Jacobs Solutions Inc. Kicks Off Fiscal 2025 with Strong Q1 Results

Jacobs Solutions Inc. began fiscal 2025 on a positive note, as its first-quarter earnings and revenues beat the Zacks Consensus Estimate. In reaction to the earnings announcement, shares of this construction and technical services company rose by over 1.6% in pre-market trading.

Stay informed on market trends and developments with the Zacks Earnings Calendar.

Financial Performance Overview

For the quarter ending December 24, 2024, Jacobs reported adjusted earnings per share (EPS) of $1.33, surpassing the consensus estimate of $1.29 by 3.1%. This figure, however, reflects an 8.3% decline compared to the same quarter last year. The company’s revenues stood at $2.932 billion, which also exceeded expectations of $2.9 billion and marked a 4.4% year-over-year increase.

Jacobs experienced a remarkable 24.9% growth in adjusted operating profit, reaching $277 million. Additionally, its adjusted operating margin improved by 210 basis points to 13.3%. Adjusted EBITDA amounted to $282 million, up 23.6% year over year, yielding a margin of 13.5%, up from 11.5% in the previous year.

The company’s backlog grew 18.9% year over year to $21.8 billion, driven by strong project wins. The book-to-bill ratio for the quarter was 1.00x, while it stood at 1.3x for the preceding 12 months, indicating healthy demand and future revenue stability.

Segment Performance Insights

The Infrastructure & Advanced Facilities (IA&F) segment generated revenues of $2.92 billion, marking a 4.9% increase from last year. Adjusted net revenues, excluding pass-through revenue, were $1.78 billion—up 6% from a year ago. Operating profit in this segment soared by 25.6% to $210 million, with the margin improving by 185 basis points to 11.8%, thanks to enhanced operational efficiencies and successful project completions.

At the end of the quarter, the IA&F backlog was $21.48 billion, a rise from $18 billion in the previous year. Notably, the company achieved strong growth in its water and environmental business, with gross revenues increasing by 9.1% year over year. Key projects included the Jackson, Mississippi Water Treatment System, which focuses on design, program management, and operations & maintenance, aligning with global trends in water sustainability.

The critical infrastructure segment also saw notable growth, posting a 4.7% increase in gross revenue.

On the other hand, the life sciences and advanced manufacturing sector displayed mixed results. Although the life sciences area thrived, advanced manufacturing encountered challenges, resulting in only a 0.7% rise in gross revenue. However, Jacobs has secured multiple confidential life sciences projects, pointing to a promising future pipeline.

PA Consulting contributed $306.7 million in revenues, an increase of 0.2% compared to last year. The adjusted operating profit climbed 22.6% to $67 million, while the adjusted operating margin improved significantly, rising 396 basis points to 21.8%. The backlog at the end of the quarter totaled $331 million, up from $317 million a year ago.

Financial Health and Cash Flow Analysis

By the end of the first fiscal quarter, Jacobs held cash and cash equivalents totaling $1.3 billion, up from $1.14 billion at the end of fiscal 2024 on September 27, 2024. Long-term debt increased to $1.72 billion from $1.35 billion during the same period.

Net cash provided by operating activities was $107.5 million this quarter, compared to $418.4 million during the same quarter last year. Free cash flow recorded at $97.1 million marks a decrease from $401.1 million a year ago.

Jacobs’ Outlook for Fiscal 2025

Looking ahead, Jacobs expects adjusted net revenue to grow in the mid-to-high single digits year over year, anticipating consistent improvements each quarter. Adjusted EBITDA margins are projected in the range of 13.8%-14%, signaling ongoing efficiency gains.

The company anticipates adjusted EPS to be between $5.85 and $6.20, slightly above previous expectations of $5.80-$6.20. Jacobs aims for more than 100% free cash flow conversion from net income, highlighting its strong cash generation capabilities.

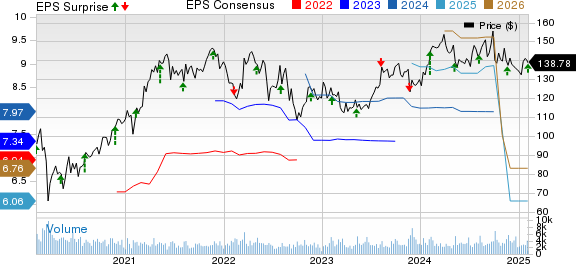

Jacobs Stock Update

Currently, Jacobs holds a Zacks Rank #3 (Hold).

For more insights, see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Developments in the Construction Sector

United Rentals, Inc. (URI) recently reported a mixed performance for the fourth quarter of 2024. Their EPS fell short of the Zacks Consensus Estimate, although revenues exceeded expectations, showing year-over-year improvement in both aspects.

Looking into 2025, United Rentals anticipates growth driven by strong demand and customer confidence. Their focus remains on achieving profitable growth, maintaining substantial free cash flow, and maximizing returns for shareholders, alongside the completion of their H&E acquisition.

Otis Worldwide Corporation (OTIS) also shared mixed results for the fourth quarter of 2024, with adjusted earnings falling short of estimates while net sales exceeded expectations. This marks their second consecutive earnings miss following 18 successful quarters of beating estimates.

Otis projects net sales between $14.1 billion and $14.4 billion, suggesting a slight decline or modest increase. Organic sales growth is anticipated in the range of 2% to 4%, with organic new equipment sales expected to decrease between 1% and 4%. In contrast, organic service sales are expected to rise by 6-7%.

Acuity Brands, Inc. (AYI) reported mixed outcomes in the first quarter of fiscal 2025 (ending November 30, 2024), where their earnings exceeded Zacks estimates, but sales did not meet expectations.

Acuity Brands Sees Strong Earnings Growth Amid Sales Decline

Anticipated Growth and Strategic Investments for Fiscal 2025

Acuity Brands, Inc. (AYI) recently reported earnings that surpassed market expectations for the 19th consecutive quarter. Despite this achievement, net sales fell short of expectations. The company’s Intelligent Spaces segment and an emphasis on innovation contributed significantly to improving profitability.

Looking ahead to fiscal 2025, Acuity Brands projects net sales between $4.3 billion and $4.5 billion. This forecast represents a solid increase from the $3.84 billion recorded in fiscal 2024. Additionally, adjusted earnings per share (EPS) are estimated to be in the range of $16.50 to $18.00, reflecting growth from the $15.56 reported last year. Acuity Brands plans to exercise caution in its capital expenditures, focusing on core business investments and potential mergers and acquisitions while also aiming to repay related debt within the next 12 to 18 months.

Investment Insights from Leading Analysts

In exciting market news, five experts from Zacks Investment Research have identified their top stock picks with the potential to double in value in the coming months. Among these, Director of Research Sheraz Mian has highlighted one company that he believes holds exceptional upside potential.

This selected company specifically targets millennial and Gen Z demographics, generating nearly $1 billion in revenue last quarter. A recent dip in its stock price suggests that now may be a strategic entry point for investors. While not all recommended stocks guarantee success, this one could very well follow in the footsteps of other standout performers like Nano-X Imaging, which saw a remarkable 129.6% increase in just over nine months.

Free: See Our Top Stock And 4 Runners Up

United Rentals, Inc. (URI): Free Stock Analysis Report

Acuity Brands Inc (AYI): Free Stock Analysis Report

Jacobs Solutions Inc. (J): Free Stock Analysis Report

Otis Worldwide Corporation (OTIS): Free Stock Analysis Report

Read more about this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.