When making investment decisions, many investors turn to Wall Street analyst recommendations to guide them. These recommendations can heavily influence a stock’s price. So, what do these financial gurus think about Uber Technologies (UBER)?

Wall Street’s Take on Uber Technologies (UBER)

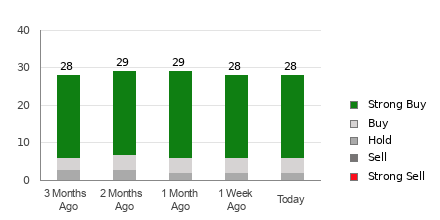

According to 36 brokerage firms, Uber currently has an average brokerage recommendation (ABR) of 1.19, lying between ‘Strong Buy’ and ‘Buy’. Among the 36 recommendations, 31 are ‘Strong Buy’ and three are ‘Buy’, making up a whopping 86.1% and 8.3% respectively.

Check price target & stock forecast for Uber here>>>

While the ABR suggests a bullish sentiment towards Uber, relying solely on this information can be misleading. Research has indicated that brokerage recommendations are often heavily biased, with a notable tendency to skew positively.

Zacks Rank vs. ABR: Unveiling the Truth

Instead, investors should consider the Zacks Rank, a tool that has been externally audited and offers a reliable indicator of a stock’s short-term price performance. The Zacks Rank classifies stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell).

The Zacks Consensus Estimate for Uber’s current year earnings has risen by 1.4% over the past month to $0.37, underlining analysts’ growing optimism for the company’s earnings prospects. This, coupled with other factors, has resulted in a Zacks Rank #2 (Buy) for Uber.

So, while the ABR indicates a ‘Buy’, it’s essential to corroborate this with the Zacks Rank for a more well-rounded investment decision.

Understanding the Discrepancy

It’s important to note the clear disparity between ABR and Zacks Rank. Although both are rated on a scale of 1-5, ABR is solely based on brokerage recommendations and is often influenced by skewed opinions. In contrast, the Zacks Rank is rooted in quantitative models and focuses on earnings estimate revisions, making it more robust and reliable.

Earnings estimate revisions are integral to the Zacks Rank, backed by empirical research showing a strong correlation between these revisions and near-term stock price movements.

Conclusion

Ultimately, while brokerage recommendations paint a positive picture for Uber, investors should exercise caution. The Zacks Rank offers a more balanced and reliable perspective, making it a valuable tool for making informed investment decisions.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zacks Investment Research

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.