Apple (NASDAQ: AAPL) reinstated its dividend in 2012 and has increased it annually since then. However, with its current forward yield at a paltry 0.5%, it offers little appeal to income investors compared to CDs and T-bills sporting 5% yields. It’s time for Apple to significantly boost its dividend to reward its investors, particularly as its revenue growth slows down. Let’s assess its free cash flow (FCF) growth to gauge the potential for a larger dividend.

Image source: Apple.

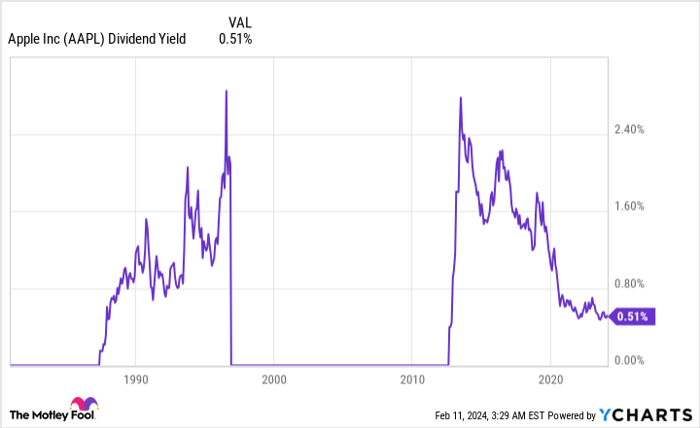

Apple’s Historical Yield and Current Situation

Apple initially paid dividends from 1987 to 1995, gradually increasing its yield to over 2.4%. However, it suspended dividends in 1996 due to a sales slump. When it reinstated dividends in 2011, it began with a forward yield of over 2.4%, which later decreased to the current 0.5% as its stock price rose.

Source: YCharts

Dividends vs. Buybacks

Apple has favored buybacks over dividends, allocating a significant portion of its FCF to share repurchases. Over the past five fiscal years, it bought back $392 billion in shares while only paying out $73 billion in dividends.

|

Metric |

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

|---|---|---|---|---|---|

|

Dividends |

$14.1 billion |

$14.1 billion |

$14.5 billion |

$14.8 billion |

$15.0 billion |

|

Buybacks |

$66.9 billion |

$72.4 billion |

$86.0 billion |

$89.4 billion |

$77.6 billion |

|

Total FCF |

$58.9 billion |

$73.4 billion |

$93.0 billion |

$111.4 billion |

$99.6 billion |

Data source: Apple.

Apple prefers buybacks as they reduce outstanding shares while boosting its earnings per share (EPS). This approach led to an EPS growth at a compound annual growth rate (CAGR) of 20% from fiscal 2019 to 2023, outpacing the 15% CAGR of its net income. Buybacks are also more tax-efficient for investors compared to dividends, which are taxed as ordinary income. Well-timed buybacks enabled Apple to repurchase 16% of its shares over the past five years as its stock price surged more than 300%.

The Need for a Shift

However, in the last six months, Apple’s stock rose only 6% while the Nasdaq Composite surged 16%. Apple’s underperformance stems from concerns over slowing iPhone sales, accounting for over half of its total revenue, and the absence of near-term catalysts. Analysts forecast a modest 4% CAGR in Apple’s revenue from fiscal 2023 to fiscal 2026, driven by another cyclical downturn in iPhone sales and softness in sales of iPads and Macs. On the positive side, Apple’s services ecosystem and its substantial cash reserves provide avenues for growth. Nevertheless, its stock, trading at 29 times forward earnings, may struggle to justify such high valuation amid a market offering more appealing value and growth prospects.

Potential for a Dividend Increase

Given these dynamics, Apple should consider reallocating more of its FCF to dividends rather than buybacks until the next iPhone upgrade cycle. In fiscal 2023, it dedicated 78% of its FCF to buybacks and only 15% to dividends. By reversing these percentages, Apple could potentially increase its dividend yield fivefold to about 2.5%, putting it in the league of blue-chip dividend giants such as Cisco Systems and HP, which currently offer forward yields of 3.1% and 3.9%, respectively. This move would provide investors with a fresh reason to remain invested in Apple’s stock, though the company may not be keen on shifting its prioritization from buybacks to dividends at this time.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now, with Apple not making the cut. The selected stocks are positioned to yield significant returns in the coming years. Stock Advisor equips investors with an actionable plan for success, offering portfolio building guidance, regular analyst updates, and two new stock picks every month. Furthermore, the service has outperformed the S&P 500 by over threefold since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Leo Sun has positions in Apple. The Motley Fool has positions in and recommends Apple, Cisco Systems, and HP. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.