Wall Street Analysts Favor Vertiv, But Should You Follow Their Lead?

Investors often look to Wall Street analysts’ ratings when deciding whether to Buy, Sell, or Hold a stock. While changes in these ratings can influence a stock’s price, their true value is often debated.

Let’s explore the insights from analysts regarding Vertiv Holdings Co. (VRT) and assess how to effectively use brokerage recommendations.

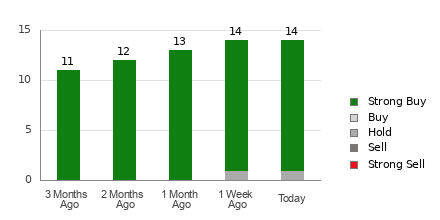

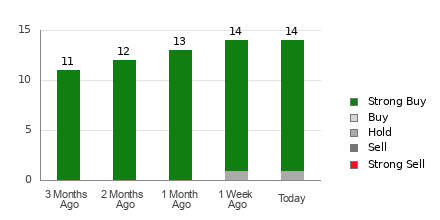

Currently, Vertiv has an average brokerage recommendation (ABR) of 1.14 on a scale of 1 to 5 (with Strong Buy as 1 and Strong Sell as 5). This ABR is determined by the recommendations (Buy, Hold, Sell, etc.) of 14 brokerage firms. An ABR of 1.14 indicates a position between Strong Buy and Buy.

Out of the 14 recommendations informing the current ABR, 13 are Strong Buy, signifying that 92.9% endorse a positive outlook.

Current Trends in Brokerage Recommendations for VRT

Explore price targets & stock forecasts for Vertiv here>>>

While the ABR suggests buying Vertiv, it’s wise not to rely solely on this metric. Research indicates that brokerage recommendations often lack accuracy in identifying stocks with significant potential for price gains.

Why is this the case? Brokerage firms tend to show a positive bias due to their interest in the stocks they cover. Findings suggest that for every “Strong Sell,” there are typically five “Strong Buy” recommendations issued by these analysts.

This disconnect means their ratings may not genuinely reflect where a stock’s price is headed. Therefore, it may be more effective to use this information to support your own research or to validate indicators that have historically demonstrated predictable price movements.

Zacks Rank is a proprietary stock rating system known for its strong track record, categorizing stocks into five groups from Zacks Rank #1 (Strong Buy) to #5 (Strong Sell). This tool can guide investors in predicting stock price movements effectively. Comparing the ABR with the Zacks Rank could enhance investment decision-making.

Understanding the Difference Between ABR and Zacks Rank

Despite appearing similar, the Zacks Rank and ABR measure different aspects of stock evaluation.

The ABR is derived purely from brokerage recommendations and displayed with decimals (e.g., 1.28). In contrast, the Zacks Rank utilizes earnings estimate revisions and is presented as whole numbers from 1 to 5.

Historical evidence shows that brokerage analysts tend to be overly optimistic. Their recommendations often exceed what their research would justify, which can mislead investors.

Conversely, earnings estimate revisions are central to the Zacks Rank, and studies indicate a strong link between these revisions and short-term stock price changes.

The Zacks Rank categorizes stocks uniformly based on earnings estimates from analysts, maintaining balance across its five ranks at all times.

Another notable distinction is in the recency of information. The ABR may not be the latest update you can find. Meanwhile, Zacks swiftly adjusts to accurately reflect analysts’ revised earnings expectations, ensuring timely insights.

Is Investing in VRT a Smart Move?

Looking at Vertiv’s earnings estimate revisions, the Zacks Consensus Estimate remains steady at $2.69 for the current year. This consistency reflects analysts’ stable outlook on the company’s earning capabilities.

This stable consensus estimate suggests that Vertiv’s stock might perform in line with the broader market in the near term.

The recent consensus estimate change and accompanying metrics have led to a Zacks Rank #3 (Hold) for Vertiv. For a complete list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

Given this backdrop, it may be wise to exercise caution despite the favorable ABR for Vertiv.

Zacks Upcoming Top 10 Stock Picks for 2025

Are you interested in early insights on our 10 top stock picks for 2025?

Historical performance suggests these selections may yield impressive returns.

From 2012 to November 2024, when our Director of Research Sheraz Mian began overseeing the portfolio, the Zacks Top 10 Stocks portfolio achieved a remarkable +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Now, Sheraz is meticulously selecting the best 10 stocks to hold through 2025. Don’t miss out—these stocks will be unveiled on January 2.

Be First to Discover New Top 10 Stocks >>

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

Read more about Vertiv on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.