Vertiv Sees Strong Growth Amid AI Data Center Demand

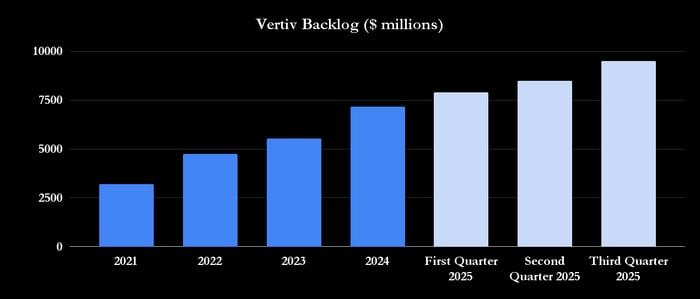

Power and cooling technology company Vertiv (NYSE: VRT) reported a 42.6% increase in stock price in 2025, fueled by rising demand for AI-driven data centers. The company ended Q3 2025 with a backlog of $9.5 billion, while Wall Street anticipates Vertiv’s sales could reach $12.4 billion in 2026.

Key Partnerships Boost Growth Prospects

Vertiv’s strategic partnerships with Nvidia, Oklo, and Caterpillar are set to enhance its growth trajectory. The company plans to launch a new data center power system in collaboration with Nvidia for its upcoming 800-V high-voltage architecture, expected in 2027. Additionally, Vertiv is developing power management solutions with Oklo and integrating its systems with Caterpillar’s industrial gas turbines for data centers.

Financial Outlook

Despite facing cost pressures, including tariffs, Vertiv expects revenue growth in the high teens and free cash flow to rise nearly 25% annually over the next few years. The company has consistently raised its revenue guidance throughout 2025, positioning itself well for potential growth in 2026 and beyond.