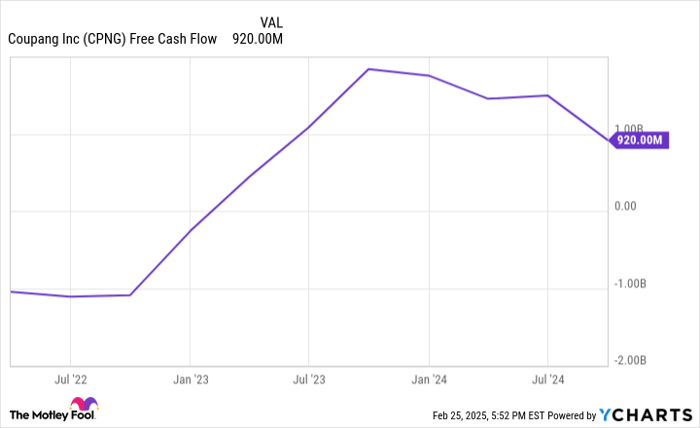

While Coupang’s net income fell to $131 million due to substantial investments in new offerings, the full-year free cash flow amounted to $1 billion. This indicates the company has the means to self-fund its growth through its available capital—a strong sign of a healthy business.

The Developing Offerings division, encompassing international e-commerce, financial technology, and food delivery, showcased outstanding growth with revenue skyrocketing over 300% year over year (or 136% when excluding the Farfetch impact). This segment is generating $1.1 billion in quarterly revenue and is expected to continue expanding, drawing an increasingly larger share of Coupang’s business.

Future Prospects Among Existing Customers

Although the Developing Offerings segment shows tremendous potential, the core e-commerce marketplace in South Korea remains robust. According to the company’s earnings slides, customers who joined Coupang more than six years ago continue to increase their spending, while newer customers from this year are starting with higher spending levels.

This trend bodes well for Coupang shareholders, indicating additional growth opportunities among existing customers. On a foreign currency neutral basis, spending per active customer rose by 6% year over year. Should these new customers follow the spending patterns of previous cohorts, significant growth in active customer spending is likely.

Additionally, Coupang continues to attract new active customers annually, with total active users growing by 10% year over year, reaching 22.8 million in Q4 2024.

CPNG Free Cash Flow data by YCharts.

Coupang’s Valuation Remains Attractive

Looking ahead, Coupang aims for an adjusted profit margin of 10%. While adjusted figures can sometimes misrepresent profitability, Coupang’s efficient operations and robust free cash flow generation lend credibility to its targets.

Furthermore, the company’s unique business model allows it to collect payments from customers before settling with e-commerce suppliers, optimizing its working capital cycle and enhancing free cash flow.

Given these factors, Coupang’s free cash flow margin could reach 10% or higher as the business matures. With $30 billion in annual revenue and the potential to exceed $50 billion in the next few years, Coupang is well-positioned for growth. That projection could translate to over $5 billion in annual free cash flow at a 10% margin.

Currently, Coupang’s market capitalization is just under $43 billion, representing about 9 times its projected free cash flow. This valuation seems low for a company experiencing gross profit growth close to 30% year over year and a Developing Offerings segment expanding over 100% year over year. Consequently, it appears the market may still undervalue Coupang Stock following its recent earnings pop. It represents a promising investment opportunity for today’s investors.

Should You Invest $1,000 in Coupang Now?

Before deciding to invest in Coupang Stock, consider this:

The Motley Fool Stock Advisor analyst team has highlighted what they consider the 10 best stocks for investors to buy right now, and Coupang did not make that list. The stocks selected have the potential for significant returns in the coming years.

For context, when Nvidia appeared on this list on April 15, 2005, a $1,000 investment at the time would now be worth $736,343!*

Stock Advisor provides investors with a straightforward success plan, including portfolio building guidance, routine updates from analysts, and two new Stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of February 28, 2025

Brett Schafer has positions in Coupang. The Motley Fool recommends Coupang. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.