Walmart’s Stock Surges Amid Valuation Concerns

Walmart (NYSE: WMT) saw a remarkable 75% increase in its stock last year, ranking second only to Nvidia (NASDAQ: NVDA) among Dow companies. The momentum continues into 2025, with an additional 7% rise while the overall market struggles. Key drivers include strong in-store performance, booming e-commerce sales, and swift Walmart+ delivery.

However, Walmart trades at 41x earnings and 21x free cash flow, resulting in a modest 4.7% cash flow yield. In contrast, Amazon, despite being the e-commerce leader, has a lower valuation and boasts revenue growth nearly double that of Walmart. At $96 per share, this valuation suggests a premium for growth, which may not materialize.

Historical Performance Raises Flags

Walmart is often deemed recession-resistant, but its history contradicts this narrative. The stock plummeted nearly 27% during the 2008 financial crisis and dropped 17% at the start of the Covid-19 pandemic in 2020. It also faced a 26% decline in 2022 due to surging inflation, yet it now trades at a high valuation.

What’s Driving the Premium?

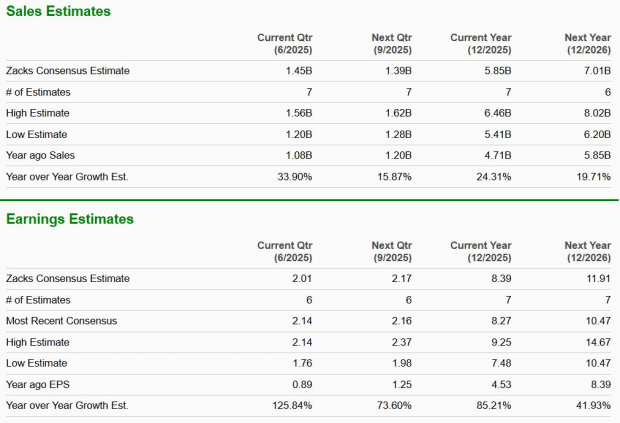

Walmart aims for growth in high-potential areas such as e-commerce, advertising via Walmart Connect, membership programs, and marketplace expansion. Q1 performance showed impressive results: global e-commerce sales rose 22%, and advertising revenue was up 31%. The company also achieved profitability in e-commerce during Q1 2026.

Nevertheless, gross margins improved only marginally by 12 basis points. While customer transactions grew by 1.6%, this marked the fourth straight quarter of slowing growth. Walmart’s premium valuation depends on the hope that emerging sectors will generate substantial profit increases.

What’s Next?

Despite e-commerce growth, Walmart’s projected performance is muted. For FY 2026, management indicates 4% revenue growth, 4.5% operating income growth, and under 2% EPS growth. This underwhelming growth contrasts sharply with the expectations set by its current market valuation.

Additionally, tariff risks pose a growing concern. New U.S. tariffs on imports from Central America may raise prices soon. While Walmart is not canceling orders, it is cutting back on purchases of sensitive items. With around one-third of its merchandise imported and significant exposure to Chinese goods, the tariff threat is significant.

Why It’s Not All Bad News

Despite these challenges, Walmart’s scale provides competitive advantages. Its grocery dominance ensures consistent foot traffic, which boosts sales of other items. Walmart saw a 4.5% increase in U.S. same-store sales in Q1 and maintains its full-year guidance.

The company is advancing into lucrative areas like e-commerce and digital advertising, positioning itself for sustained growth. Although its stock may appear expensive, it remains resilient.

Investing in individual stocks carries risks, but the Trefis High Quality (HQ) Portfolio, featuring 30 stocks, has historically outperformed the S&P 500 over the past four years.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.