JP Morgan Downgrades Cooper Companies from Overweight to Neutral

On May 30, 2025, JP Morgan revised its outlook for Cooper Companies (BIT:1COO) from Overweight to Neutral.

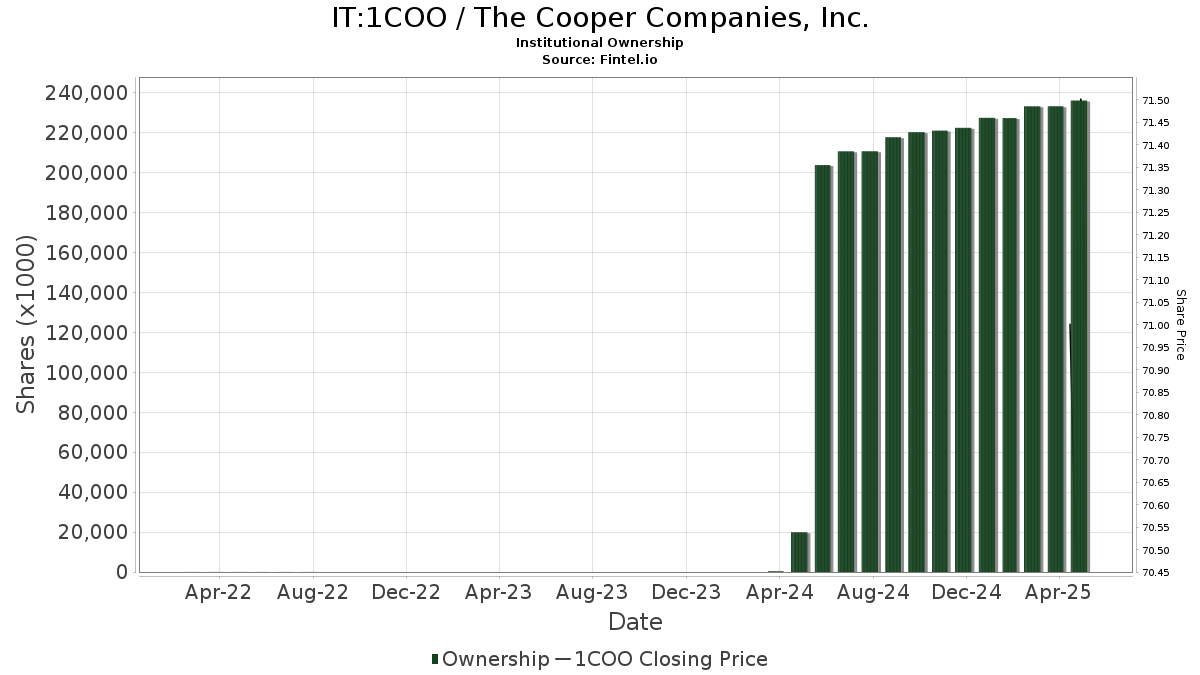

Fund Sentiment Overview

1,283 funds and institutions report holdings in Cooper Companies, down by 60 or 4.47% in the last quarter. The average portfolio weight for all funds dedicated to 1COO is 0.22%, which marks an increase of 5.47%. Institutional ownership increased by 0.99% over the past three months, totaling 235,521K shares.

Analysis of Major Shareholders

Kayne Anderson Rudnick Investment Management owns 7,985K shares, equating to 3.99% of Cooper Companies, down from 8,083K shares, reflecting a 1.22% decrease in ownership. Portfolio allocation fell by 3.54% last quarter.

Capital World Investors holds 7,747K shares for a 3.87% ownership stake, up from 4,189K shares, marking a 45.93% increase. Their portfolio allocation in 1COO rose by 81.11% over the last quarter.

T. Rowe Price Investment Management retained 7,273K shares, representing 3.64% ownership, down from 7,679K shares—a 5.58% decrease. Their portfolio allocation decreased by 6.81% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 6,314K shares, or 3.16% ownership, slightly up from 6,256K shares—a 0.92% increase. However, their portfolio allocation decreased by 3.40% last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares owns 5,545K shares, representing 2.77% of the company, up from 5,391K shares—an increase of 2.78%. Yet, their portfolio allocation fell by 3.63% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.