IonQ’s Potential: The Next Big Thing in Quantum Computing?

As new megatrends emerge, small companies often leap into prominence. Within the realm of artificial intelligence (AI), quantum computing has garnered significant attention. While one might expect this trend to bolster established tech giants like Nvidia, Microsoft, Alphabet, and Amazon, investors sometimes seek fresh opportunities, leading them to explore nascent sectors and companies.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In the quantum computing field, a small firm named IonQ (NYSE: IONQ) has quickly gained popularity. Its shares have surged by 222% over the past six months, and CEO Niccolo de Masi has made headlines with bold claims, suggesting monumental growth could be on the horizon. Could investing in IonQ now be akin to buying Nvidia before the AI boom?

IonQ’s CEO Makes a Provocative Statement

The computing industry has undergone significant transformations over the decades. The introduction of the central processing unit (CPU) marked a pivotal advancement, allowing for sophisticated instruction processing vital to modern computing. In the 1990s, Intel was a key player in CPU development for personal computers.

In the early 2000s, graphics processing units (GPUs) gained popularity, enhancing the visual experience for video gaming. Their specialized designs enable efficient parallel processing of data, which is essential for certain computational tasks. While Nvidia led the charge in GPU innovation, Advanced Micro Devices has emerged as a notable contributor in recent years. Presently, GPUs are crucial for the rise of generative AI applications, which demand their specific processing capabilities.

As the tech sector looks forward, quantum computing is at the forefront, promising a novel way to process data. Although these advanced machines can tackle complex problems at unparalleled speeds, they currently have few practical applications. Nonetheless, some industry experts argue that quantum computing could represent the next computing evolution, making it a potentially lucrative investment area.

In a recent CNBC interview, IonQ’s CEO referred to the company as the “800-pound gorilla” in quantum computing and likened its potential future to Nvidia’s rise before the AI revolution.

🚨 $IonQ ‘s new CEO on CNBC:

“We are decades ahead of MSFT, IBM, AMZN.” 👀

“We are what NVDA was a few years ago.” 🔥@IonQ_Inc @NiccoloDeMasi pic.twitter.com/sXmzqIXYZL

— The Dude (@1_regular_dude) February 27, 2025

Evaluating the Comparison to Nvidia

During the interview, De Masi compared IonQ’s position to Nvidia’s situation a decade ago. To determine the validity of this claim, let’s examine the numbers.

In Nvidia’s fiscal year 2015, which concluded on January 25 of that year, the company reported revenues of $4.7 billion, with a net income of approximately $631 million. At that time, its market capitalization was around $11.3 billion.

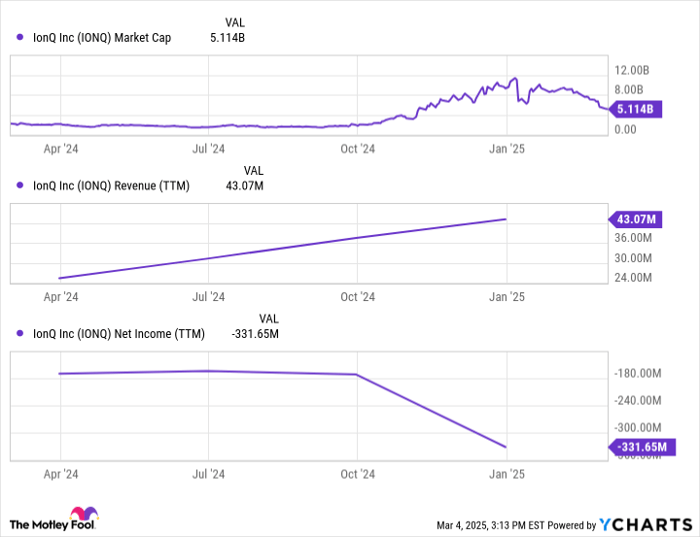

IONQ Market Cap data by YCharts.

IonQ, however, remains a smaller player than Nvidia was a decade ago. Moreover, the company’s cash burn rate has increased, even as it experiences accelerated revenue growth. This raises concerns about sustainability given its limited revenue base.

Image source: Getty Images.

Should Investors Consider IonQ Stock?

In my assessment, equating IonQ’s current state to what Nvidia experienced before the AI revolution is misguided. IonQ’s stock is trading at a price-to-sales (P/S) ratio exceeding 100, while Nvidia’s P/S was only 2.4 in early 2015.

This stark valuation contrast implies that investors may have overlooked Nvidia’s future potential at that time. Few recognized that GPUs could extend beyond gaming toward broader computing applications. As a result, Nvidia traded at a humble multiple despite a thriving and profitable business. Investing in IonQ stock today does not parallel that situation; it carries a significantly higher valuation premium.

Additionally, IonQ’s valuation has escalated rapidly in just a few months, and even with a considerable pullback, it might still be overvalued due to its low sales and high cash burn. While investing in quantum computing could resemble an early bet on AI, I advise caution. Substantial development is still required before quantum computing becomes a practical technology, and this process may take decades.

Unless you can afford to wait with your investments and withstand significant volatility, I would recommend against investing in IonQ stock at this moment.

Missed Chances: A Second Opportunity?

Have you ever felt you missed the opportunity to invest in successful stocks? If so, this news might interest you.

Occasionally, our team of expert analysts issues a “Double Down” Stock recommendation for companies poised for significant gains. If you’re concerned about having missed your chance, now may be the best time to invest before it’s too late. The results are compelling:

- Nvidia: if you invested $1,000 when we advised doubling down in 2009, you’d have $292,207!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,326!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,568!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and the time to act may be limited.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.