Lucid Motors Faces Financial Challenges While Improving Liquidity

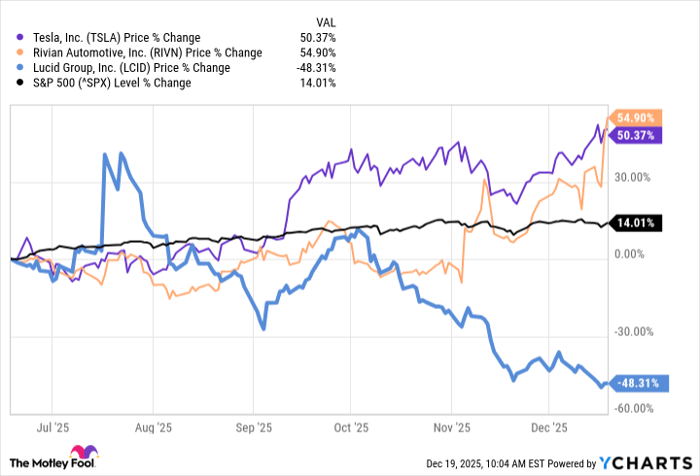

Lucid Motors (NASDAQ: LCID) has seen its stock value drop 50% in 2023, contrasting sharply with gains from competitors Rivian (NASDAQ: RIVN) and Tesla (NASDAQ: TSLA). The automaker recently acknowledged its struggles in a message to investors, promising transparency and highlighting a robust liquidity position. In Q3, Lucid raised $975 million through convertible senior notes due in 2031, which it plans to use for repurchasing existing notes and general corporate purposes, effectively extending financial obligations.

Additionally, Lucid reached an agreement with Saudi Arabia’s Public Investment Fund to increase an untapped credit line from $750 million to $2 billion, elevating its total liquidity at quarter’s end to approximately $5.5 billion. This funding is expected to support the company’s growth amid production ramp-up of the Gravity SUV and the upcoming launch of a midsize platform. However, investors remain cautious due to high cash burn rates and concern over the fund’s significant ownership stake in Lucid, which could influence future decisions.