J.B. Hunt’s Stock Struggles After Mixed Earnings Report

J.B. Hunt Transport Services, Inc. JBHT saw its shares increase in value on Thursday, despite a disappointing earnings report. The company reported a first quarter earnings per share of $1.17, falling short of analysts’ expectations of $1.19.

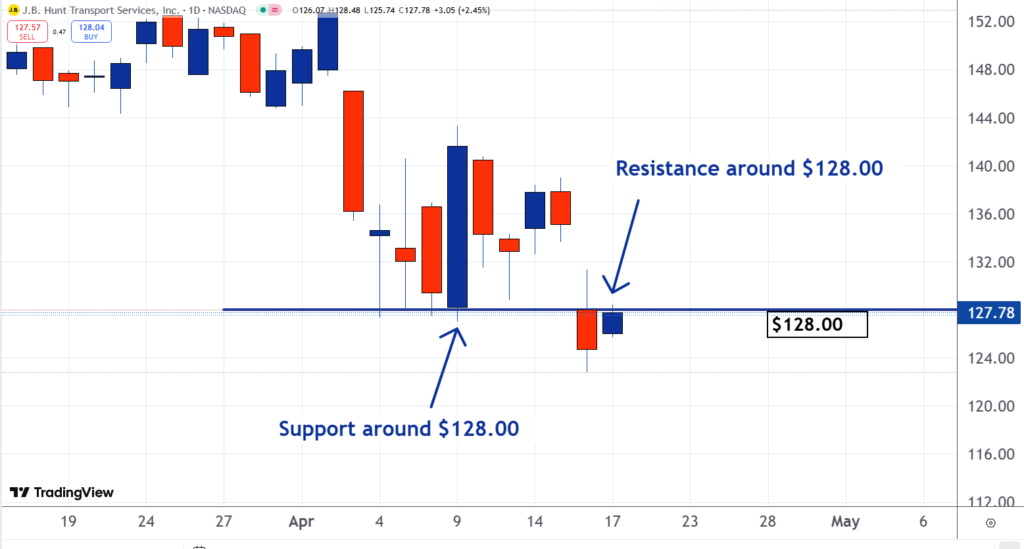

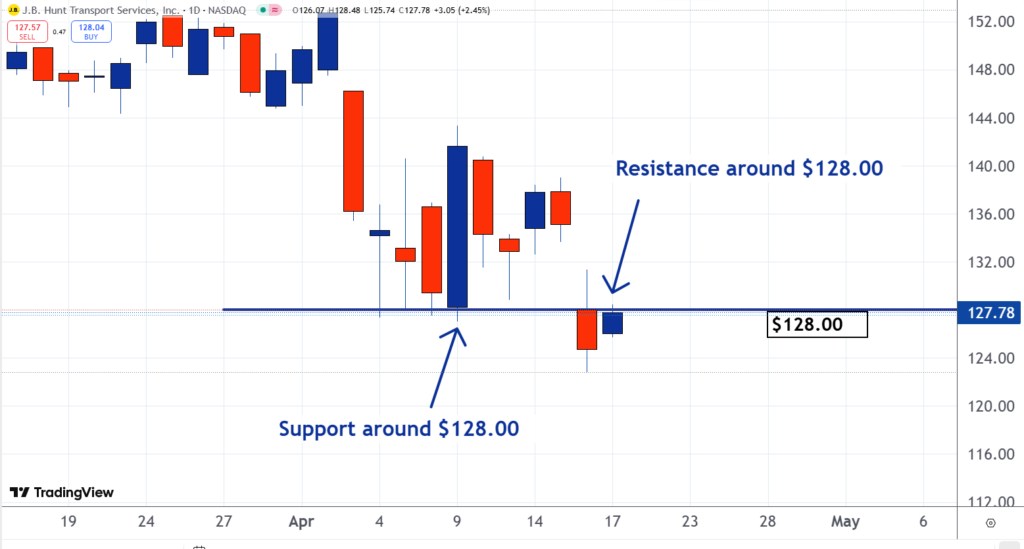

Investors are closely monitoring J.B. Hunt’s stock as it navigates the significant $128.00 price point. This level previously acted as support but has now transitioned to resistance, which is why the stock has gained attention as our Stock of the Day.

Key Trading Insights

Typically, stocks experience the highest trading volume at the market open and close. For short-term traders, it’s crucial to identify these trading levels. High volume at specific prices can create crucial support and resistance, influencing a stock’s price trajectory.

Additionally, the previous day’s high and low values carry weight due to investor psychology, not just because of heavy trading at these points.

Read also: US-Listed Chinese Stocks Face $250 Billion Forced Selling Risk As Delisting Fears Emerge: What Investors Need To Know

Recent Price Actions and Market Psychology

The chart indicates that lows on April 4, April 7, April 8, and April 11 hovered around the $128 mark, while the opening price on April 9 was $128.22.

Since J.B. Hunt’s stock has dipped below the $128 threshold, traders who acquired shares near this price may be reconsidering their positions. Many may opt to sell if they can find a break-even point.

These traders likely placed sell orders around $128, leading to the observed resistance. Following the stock’s opening price, shares experienced a decline, closing nearly four points lower. As of Thursday’s trading, this resistance appears to remain in place.

Implications for Future Trading

A breakout above the current resistance could signify a crucial market shift. If JBHT successfully trades and maintains a position above $128, it suggests that sellers may have exhausted their orders. This scenario could pave the way for an upward movement, requiring buyers to compete for limited shares available for sale.

Understanding recent trading levels—opens, closes, highs, and lows—is vital for savvy traders seeking to leverage market movements effectively.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs