Taiwan Semiconductor’s Stock Drop: A Buyer’s Opportunity Amid Market Turmoil

Taiwan Semiconductor Manufacturing Company (TSM) has seen its stock decline by nearly 16.9% over the past month, a downturn linked to a wider market sell-off. Investor sentiment has turned negative due to escalating trade war tensions, with rising tariffs causing concerns about increased costs and reduced consumer purchasing power. This decline has particularly affected technology stocks, including notable firms such as NVIDIA Corporation (NVDA), Broadcom Inc. (AVGO), and Advanced Micro Devices, Inc. (AMD). However, the long-term outlook for TSM continues to appear strong.

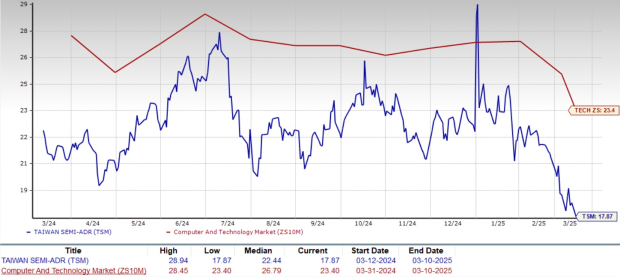

TSM Stock Price: One-Month Performance Overview

Image Source: Zacks Investment Research

Investors are encouraged to view this decline not as a warning sign but as a valuable opportunity to invest in a leading semiconductor company at a discounted price.

AI Demand Drives TSM’s Future Growth

TSMC is at the forefront of the artificial intelligence (AI) revolution, manufacturing advanced chips essential for AI applications and high-performance computing (HPC). The demand for AI accelerators, which include graphics processing units (GPUs) and custom silicon, is experiencing rapid growth, with TSM played a crucial role for companies such as NVIDIA, Broadcom, and AMD.

By 2024, revenues linked to AI have tripled, constituting a significant mid-teen percentage of TSM’s total revenues. The company anticipates that AI-related sales will double again in 2025, projecting a remarkable 40% compound annual growth rate over the next five years. This trend positions TSM as a key player in the future of AI-driven technology.

The transition to advanced 3nm and 2nm process nodes is pivotal in maintaining its industry-leading status. These cutting-edge nodes enhance both efficiency and performance, establishing TSM as the preferred foundry for semiconductor manufacturing.

Capacity Expansion Reinforces TSM’s Industry Dominance

TSMC is not only expanding but doing so at an extraordinary rate. The company plans to invest between $38 billion and $42 billion in capital expenditures in 2025, a significant increase from the $29.8 billion allocated in 2024. Approximately 70% of this investment will focus on advanced manufacturing technologies, ensuring TSM remains competitive.

A vital element of this expansion is geographic diversification. TSM’s Arizona facility has already begun high-volume chip production, while additional fabs are currently being built in Japan and Germany.

Although some investors may express concerns regarding the costs associated with these international operations, management reassures stakeholders that the effect on gross margins will be minor, estimated at 2-3 percentage points annually. These strategic investments aim to enhance supply chain resilience and meet increased customer demand, thereby strengthening TSM’s market advantage.

Solid Financial Performance Proves TSM’s Resilience

Taiwan Semiconductor’s latest earnings report illustrates the company’s continued dominance in the market. In the fourth quarter of 2024, revenues soared by 37% year over year to $26.88 billion, exceeding estimates by $504 million. Earnings per share (EPS) reached $2.24, surpassing forecasts, while gross margins improved to 59%, reflecting enhanced cost efficiencies.

For updates on all quarterly results: check Zacks earnings Calendar.

The company’s 3nm and 5nm process nodes accounted for 60% of total wafer revenues, further reinforcing its leadership in the advanced semiconductor field. High-performance computing, a significant growth driver spurred by AI adoption, represented 53% of overall revenues.

For the first quarter of 2025, TSM expects revenue to fall between $25 billion and $25.8 billion, suggesting a robust 34.7% increase at the midpoint. Additionally, the company anticipates maintaining strong margins (between 57% and 59%) despite general industry cost pressures, further confirming its financial strength.

Taiwan Semiconductor has consistently outperformed expectations, surpassing the Zacks Consensus Estimate for earnings in each of the past four quarters with an average surprise of 7.6%. For 2025, EPS is expected to grow by 30.7% to $9.20, indicating robust earnings momentum.

Taiwan Semiconductor Manufacturing Company Ltd. Stock Price, Consensus, and EPS Surprise

Taiwan Semiconductor Manufacturing Company Ltd. price-consensus-eps-surprise-chart | Taiwan Semiconductor Manufacturing Company Ltd. Quote

Valuation: TSM Stock Presents a Rare Buying Opportunity

Despite its impressive growth potential, Taiwan Semiconductor’s stock currently trades at a forward price-to-earnings (P/E) ratio of 17.87, significantly lower than the Zacks Computer and Technology sector average of 23.4. Given TSM’s strong market presence, advantageous AI-driven growth prospects, and continuous expansion, this valuation offers an attractive entry point for investors. Those aiming to benefit from the AI surge and the semiconductor trend should view the recent dip as an opportunity rather than a warning sign.

TSM Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

Conclusion: Now is the Time to Invest in TSM Stock

Market downturns often reveal rare investment opportunities, and TSM’s current stock price drop falls into this category. The company’s strong position in AI chip production, ambitious capacity growth plans, and solid financial results present a convincing case for investment. Though short-term volatility may continue, TSM’s long-term growth path remains secure.

With an appealing valuation and a surge in AI-driven demand, now is an optimal moment to acquire Taiwan Semiconductor stock prior to the market recognizing its full potential.

TSM Earns Zacks Rank #2 as Top Picks Highlighted

TSM currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expert Highlights Stock with Potential to Double

Zacks’ research team has identified five stocks that possess the highest probability of gaining over 100% in the upcoming months. Among these, the Director of Research, Sheraz Mian, emphasizes one stock set to rise significantly.

This standout stock is affiliated with an innovative financial firm that has rapidly expanded its customer base to over 50 million. With a range of state-of-the-art solutions, this company is well-positioned for major growth. While past elite picks may not always succeed, this stock has the potential to exceed previous Zacks Stocks Set to Double, such as Nano-X Imaging, which increased by 129.6% in just over nine months.

For more insights, you can exchange your details for our Top Stock and four additional recommendations.

Are you looking for the latest guidance from Zacks Investment Research? You can now download the report on the 7 Best Stocks for the Next 30 Days. Click here to access this free report.

Analyze these stocks with free reports:

- Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

- NVIDIA Corporation (NVDA): Free Stock Analysis report

- Broadcom Inc. (AVGO): Free Stock Analysis report

- Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

This article initially appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.