Jacobs Solutions Set for Q2 Earnings Report and Financial Insights

Jacobs Solutions Inc. (J), with a market capitalization of $14.5 billion, operates in the infrastructure and advanced facilities consulting sectors across the United States and internationally. Established in 1947 and based in Dallas, Texas, the company is slated to report its Q2 earnings on Tuesday, May 6, ahead of market opening.

Expected Earnings Performance

Analysts anticipate that Jacobs Solutions will report earnings of $1.41 per share for the quarter, representing a 26.2% decrease from $1.91 per share in the same quarter last year. Noteworthy is the fact that Jacobs has surpassed earnings estimates in each of the last four quarters. In the previous quarter, the company reported an EPS of $1.33, exceeding forecasts by 3.1%, largely due to impressive revenue growth in the Water and Life Sciences segments of Infrastructure & Advanced Facilities.

Long-Term Earnings Outlook

Looking toward the current fiscal year, analysts project an EPS of $6.03 for Jacobs, marking a 14.2% increase from the $5.28 reported in fiscal 2024. Furthermore, expectations are for earnings to rise 13.6% year-over-year to $6.85 per share in fiscal 2026.

Stock Performance Relative to Industry

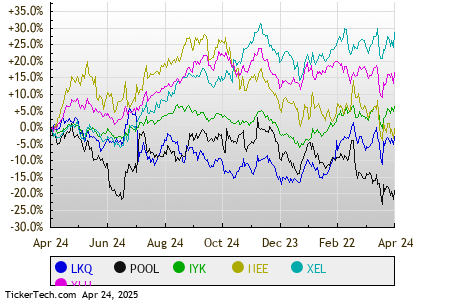

Over the past year, Jacobs Solutions’ stock has seen a decline of 1.1%, falling short compared to the S&P 500 Index’s 6% gain and the Industrial Select Sector SPDR Fund’s (XLI) 2.5% rise during the same period.

Analysts’ Ratings and Price Target

Following the announcement of its Q1 earnings on February 4, Jacobs’ stock price dropped by 3.5%. The company reported a 4.4% increase in gross revenue, totaling $2.9 billion, largely thanks to a 4.8% rise in revenue from Infrastructure & Advanced Facilities. Additionally, adjusted EBITDA surged by 23.6% year-over-year to $282 million.

Current consensus on Jacobs Solutions’ stock is moderately optimistic, reflected in a mean rating of “Moderate Buy.” Among 15 analysts covering the stock, seven recommend a “Strong Buy,” two recommend a “Moderate Buy,” and six recommend a “Hold.” The average price target stands at $146.25, indicating a potential upside of 22.7% from the current price level.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.