UnitedHealth Group Faces Pressure Amid Criminal Investigation

UnitedHealth Group (UNH) has seen a sharp decline, with shares dropping over 30% in a matter of days, now more than 60% below their all-time highs. This selloff was triggered by news of a criminal investigation into potential Medicare fraud.

Although panic selling can create investment opportunities, it demands cautious consideration. One useful approach in such scenarios is the “three-day rule,” a guideline designed to help investors avoid buying into declining stocks too hastily.

In this article, I will explain how this rule operates, evaluate if UnitedHealth shares are currently undervalued, and contemplate whether it’s an appropriate time to invest. Additionally, I’ll introduce two alternative insurance stocks with stronger market momentum and favorable Zacks Ranks: The Progressive (PGR) and HCI Group (HCI).

Image Source: TradingView

Understanding the 3-Day Rule for Stock Purchases

The “three-day rule” is a well-regarded guideline used by traders and investors. It advises waiting at least three full trading days after a significant negative event before considering purchasing the affected stock.

The rationale behind this waiting period is that institutional selling, ratings downgrades, and pressure from margin calls typically develop over several days. By the third day, this selling pressure may have been significantly reduced, allowing investors to gain a clearer view of market sentiment and support levels.

In light of UnitedHealth’s recent stock decline driven by legal uncertainties, applying this rule can help investors avoid entering a volatile situation prematurely.

Is UnitedHealth Group Stock Currently Undervalued?

Currently, UnitedHealth is trading at approximately 10.5 times its forward earnings, a notable discount compared to its 10-year median of 19.1 times. Analysts anticipate an annual EPS growth rate of 12.2% over the next three to five years, resulting in a PEG ratio of under 1, often indicative of undervaluation relative to growth potential.

Though uncertainty surrounds possible legal ramifications, the stock’s valuation appears increasingly attractive for long-term investors willing to endure short-term volatility.

Image Source: Zacks Investment Research

Should Investors Consider UNH Shares?

For long-term investors with a multi-year outlook, this decline may present a buying opportunity. The stock has now reached the three-day point, its valuation looks compelling, and UnitedHealth maintains a dominant position in the healthcare insurance market.

However, the Zacks Rank indicates precaution is necessary. UNH currently holds a Zacks Rank #5 (Strong Sell), driven by lowered earnings estimates and ongoing hesitancy from analysts. This suggests investors may want to be cautious.

Short-term traders may prefer to wait for additional market stabilization or a Zacks Rank improvement before making a purchase.

Alternative Insurance Stocks: Progressive and HCI Group

While the health insurance sector can be complex due to regulatory challenges, other areas within the insurance market are performing better.

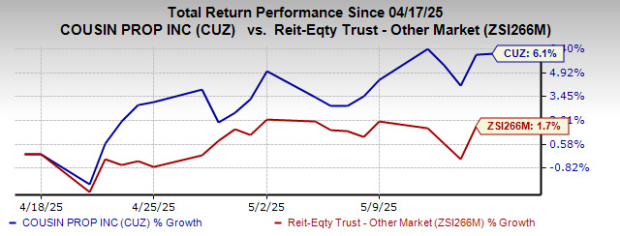

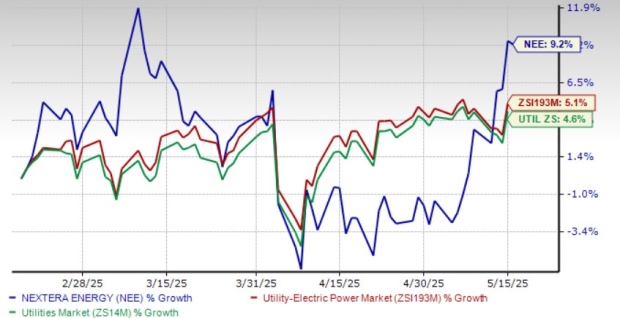

The Progressive (PGR) has established itself as a consistent performer in the insurance industry, benefiting from strong underwriting practices, pricing power, and effective customer acquisition within its auto and property divisions.

PGR has consistently ranked near the top of the Zacks Rank list over the past two years, showcasing steady earnings growth and positive price momentum. It holds a Zacks Rank #2 (Buy) and is poised for a significant technical breakout after recently stabilizing near historical highs, as shown in the chart below.

HCI Group (HCI), a smaller yet rapidly expanding insurer, focuses on homeowners’ insurance, primarily in areas vulnerable to natural disasters like Florida. The company integrates traditional risk management with modern technology and reinsurance strategies to enhance efficiency.

Like Progressive, HCI also holds a Zacks Rank #2 (Buy) and continues to achieve new price highs, showcasing robust market momentum.

Image Source: TradingView

Strategies for Trading Declining Stocks

Though it might be tempting to invest in stocks like UnitedHealth Group after a dramatic drop, it’s important to be cautious. The “three-day rule” serves as a guideline, but I prefer to focus on stocks that exhibit positive momentum and increasing earnings estimates—those that are experiencing buying interest rather than selling pressure.

In the current market, alternatives like The Progressive and HCI Group present compelling investment opportunities.

# Semiconductor Growth Set to Surge Over the Next Few Years

Overview of Recent Market Dynamics

UnitedHealth is facing significant challenges amid market volatility, which may limit its growth potential. Investors looking for opportunities with less risk might consider alternatives that offer upside without the current headline concerns surrounding UnitedHealth.

Zacks Highlights Promising Semiconductor Stock

A new semiconductor stock has caught attention, being only 1/9,000th the size of NVIDIA, which has experienced over +800% growth since its recommendation. While NVIDIA remains strong, analysts believe this new chip stock has even greater potential for growth.

Market Demand and Future Projections

With strong earnings growth and an expanding customer base, this semiconductor company is well-positioned to meet the skyrocketing demand in areas like Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is projected to expand significantly, growing from $452 billion in 2021 to an estimated $803 billion by 2028.

Discover This Stock Now at No Cost >>

Free Stock Analysis Reports Available

Investors can access free stock analysis reports, including for:

For more insightful analysis, visit Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.