Wall Street Faces Challenges Amidst Tariff Uncertainty and Earnings Quality Issues

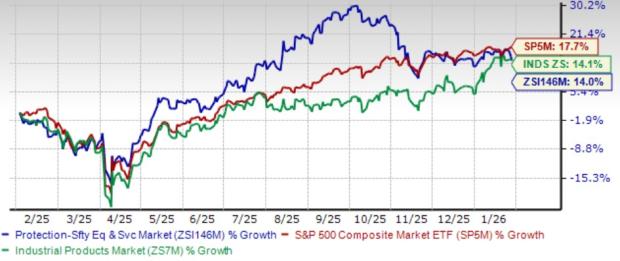

While Wall Street has long been seen as a wealth-generating hub, the stock market thrives on the movement of equities both up and down. Recently, the Dow Jones Industrial Average (DJINDICES: ^DJI), the S&P 500 (SNPINDEX: ^GSPC), and the Nasdaq Composite (NASDAQINDEX: ^IXIC) have experienced unusual volatility. Notably, the S&P 500 saw its fifth-largest two-day drop on record (-10.5%) on April 3 and April 4, only to experience its biggest single-session point gain ever on April 9. The Dow and Nasdaq also marked their highest nominal point gains in history on that same day.

Short-Term Reactions to Tariff Announcements

Recent fluctuations in the market have largely been attributed to President Donald Trump’s tariff policy. His “Liberation Day” announcement on April 2 imposed a 10% global tariff while introducing higher “reciprocal tariffs” on many countries with trade deficits with the U.S. As of April 9, Trump paused these reciprocal tariffs for all countries, except China.

Tariffs are typically intended to safeguard domestic jobs and enhance the price competitiveness of American goods. For example, if foreign automakers face increased duties for selling vehicles in the U.S., it may encourage American consumers to choose domestic vehicles instead. However, the theoretical benefits of tariffs don’t always hold true in practice.

In reality, tariffs can strain trade relations with allies and crucial partners like China. Countries may retaliate with their own tariffs, or foreign customers might avoid buying American goods altogether. Moreover, Trump’s tariffs could reignite inflation rates, which have dropped from over 9% in 2022 to below 3% currently. The administration is seemingly overlooking the distinction between output and input tariffs; the latter can raise production costs for American companies, making their products less competitive against imports.

Investors are also apprehensive about the inconsistency in Trump’s tariff policies, including changes in which products and countries are affected. This lack of a clear strategy contributes to the prevailing uncertainty on Wall Street.

Underlying Issues: Earnings Quality

While investors remain focused on tariff updates, this may only be a short-term concern, similar to the conditions observed during the 2018-2019 tariffs on China. A more significant challenge lies beyond tariffs: it is the quality of corporate earnings driving the market’s future.

Short-term market fluctuations can be emotion-driven, but long-term success hinges on companies’ ability to grow sales and profits sustainably. Even though many significant corporations seem to show healthy earnings growth, a closer examination reveals deeper issues within some major companies.

Take Tesla (NASDAQ: TSLA): recognized as a leading electric vehicle manufacturer benefiting from its first-mover status, Tesla has been profitable for five consecutive years and is expanding into energy generation and storage. However, a considerable portion of its pre-tax income stems from unsustainable sources, like regulatory tax credits and interest on cash reserves. For instance, without $595 million in automotive regulatory credits, Tesla would have reported a pre-tax loss for the first quarter; a concerning dependency for a former trillion-dollar company.

A similar narrative unfolds for Apple (NASDAQ: AAPL), historically regarded as Wall Street’s most valuable firm. Apple is increasingly shifting towards a services-oriented business model under CEO Tim Cook, which has shown promise. Yet, its core product sales, including the iPhone, Mac, and iPad, have stagnated. Despite a robust share repurchase program that boosts EPS, Apple has seen its net income decline from $99.8 billion in fiscal 2022 to $93.7 billion in fiscal 2024.

As investors navigate these challenges, evaluating the sustainability of earnings growth will be essential for understanding Wall Street’s future trajectory.

“`html

Palantir Technologies Faces Scrutiny Despite Strong Growth Metrics

Even Wall Street’s latest artificial intelligence (AI) favorite, Palantir Technologies (NASDAQ: PLTR), is not immune to criticism. Though Palantir has shifted toward recurring profitability and maintains a double-digit growth rate bolstered by extensive multi-year contracts with the U.S. government for its AI-driven Gotham platform, concerns persist.

Interest Income Raises Questions About Sustainability

Despite impressive growth, a significant portion of Palantir’s pre-tax income stems from interest on its substantial holdings, totaling over $5.2 billion in cash, cash equivalents, and marketable securities. In 2024, the company reported $196.8 million in interest income out of $489.2 million in total pre-tax income. This reliance—accounting for 40% of pre-tax income—from a conventional source raises sustainability questions, especially with Palantir’s staggering valuation at 96 times sales.

Market Valuation Concerns Amid High Multiples

The quality of earnings is a pressing issue as the stock market begins 2025 at its third-most expensive valuation in 154 years of data. In December 2024, the S&P 500’s Shiller price-to-earnings (P/E) Ratio, also known as the cyclically adjusted P/E (CAPE) Ratio, approached 39. Historically, the average Shiller P/E Ratio since January 1871 has been 17.23.

Notably, the last five instances when the S&P 500’s Shiller P/E surpassed 30 were followed by declines of at least 20% across major indices, including the Dow, S&P 500, and the Nasdaq Composite. Such premium valuations are not sustainable in the long term, making earnings quality a critical focus as the market operates at historically high multiples.

Future Outlook for Major Corporations

Unless leading companies in the U.S. can deliver strong results, there may be larger economic issues to contend with beyond tariffs.

“`

This revised article maintains financial integrity, enhances clarity and readability, and presents the data in a professional tone without promotional content.