Jabil Inc. JBL has reaffirmed its guidance for the third quarter of fiscal 2024. The company expects net revenues between $6.2 billion and $6.8 billion, with GAAP operating income ranging from $221 million to $301 million and GAAP earnings between 82 cents and $1.38 per share. The core operating income is projected to be between $325 million and $385 million, with core earnings in the range of $1.65 to $2.05 per share.

Jabil has been experiencing a dynamic market environment in fiscal 2024, marked by the divestiture of its Mobility business and plans to use most of the net proceeds for share repurchases. Although some end markets, such as renewables, 5G, semiconductor capital equipment and electric vehicles, have shown weakness, Jabil remains confident in achieving core margins of 5.6% and core earnings of $8.40 per share in fiscal 2024. The company also aims to generate more than $1 billion in adjusted free cash flow, underscoring the resilience of its business model despite lower volumes and revenue trajectory.

However, due to uncertain market conditions and an unexpected CEO transition, Jabil has decided to withdraw its previously provided guidance for fiscal 2025. The company cites murky visibility in specific end markets as a key reason for this decision.

Despite these short-term challenges, Jabil is bullish on its long-term prospects. The company is well-positioned to capitalize on growth opportunities in areas such as AI data center hardware, power and energy infrastructure, software-defined electric and hybrid vehicles, and healthcare. Strong margins and robust free cash flow are likely to enable continued investment in profitable growth and capital returns to shareholders.

Management believes that the company’s strategic direction and financial strength will allow it to navigate current challenges better and emerge stronger, focusing on high-potential sectors for future growth.

Jabil is likely to benefit from secular growth drivers with strong margin and cash flow dynamics. Moreover, proven technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility.

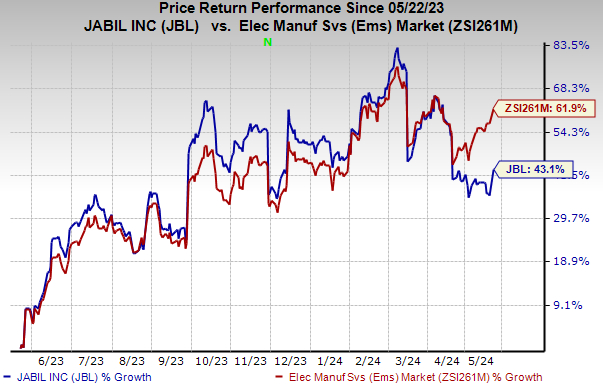

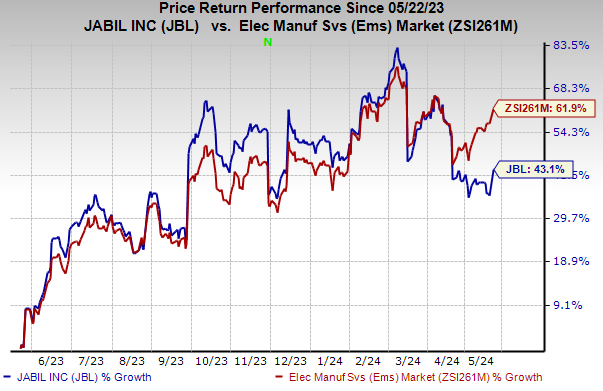

The stock has gained 43.1% in the past year compared with the industry’s growth of 61.9%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Jabil presently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2 (Buy) at present, is a key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

It boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

NVIDIA Corporation NVDA, carrying a Zacks Rank #2, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high performance computing, gaming and virtual reality platforms.

The company’s GPU platforms are playing a major role in developing multi-billion-dollar end-markets like robotics and self-driving vehicles. NVIDIA has a long-term earnings growth expectation of 30.9% and delivered an earnings surprise of 20.2%, on average, in the trailing four quarters.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.