Jacobs Engineering Group Inc. sealed a deal with United Utilities, one of the U.K.’s largest water companies, to enhance program optimization for major capital works in its Strategic Solutions Team.

Under this agreement, J will drive program and asset optimization, value engineering, innovation, and standardization across United Utilities’ existing and new asset base, crafting efficient and integrated solutions while recommending optimal options.

Jacobs’ technical advisories will encompass feasibility and value management studies, commercial modeling, business case development, design and digital engineering, whole-life cost assessments, best value evaluations, and more.

The total framework agreement is estimated at around $211 million for the base contract period of six years with an option for a five-year extension.

Delivering Steady Growth Through Project Execution

Jacobs’ proficient project execution has been a cornerstone in propelling the company’s performance in recent quarters. The ability to consistently secure new contracts is a testament to this proficiency. As of the first quarter of fiscal 2024, the company reported a backlog of $29.6 billion, signifying a 4.7% increase from the previous year. This growth underscores the sustained robust demand for Jacobs’ consulting services.

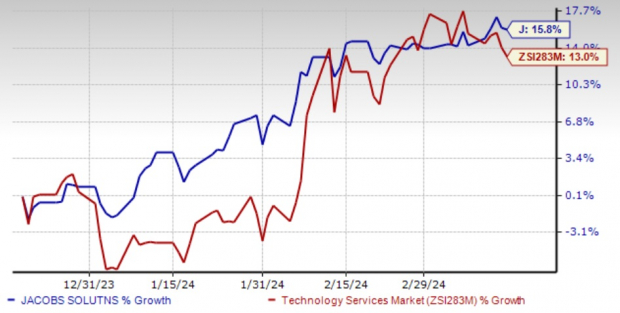

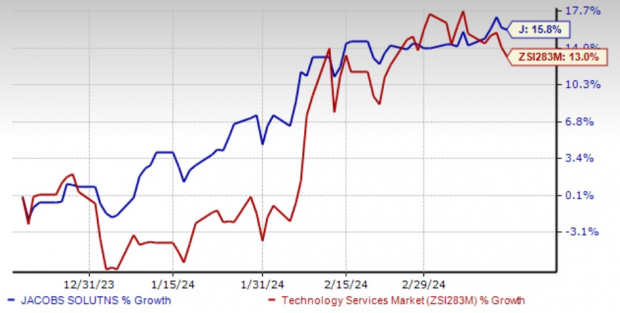

Image Source: Zacks Investment Research

J’s shares have risen by 15.8% in the last three months, outpacing the Zacks Technology Services industry’s 13% growth.

Earnings estimates for fiscal 2024 have been revised upwards to $8.06 per share from $8.05 in the past 60 days. This estimate reflects a projected 11.9% year-over-year growth on a 5.4% increase in revenues.

Zacks Rank and Selections to Contemplate

Presently, Jacobs holds a Zacks Rank #3 (Hold).

Here are some alternative suggestions from the Zacks Business Services sector.

AppLovin Corporation APP currently boasts a Zacks Rank of 1 (Strong Buy). Check out the full list of Zacks #1 Rank stocks today.

APP has an average trailing four-quarter earnings surprise of 26.5%. The Zacks Consensus Estimate for APP’s 2024 sales and earnings per share (EPS) indicates an anticipated growth of 23.2% and 153.1%, respectively, from the previous year.

Block, Inc. SQ currently holds a Zacks Rank of 1.

SQ has an average trailing four-quarter earnings surprise of 10.8%. The Zacks Consensus Estimate for SQ’s 2024 sales and EPS projects an increase of 12.8% and 68.3%, respectively, from the preceding year.

Duolingo, Inc. DUOL currently sports a Zacks Rank of 1.

DUOL has an average trailing four-quarter earnings surprise of 111.5%. The Zacks Consensus Estimate for DUOL’s 2024 sales and EPS anticipates growth of 36.5% and 294.3%, respectively, over the prior-year levels.

Infrastructure Stock Boom to Sweep America

A colossal effort to revamp the deteriorating U.S. infrastructure is on the horizon. It’s bipartisan, pressing, and unavoidable. Trillions will be disbursed. Fortunes will be amassed.

The only question remaining is “Will you invest in the right stocks early on when their growth potential is at its peak?”

Zacks has unveiled a Special Report to guide you through this journey, and it’s free today. Uncover 5 exceptional companies poised to benefit the most from the overhaul and rejuvenation of roads, bridges, buildings, as well as the transformation of energy and cargo services on an almost unfathomable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

AppLovin Corporation (APP) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

For the full article by Zacks.com, click here.

Author’s views and opinions may differ from those of Nasdaq, Inc.