Jacobs Solutions Inc. J has been selected by the United Kingdom Atomic Energy Authority (“UKAEA”) for its multi-supplier Engineering Design Services (EDS) framework. The four-year contract, valued at up to $11.25 million (£9 million), positions Jacobs to significantly enhance the U.K. industrial supply chain for fusion energy research.

The EDS framework covers a comprehensive range of engineering services, including mechanical, process, electrical, control and instrumentation, and systems engineering. Additionally, it includes computer-based modeling, simulations, and specialist nuclear services such as laboratory research, decommissioning, and waste management. Jacobs’ appointment to all capability areas within the framework underscores its extensive expertise in these domains.

This collaboration with UKAEA aims to support the delivery of critical and routine tasks essential for advancing fusion energy projects. One of the key initiatives under this framework is the Spherical Tokamak for Energy Production program, which targets building a prototype power plant by 2040. Achieving this would demonstrate the potential for net electricity generation from fusion, providing a safe, clean, and nearly limitless energy source.

Jacobs’ involvement extends beyond the U.K., with significant contributions to ITER, the world’s largest fusion energy project based in France. With more than 350 employees dedicated to fusion energy globally, Jacobs offers technological and engineering innovation, creating numerous opportunities for professionals in various scientific and engineering fields.

The renewed framework allows the UKAEA to maintain high efficiency and collaboration with its industrial partners, leveraging their engineering and technical expertise. For Jacobs, this contract not only strengthens its role in the fusion energy sector but also enhances its global presence and growth potential in cutting-edge energy solutions. This strategic partnership with UKAEA marks a crucial step in accelerating the commercialization of fusion energy, benefiting the industry and society at large.

Robust Backlog Level: A Boon

Jacobs’ efficient project execution has increased the demand for its consulting services in various sectors, including infrastructure, water, environment, space, broadband, cybersecurity and life sciences. The strong performance in the recent quarters is reflected through its ongoing contract.

The backlog at the end of second-quarter fiscal 2024 amounted to $29.4 billion, up 2% from a year ago. Of this backlog, the CMS segment’s backlog was $8.45 billion, up from $8.14 billion a year ago. People and Places Solutions’ backlog at the quarter’s end was $17.93 billion, up from $17.56 billion a year ago. This growth underscores the sustained strong demand for Jacobs’ consulting services.

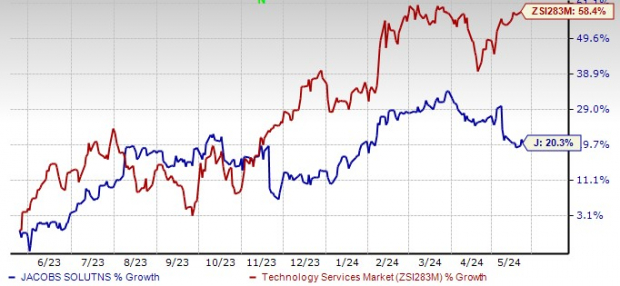

Image Source: Zacks Investment Research

J’s shares have gained 20.3% in the past year compared with the Zacks Technology Services industry’s 58.4% growth. Earnings estimates for fiscal 2024 have decreased to $7.98 per share from $8.07 in the past 30 days. The estimated figure suggests 10.8% year-over-year growth on 5.8% higher revenues.

Although the company is efficiently managing its working capital and taking certain initiatives to combat cost woes, labor-related medical costs, IT-related investment costs, as well as other investments may put pressure on margins. Jacobs unveiled that in the first half of fiscal 2024, the direct cost of contracts increased 8.1% to $6.67 billion year over year due to the ongoing inflationary pressures of labor, materials and other related expenses.

Zacks Rank & Stocks to Consider

Currently, Jacobs carries a Zacks Rank #4 (Sell).

Here are some better-ranked stocks in the same space:

AppLovin Corporation APP currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

APP delivered a trailing four-quarter earnings surprise of 60.9%, on average. The Zacks Consensus Estimate for APP’s 2024 sales and earnings per share (EPS) indicates growth of 31.7% and 202%, respectively, from the prior-year levels. Shares of APP have surged 227.4% over the past year.

Duolingo, Inc. DUOL currently sports a Zacks Rank of 1. Shares of DUOL have gained 19.8% over the past year.

DUOL delivered a trailing four-quarter earnings surprise of 115.2%, on average. The Zacks Consensus Estimate for DUOL’s 2024 sales and EPS indicates growth of 37.8% and 397.1%, respectively, from the prior-year levels.

SPX Technologies, Inc. SPXC presently flaunts a Zacks Rank of 1. SPXC has a trailing four-quarter earnings surprise of 13.9%, on average. The stock has surged 88.9% in the past year.

The Zacks Consensus Estimate for SPXC’s 2024 sales and EPS indicates 14.7% and 24.4% increases from the year-ago period’s reported levels.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

AppLovin Corporation (APP) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.