Intuitive Surgical, Inc. (ISRG) reported its second-quarter fiscal 2025 results on July 22, 2023, showcasing a strong top-line performance but a subsequent decline in share prices of over 7%. Key issues impacting investor sentiment include margin pressures from recent tariffs and rising operational costs. Pro-forma gross margin fell to 67.9% from 70% year-over-year.

Performance Metrics

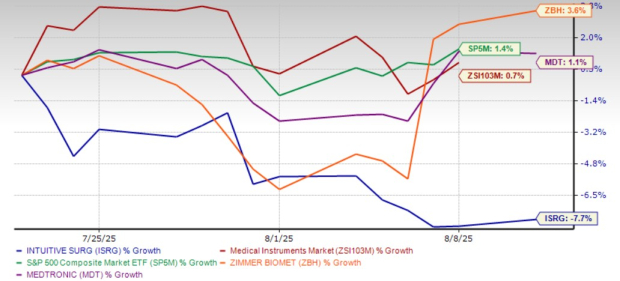

Since the earnings report, ISRG has underperformed, dropping 7.7% compared to a 0.7% increase in its industry. This dip also contrasts with peers like Medtronic (MDT), which rose 1.1%, and Zimmer Biomet (ZBH), which improved by 3.6%. Additionally, an expected 100-basis-point impact from tariffs on costs has been highlighted.

Future Outlook

Estimates for 2025 and 2026 suggest slower growth, particularly in earnings per share (EPS), as operational expenses and a shift to lower-margin products constrain margins. The company is focusing on expanding its international markets and developing the Intuitive Telepresence platform for remote surgeries, which could redefine its service model in the long term.