Intuitive Surgical Shares Rebound Amid Strong Fundamentals and Market Challenges

Shares of Intuitive Surgical (ISRG) are gaining traction after a decline of over two months. The stock has climbed 9.7% in the past month despite a more than 30% drop from its all-time peak of $616 in January. The upward movement is credited to robust fundamentals, even as tariff risks loom. Notably, a recently negotiated trade deal between the United States and China has reduced tariffs for 90 days, potentially softening the expected 170 basis point impact on goods sold in 2025.

As a leader in robotic-assisted surgery, Intuitive Surgical continues to thrive, showcasing solid revenue performance and ongoing procedural growth. Heading into 2025, the company’s strategic focus encompasses technological advancements, international expansion, and enhancements to manufacturing operations. However, global economic uncertainties remain, particularly with rising trade tensions stemming from the U.S. adopting a protectionist approach under President Trump’s recent return to office.

Financial Performance and Revenue Growth

In the first quarter of 2025, ISRG reported revenues of $2.25 billion, reflecting a year-over-year increase of 19.2%. This performance indicates the company’s capacity for consistent, recurring revenues, which now account for 85% of total earnings. Earnings per share (EPS) grew by 20%, reaching $1.81, with an operating margin of 34.1%. The firm anticipates a decrease in operating margin in 2025 due to rising depreciation costs and a shift towards lower-margin products such as da Vinci 5, Ion, and SP.

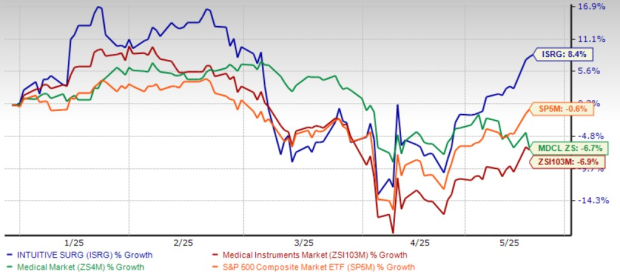

Even with the recent dip in stock price, ISRG shares have risen 8.4%, outperforming the Zacks Medical – Instruments industry’s decline of 6.9% year-to-date. In comparison, the broader Zacks Medical sector has dropped 6.7%, while the S&P 500 Index has seen a minor decrease of 0.6% in the same timeframe.

YTD Price Performance

Image Source: Zacks Investment Research

Rising Procedure Volume and Market Expansion

Revenue growth in the first quarter was driven primarily by increases in da Vinci surgical procedures and significant growth in Ion and SP procedures. To combat inflationary pressures, Intuitive Surgical has been raising procedure prices, which has supported sales momentum.

The growing adoption of the da Vinci 5 system is expected to bolster revenues further, with a launch planned for broad release in the second half of the year. Although slower adoption rates are anticipated in Germany, the U.K., and Japan, the clearance of the Ion platform in Australia, along with its launch in China, should enhance system placements and procedural volume. The recent FDA clearance for the da Vinci SP SureForm 45 stapler in the U.S. is also on track to expand the use of SP in thoracic and colorectal applications.

The recent FDA approval for ISRG’s da Vinci Single Port surgical system for transanal local excision/resection is expected to further boost system revenues. This device facilitates minimally invasive surgeries, offering a solution that eliminates abdominal surgical incisions for select procedures, particularly colorectal surgeries.

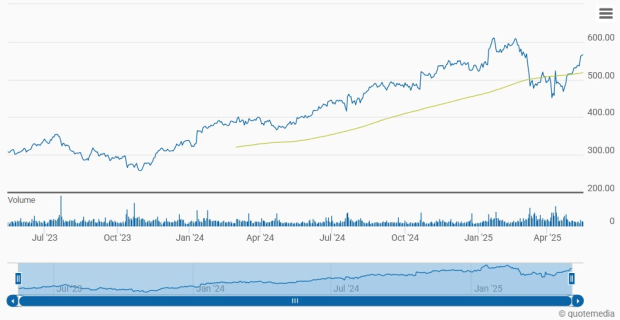

ISRG Stock Trades Above 200-Day Average

Image Source: Zacks Investment Research

To drive further growth, ISRG intends to market its da Vinci products directly in Italy, Spain, and Portugal for an investment of EUR 290 million, thus strengthening customer relations. Additionally, the company is expanding manufacturing with new facilities in California, Germany, and Bulgaria to enhance scalable production for the da Vinci 5 and Ion systems. Digital tools, including the My Intuitive app and VR simulators, are set to improve surgeon training and optimize procedural outcomes.

Competitive Challenges and Market Headwinds

In 2025, Intuitive Surgical anticipates that gross margins will be pressured by 170 basis points due to newly implemented global tariffs. These costs primarily arise from U.S.-China trade tensions, retaliatory tariffs from Europe, and a small number of Mexican exports not meeting USMCA standards. Significant tariffs will apply to components imported from China and finished products entering the U.S., alongside tariffs on Chinese-sourced components for the Ion platform.

The company expects the effects of tariffs to escalate each quarter for the remainder of the year, although potential reductions in tariff rates—such as the drop from 145% to 30% on Chinese imports—may alleviate some of the pressure going forward.

ISRG is also facing mounting competition in the robotic-assisted surgery market, heightening the importance of cost efficiency. Major competitors, including Johnson & Johnson (JNJ) and Medtronic (MDT), are investing heavily in robotic surgery innovations. Medtronic has recently filed for FDA clearance for its Hugo robotic-assisted surgery system, with potential approval expected in the latter half of 2025.

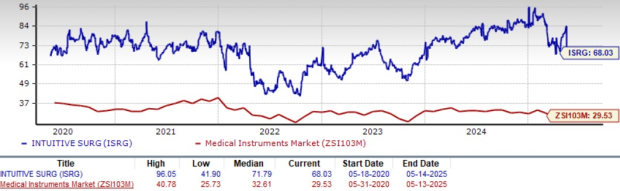

ISRG’s P/E F12M Higher Than Industry

Image Source: Zacks Investment Research

Wrapping Up

ISRG’s stock has surpassed the significant 200-day moving average earlier this month, indicating resilience. However, its elevated valuation raises concerns. Although the company trades significantly higher than its industry, it is currently below its five-year median price, which may provide some cushioning against future declines.

ISRG holds a Zacks Rank #3 (Hold). The Style Scores indicate mixed outlooks, with a Value Score of D and a Growth Score of C. Additionally, the valuation chart suggests a considerable premium for ISRG stock compared to its industry peers, while the Momentum score of ‘F’ implies limited price movement in the upcoming months.

In summary, it may be wise for investors to hold onto ISRG stock for now, while exercising caution about establishing new positions. Strong fundamentals indicate potential for price growth, but a strategic wait for a more attractive entry point is advisable.