“`html

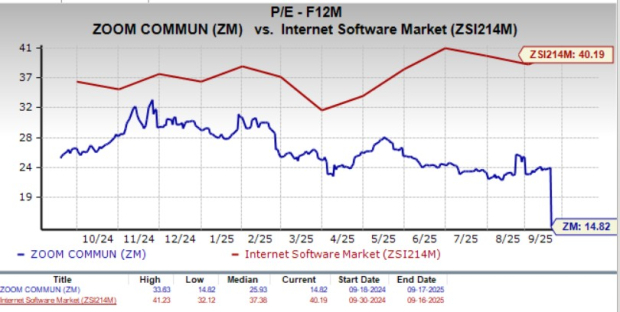

Zoom Communications (ZM) reported total revenues of $1.22 billion for the second quarter of fiscal 2026, reflecting a 4.7% year-over-year growth, driven mainly by a 7% increase in enterprise revenues. Despite the improvements, Zoom’s shares have only returned 5.7% year-to-date, significantly trailing industry peers like Microsoft (21%), Cisco (14.4%), and Alphabet (31.8%), as the company trades at a forward 12-month Price/Earnings ratio of 14.82X, contrasted with the industry average of 40.19X.

Key highlights include an 8.7% increase in customers contributing over $100,000 annually, reaching 4,274. Revenues across regions also showed positive growth: 5% in the Americas, 6% in EMEA, and 4% in APAC. The Zacks Consensus Estimate for third-quarter revenues stands at $1.21 billion, with earnings expected to rise 2.9% year-over-year to $1.42 per share.

Zoom’s strategic diversification into products like AI capabilities and the growth of its Contact Center solutions, which saw a 94% year-over-year increase in customers with annual recurring revenue exceeding $100,000, further positions the company for future growth amidst strong competition from Microsoft Teams, Cisco Webex, and Google Meet.

“`