iShares U.S. Home Construction ETF Sees Major Outflows This Week

Today, an analysis of week-over-week changes in shares outstanding for ETFs reveals a significant outflow from the iShares U.S. Home Construction ETF (Symbol: ITB). The ETF experienced approximately $153.8 million in outflows, translating to a 6.2% decrease in shares outstanding—from 27,450,000 to 25,750,000.

Current Performance of Major Holdings

Among the largest components in the ITB, Horton Inc (Symbol: DHI) is down about 0.9%, Lennar Corp (Symbol: LEN) has decreased by approximately 0.8%, and NVR Inc. (Symbol: NVR) is lower by roughly 0.6%. For detailed information on ITB’s holdings, refer to the ITB Holdings page.

Price Performance Overview

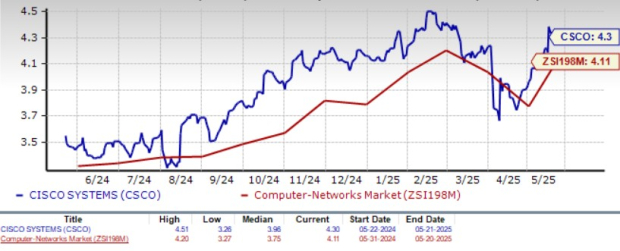

The chart below illustrates the one-year price performance of ITB compared to its 200-day moving average:

ITB’s price range over the last 52 weeks shows a low point at $82.71 per share and a high at $129.89. The latest recorded trade was $89.67. Analyzing the current share price relative to the 200-day moving average is a valuable technique for technical analysis.

Understanding ETF Structures and Flows

Exchange-traded funds (ETFs) operate similarly to stocks, with investors buying and selling “units” instead of traditional shares. These units can be traded just like stocks, but they can also be created or destroyed based on investor demand. Each week, we track the changes in shares outstanding to identify ETFs experiencing significant inflows (indicating the creation of new units) or outflows (indicating the destruction of existing units). Large flows may impact the ETF’s underlying holdings, requiring purchases or sales of the corresponding stocks.

![]()

Click here to find out which 9 other ETFs experienced notable outflows.

See Also:

- ETFs Holding ICFI

- ETFs Holding CERS

- HP Shares Outstanding History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.