Trump Media & Technology Group: A Risky Bet Amid Market Volatility

Trump Media & Technology Group (NASDAQ: DJT), which oversees the Truth Social media platform, has experienced significant fluctuations since it began trading in March following a merger with a special purpose acquisition company to go public. The company has established a market cap nearing $7 billion but reported only $3.7 million in revenue over the last four quarters.

Investor Expectations Hang in the Balance

Investors are pinning their hopes on Trump’s large following, a strong cash reserve, and current political trends to transform Truth Social and the recently launched streaming service, Truth+, into profitable ventures. However, questions linger about whether the stock can help investors realize millionaire status, with potential hurdles ahead.

Changing Media Landscape Threatens Truth Social’s Appeal

Launched in early 2022, Truth Social was designed as an alternative platform for users seeking unrestricted free speech, especially after Trump faced bans from major social media networks following the January 2021 Capitol events. However, the media environment has shifted significantly. Major companies like Meta Platforms and Alphabet have lifted their suspensions on Trump, while Tesla CEO Elon Musk has allowed Trump’s return to X (formerly Twitter). These developments reduce the unique position Truth Social once held for Trump and his supporters.

The Election’s Implications for Trump Media & Technology

The recent election outcome reestablished Trump’s presidency and granted his party control over all branches of the federal government. This alignment may enhance the chances of legislation that aligns with Trump’s views on content moderation. However, if mainstream platforms reduce their restrictions, Truth Social could face stiff competition for users seeking diverse avenues for free expression.

Stock Valuation Raises Investor Concerns

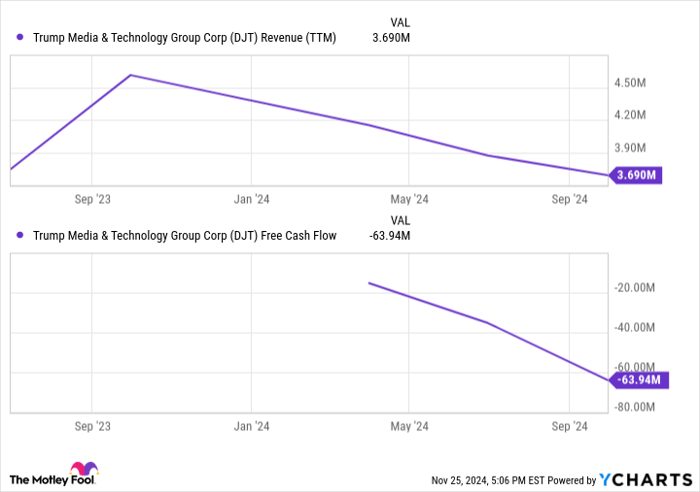

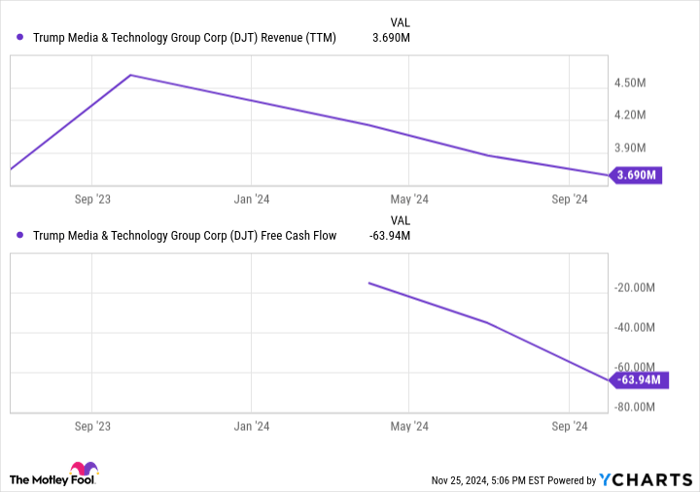

Ultimately, the largest challenge for investors is the stock’s valuation. With $673 million in cash on hand, the effective enterprise value exceeds $6 billion despite generating less than $4 million in annual revenue. Additionally, revenue is on a downward trend, and losses are increasing.

DJT Revenue (TTM) data by YCharts

The stock has also plummeted 47% since its first day of trading on March 26, 2024. Without concrete financial progress, Truth Social and Truth+ are under increasing pressure to demonstrate substantial growth. Currently, the stock appears to be fluctuating based on market sentiment rather than fundamentals, which limits its potential for sustainable appreciation.

Weighing Investment Choices Carefully

For those looking to capitalize on the next big stock trend, caution is advisable. Transforming a $1,000 investment into $1 million would require an improbable 100,000% increase. Even with a penchant for risk, this stock may not be suitable for significant investment. The lack of robust revenue and user base growth could spell trouble, placing Trump Media & Technology in a precarious spot.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.