Analysts See Upside for iShares Russell Mid-Cap Value ETF

Our analysis of ETFs reveals the iShares Russell Mid-Cap Value ETF (Symbol: IWS) has a promising outlook driven by its underlying holdings.

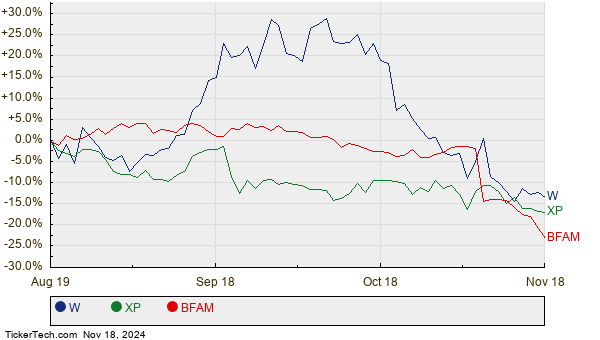

According to ETF Channel’s assessment of IWS, the weighted average implied analyst target price stands at $147.15 per unit. Currently, IWS trades at around $134.29 per unit, indicating a potential upside of 9.58% based on analyst expectations for its holdings. Among the notable stocks contributing to this outlook are Wayfair Inc (Symbol: W), XP Inc (Symbol: XP), and Bright Horizons Family Solutions, Inc (Symbol: BFAM). Data shows that Wayfair’s recent price is $38.22 per share, yet analysts predict a substantial upside of 50.72% to a target price of $57.61 per share. Similarly, XP is priced at $16.63 with an expected climb of 50.33% to an analyst target of $25.00 per share. Bright Horizons also appears promising, with a target price of $141.40, representing a 35.96% increase from its current price of $104.00. Below is a 12-month price history chart showcasing the performance of these stocks:

Below is a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Mid-Cap Value ETF | IWS | $134.29 | $147.15 | 9.58% |

| Wayfair Inc | W | $38.22 | $57.61 | 50.72% |

| XP Inc | XP | $16.63 | $25.00 | 50.33% |

| Bright Horizons Family Solutions, Inc | BFAM | $104.00 | $141.40 | 35.96% |

Investors may wonder whether these analyst targets are realistic or overly ambitious. High target prices could indicate confidence in future performance, but they might also lead to downward adjustments if analysts fail to account for recent changes in the market or companies. Investors should conduct their research to better understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• DAI Videos

• MYC market cap history

• SSII Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.