Investors often look to Wall Street analysts’ recommendations when making crucial investment decisions. However, the accuracy and reliability of these recommendations have come under scrutiny. The recent recommendation trend for UnitedHealth Group (UNH) has sparked interest, but before jumping to conclusions, it’s essential to understand the nuances of brokerage ratings and the potential impact on investments.

Exploring Wall Street Sentiments

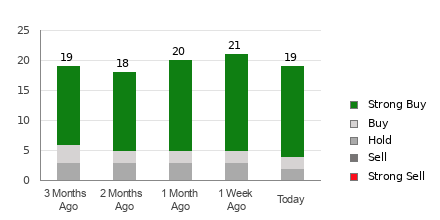

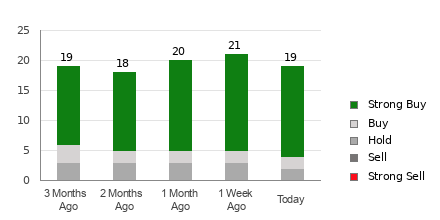

UnitedHealth currently boasts an average brokerage recommendation (ABR) of 1.33, signifying a strong buy sentiment based on the assessments of 20 brokerage firms. Among these recommendations, 80% are Strong Buy and 10% are Buy.

Check price target & stock forecast for UnitedHealth here>>>

The ABR might suggest that UnitedHealth is a strong buy, but historical data shows that brokerage recommendations often carry inherent biases. Analysts, being employees of brokerage firms, are inclined to provide overly positive ratings due to their vested interests in the stocks they cover.

So, should investors base their decisions solely on ABR? Studies indicate that doing so might not lead to optimal outcomes. Instead, it’s vital to complement these recommendations with independent research and reliable indicators of a stock’s potential.

Valuable Insights from the Zacks Rank

Amidst the noise of brokerage recommendations, the Zacks Rank stands out as a trusted, quantitatively-driven stock rating tool for evaluating investment opportunities. Unlike ABR, which relies on subjective analyst opinions, the Zacks Rank is based on concrete factors such as earnings estimate revisions.

The Zacks Rank assigns stocks into five distinct categories, reflecting a balanced approach devoid of any implicit biases that often plague brokerage recommendations.

Furthermore, the Zacks Rank has demonstrated a strong correlation between earnings estimate revisions and short-term stock price movements, adding another layer of informative value for traders and investors.

Distinguishing ABR from Zacks Rank

It’s crucial to understand that while both ABR and Zacks Rank use a 1 to 5 scale, their methodologies and implications differ significantly. ABR is based solely on brokerage recommendations and can be influenced by underlying biases, whereas Zacks Rank is driven by earnings estimate revisions, offering a more objective assessment of a stock’s potential.

Moreover, the timeliness and objectivity of the Zacks Rank make it a potent tool for investors seeking reliable cues for market movements.

Analyzing UnitedHealth’s Prospects

Despite the favorable ABR for UnitedHealth, recent earnings estimate revisions have resulted in a Zacks Rank #4 (Sell) for the company. This disparity underscores the need for investors to exercise prudence and not solely rely on brokerage recommendations.

Ultimately, the decision to invest in UnitedHealth should be based on a comprehensive analysis, factoring in not just brokerage sentiments but also concrete financial indicators and market trends.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.