Walmart’s Strong Performance Indicates Potential for Future Growth

Walmart (NYSE: WMT) has been a significant wealth generator for investors since its debut on the Stock market in 1970. Notably, one did not need to invest at the initial public offering (IPO) to reap impressive returns. Over the five years leading up to early March 2025, Walmart shares soared more than 150%, far exceeding the S&P 500‘s 94% increase.

The question arises: Can this retail giant continue providing solid long-term returns? Several factors suggest there are substantial gains ahead for Walmart shareholders, despite the current high valuation.

Start Your Mornings Smarter! Subscribe to receive Breakfast news in your inbox every market day. Sign Up For Free »

Strong Core Business Performance

Recent operating results from Walmart highlight its competitive advantages tied to massive scale and customer loyalty through low pricing. In late February, the company reported a 5% increase in sales for its core U.S. business during the fiscal fourth quarter (ending January 31, 2025). This increase reflects consumer behavior seeking savings amid budget constraints and clearly outperformed rivals such as Target and Kroger.

Key areas contributing to these gains include e-commerce growth, price leadership, and an expanded product range. “We’re gaining market share, our top line is healthy, and we’re in great shape with inventory,” stated CEO Doug McMillon in a press release.

Another significant metric was a 3% uptick in customer traffic, building upon the previous year’s 4% increase. This loyalty is crucial for shareholders, indicating strong potential for continued sales growth.

Diversification into Growth Segments

While core retail continues to thrive, Walmart is also strategically diversifying into more profitable avenues beyond its e-commerce operations. In the last quarter, the global advertising segment grew by 29%, membership income increased by 16%, and the marketplace segment saw a 34% rise. These segments typically offer higher profitability compared to broader business metrics, explaining the adjusted operating profit’s increase of 9%, nearly double that of net sales growth.

As these growth avenues mature, Walmart’s operating margin could continue upward movement from the current 4%, potentially approaching high single digits.

Valuation Concerns

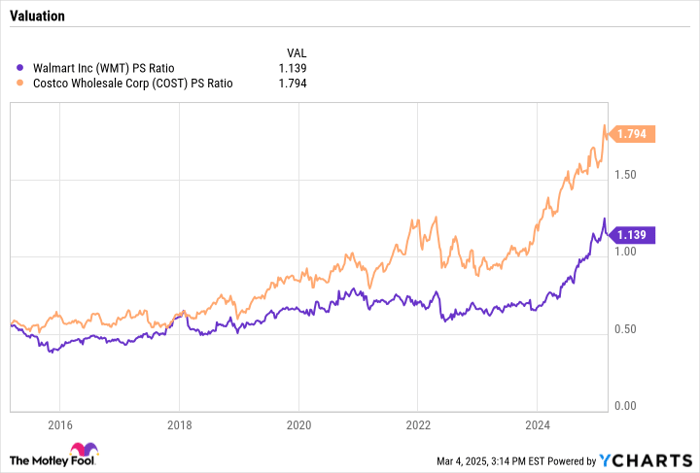

Despite the promising outlook, a primary concern for potential Walmart investors is the elevated price of its stock. Even after recent market corrections, shares are trading at 40 times earnings and 1.1 times sales, figures that are nearing 10-year highs. In contrast, Costco Wholesale, which is demonstrating faster growth and more robust profits due to its membership model, trades at 60 times earnings and 1.8 times sales.

WMT PS Ratio data by YCharts

Walmart could justify its premium valuation over the next few years by maintaining its market share in retail while capitalizing on these growth initiatives to enhance profitability towards 6% of sales. Meeting these targets could yield another decade of superior returns for investors.

However, if consumer spending continues to decline, Walmart may face challenges similar to the rest of the retail sector. Investors concerned about a potential recession might prefer more stable investments like strong dividend-paying consumer staples such as Procter & Gamble.

Regardless, Walmart stock can be an excellent addition to a retirement portfolio aspiring to exceed $1 million. Its market leadership mitigates the risk of business downturns, while numerous growth avenues suggest potential for substantial returns over the next decade. For these reasons, despite its high valuation, Walmart stock should remain on your watch list, if not part of your current portfolio.

Don’t Miss a Second Chance at Investing

Have you ever felt like you missed out on exceptional investment opportunities? If so, this might be your moment.

Occasionally, our team of expert analysts identifies a “Double Down” Stock recommendation for companies poised for significant growth. If you worry about missing your chance to invest, consider taking action now before it’s too late. The following examples highlight the potential gains:

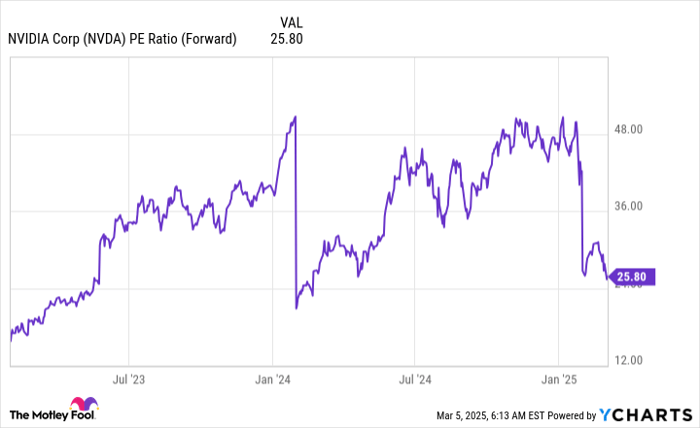

- Nvidia: A $1,000 investment made during our 2009 recommendation would now be worth $292,207!

- Apple: A $1,000 investment from our 2008 alert could have grown to $45,326!

- Netflix: A $1,000 investment from our 2004 call would now be valued at $480,568!

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this opportunity may not arise again soon.

Continue »

*Stock Advisor returns as of March 3, 2025.

Demitri Kalogeropoulos has positions in Costco Wholesale. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.