Visa Inc. Positioned as a Strong Player Amid Tariff Concerns

President Trump’s broad global tariffs have created significant fluctuations in the market, heightening investor anxiety. With concerns about potential economic repercussions, many investors are shifting focus to companies shielded from trade tensions. Visa Inc. (V), known for its resilient, transaction-based business model, is emerging as a safer investment choice.

Visa’s Resilience in a Volatile Market

Visa holds a market capitalization of $619.4 billion and stands out as a leader in global digital payments. Unlike traditional banks, Visa does not issue credit cards or extend loans; instead, it operates a payment network and earns fees for each transaction. This asset-light approach insulates it from credit risk, making Visa better equipped to navigate economic downturns.

In comparison, Mastercard Incorporated (MA) shares a similar business model, valued at $464.7 billion. However, American Express Company (AXP), with a market cap of $176.4 billion, incurs more risk by issuing its own cards and granting credit. While this enables AmEx to gain interest income alongside processing fees, it also subjects the company to higher potential losses, especially in an inflationary climate.

Inflation’s Potential Impact on Visa

Interestingly, Visa could find some advantages in inflation, which is often driven by tariffs. As Visa charges a percentage on transactions, rising prices can enhance its revenue. With millions of transactions processed daily, even minor increases in consumer spending can lead to significant revenue boosts. However, if inflation negatively affects consumer demand, Visa’s growth in transaction volume could be impacted, diminishing this advantage.

Long-Term Growth Factors for Visa

Visa is poised for sustained growth as the world increasingly transitions away from cash in favor of digital payments. The company benefits from a network effect: more users attract more merchants, creating a competitive edge.

Despite economic uncertainties, Visa has maintained steady earnings and revenue increases. The company is also investing significantly in innovation, with plans to expand into real-time payments, B2B solutions, cryptocurrency, and blockchain technologies, positioning itself for future advancements.

A Shareholder-Focused Approach

Visa appeals to income-focused investors due to its robust balance sheet, with total debt comprising merely 35% of its capital, which is significantly lower than the industry average of 42.8%. In fiscal 2024, it repurchased $16.7 billion in shares and returned $5.1 billion to shareholders through buybacks ($3.9 billion) and dividends ($1.2 billion) in Q1 of fiscal 2025. As of December 31, 2024, Visa had $9.1 billion remaining under its buyback authorization.

Earnings Outlook and Performance Records

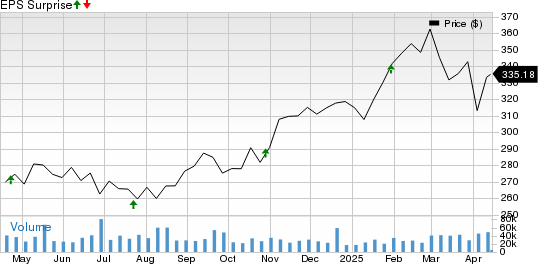

The Zacks Consensus Estimate projects Visa’s EPS for fiscal 2025 and fiscal 2026 to rise by 12.5% and 12.6%, respectively, year-over-year. These earnings estimates have remained stable over the past week. Additionally, the consensus forecasts for revenues in fiscal 2025 and fiscal 2026 indicate increases of 10.2% and 10.3%, respectively. (Visit the Zacks Earnings Calendar for more updates.)

Visa has surpassed earnings estimates in the last four quarters, registering an average surprise of over 3%.

Visa Inc. Price and EPS Surprise

Visa Inc. price-eps-surprise | Visa Inc. Quote

Recent Price Performance

Over the last month, Visa shares increased by only 0.2%, although this performance outpaced the broader industry and the S&P 500 Index. Meanwhile, Mastercard and American Express saw declines of 3.7% and 3.4%, respectively.

1-Month Price Performance – V, MA, AXP, Industry & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

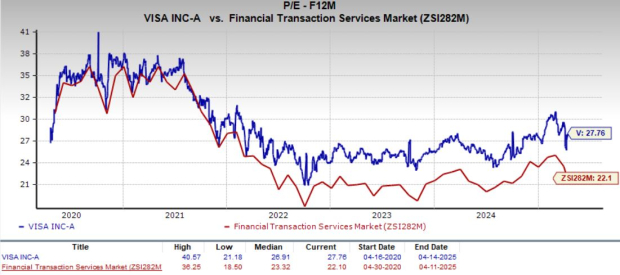

Valuation Considerations for Visa

From a valuation standpoint, Visa is currently trading at a premium price. Its forward P/E ratio stands at 27.76X, which is above its five-year median of 26.91X and the industry average of 22.10X. In comparison, Mastercard and American Express have P/E ratios of 30.75X and 16.08X, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Current Challenges for Visa

Visa faces challenges, including escalating costs and regulatory pressures that could affect its near-term outcomes. Adjusted operating expenses rose by 10.8% in fiscal 2024 and 11.4% in the first quarter of fiscal 2025. Additionally, client incentives, which diminish net revenues, increased by 11.9% and 13.4% during the same intervals.

Legal challenges are also emerging. Visa is currently embroiled in a lawsuit from the U.S. Department of Justice filed last September. In the U.K., the company is under scrutiny for its interchange fees, with the U.K.’s Payment Systems Regulator proposing a cap that Visa is contesting.

Moreover, the Credit Card Competition Act of 2023 may invite more competitors into the U.S. payments landscape, potentially squeezing pricing power for both Visa and Mastercard. The ramifications of these legal and regulatory issues, in conjunction with broader geopolitical uncertainties, will likely shape Visa’s competitive stance in the foreseeable future.

Strategic Considerations for Visa Stock

Given Visa’s strong international network and operational strength amid tariff-related tensions, it represents a compelling long-term investment. The ongoing transition towards digital payments and Visa’s investments in real-time payment solutions and blockchain technology further enhance its growth opportunities.

However, as the stock approaches its 52-week high of $366.54, short-term gains may be limited. For current investors, holding onto the stock may be prudent; prospective investors might consider waiting for a more favorable entry point.

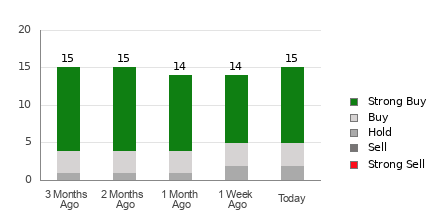

Visa Maintains Hold Rating Amid Market Dynamics

As of now, Visa holds a Zacks Rank #3 (Hold), indicating a neutral outlook from analysts. For investors looking for opportunities, a strategic entry point may be beneficial at this juncture. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top Stock Picks for Upcoming Opportunities

Recently released, market experts have identified 7 premier stocks from the current roster of 220 Zacks Rank #1 Strong Buys. These selections are regarded as “Most Likely for Early Price Pops.”

This list has consistently outperformed the market since 1988, achieving an impressive average annual return of +23.9%. Investors should pay close attention to these selected stocks.

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.