JD.com Shows Strong Growth Amid Competitive Retail Landscape

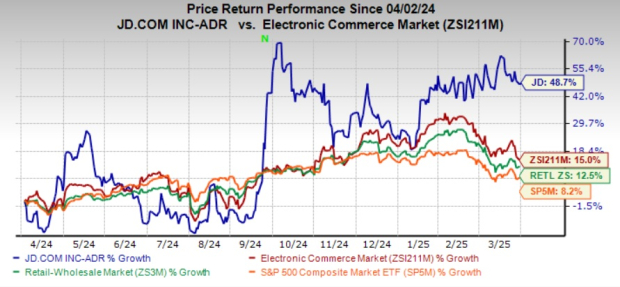

JD.com has achieved an impressive 48.7% return in the past 12 months, significantly outperforming the Zacks Retail-Wholesale sector and the S&P 500 index, which grew 12.5% and 8.2%, respectively. Furthermore, JD.com surpassed the Zacks Internet – Commerce industry, which increased by 15% during the same period.

JD.com’s exceptional performance highlights its dominant position as a supply chain-based e-commerce leader in China. This momentum has attracted investor interest, but there are deeper strengths that make JD.com a worthy addition to your investment portfolio. Here’s a closer look at the company’s attributes.

JD.com’s One-Year Price Return Performance

Image Source: Zacks Investment Research

Competitive Market Dynamics in Online Retail

The online retail landscape in China is highly competitive, with JD.com facing rivals such as Alibaba (BABA) and PDD Holdings Inc. Sponsored ADR (PDD). Globally, its major competitor is the e-commerce giant Amazon (AMZN).

Alibaba captures approximately 80% of the Chinese e-commerce market, while PDD Holdings attracts customers with significant discounts and group-buying options. Meanwhile, Amazon is known for its unbeatable prices, product variety, and convenience. Over the past 12 months, shares of Alibaba, PDD Holdings, and Amazon have returned 82.3%, 3.3%, and 6.5%, respectively.

In response to this fierce competition, JD.com is proactively enhancing its service offerings. The company aims to attract and retain PLUS members by adding new benefits such as lifestyle packages and improved return policies on electronics. It has also expanded its free shipping options and sought to make branded products more affordable.

Additionally, JD is venturing into on-demand retail services, including food delivery, to boost user interactions. This initiative aims to expedite delivery times and improve collaboration with high-quality restaurants, thus fostering customer trust and loyalty. JD continues to invest in its supply chain capabilities and innovative business models to secure long-term growth and profitability.

Harnessing AI for Enhanced Efficiency and Growth

JD.com is rapidly scaling its use of artificial intelligence (AI) to automate various processes and improve operational efficiency. AI technologies are already being utilized across critical areas, including marketing, customer service, search algorithms, and internal workflows. These advancements are streamlining traffic distribution and enhancing user engagement.

The firm has rolled out AI shopping assistants that deliver personalized search results and comparisons for users. AI is also revolutionizing JD’s supply chain and support for merchants. Algorithms are refining demand-supply matching, while logistical automation is driving down costs. With the strategic integration of AI, JD is poised to enhance efficiency, facilitate growth, and improve the overall user experience.

Strategic Initiatives Beyond Retail Operations

Through its JD Auto Service division, JD.com has made significant strides by partnering with Continental Tire to launch China’s first real-time tire delivery and installation service. This innovation provides JD.com with a notable competitive advantage by simplifying the tire purchasing process for consumers while expanding its automotive service offerings.

In the logistics space, JD has broadened its international footprint by opening its third warehouse in Poland, contributing nearly 10,000 square meters of storage space. This expansion is expected to enhance JD Logistics’s operational efficiency and facilitate quicker logistics solutions.

Moreover, JD Health has extended its commitment to rare disease patients through collaborative charity initiatives, positively impacting over 23,000 individuals. This program offers vital medical resources, financial support, and specialized consultations, thereby improving patient care and access to treatment.

Positive Earnings Estimates Signal Strong Future

The Zacks Consensus Estimate for JD.com’s 2025 earnings is set at $4.76 per share, reflecting a 6.73% upward revision in the past month. This projection indicates a year-over-year growth rate of 11.74%.

Image Source: Zacks Investment Research

The consensus forecast for 2025 revenues stands at $173.05 billion, suggesting a year-over-year growth of 7.65%. Notably, JD.com has consistently surpassed the Zacks Consensus Estimates in each of the last four quarters, achieving an average surprise of 25.23%.

Find the most recent EPS estimates and surprises on Zacks earnings Calendar.

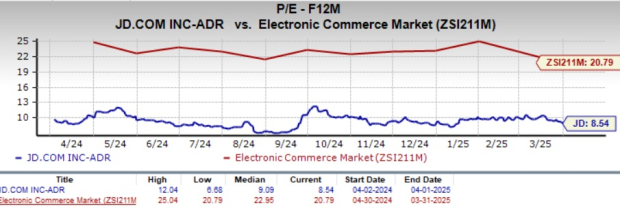

Attractive Valuation Points to Buying Opportunity

Currently, JD.com is trading at an attractive valuation, with a forward 12-month P/E ratio of 8.54X, significantly lower than the Zacks Internet – Commerce industry average of 20.79X. This discrepancy presents a noteworthy investment opportunity.

Additionally, JD.com’s Value Score of A, underlines its appealing valuation at this time.

JD’s P/E F12M Ratio Highlights Undervalued Status

Image Source: Zacks Investment Research

Here are compelling reasons to consider JD Stock now

As China’s economy continues to rebound and consumer sentiment improves, JD.com is optimistic about achieving sustainable growth through 2025. Supportive government policies and extensive AI adoption are enhancing operational efficiency. Coupled with robust strategic initiatives, JD.com is well-positioned to maintain its competitive edge in a challenging market, paving the way for long-term success.

The company’s approach to shareholder benefits is equally noteworthy, with a 32% increase in its annual dividend to $1.00 per ADS and the continuation of a $5 billion share repurchase program, making the Stock increasingly appealing. JD.com’s substantial valuation discount compared to its industry could offer investors a meaningful margin of safety.

JD.com Shows Strong Investment Potential Amid Growth Opportunities

JD.com, Inc. (JD) currently presents a compelling investment case, particularly as it navigates a growth strategy across various verticals. The company’s shares are trading at a discount, creating an attractive opportunity for investors looking for stability and long-term gains. With a Zacks Rank of #1 (Strong Buy) and a Growth Score of B, JD.com stands out based on Zacks’ proprietary methodology, suggesting a favorable outlook for potential investors.

Exciting Potential for Rapid Growth

In the midst of a competitive market landscape, JD.com continues to execute its strategies effectively. Investors may find this discounted valuation particularly appealing against the backdrop of the company’s ambitious plans. This scenario highlights an opportunity for those eager to secure future returns in a robust environment.

Top Growth Picks for 2024

Additionally, Zacks Investment Research features five stocks identified as potential home runs, handpicked by their experts as the #1 favorites to appreciate by 100% or more in 2024. While past performance does not guarantee future results, previous selections have achieved remarkable gains, such as +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this report remain undervalued in the eyes of Wall Street, presenting prime opportunities for early investment. For a closer look, explore the current list of these recommended stocks.

Accessing Expert Recommendations

For those interested in capitalizing on these insights, Zacks Investment Research is offering a downloadable report on the 7 Best Stocks for the Next 30 Days. This opportunity allows investors to gain access to the latest recommendations and market analysis.

Key stock analyses available include:

- Amazon.com, Inc. (AMZN)

- JD.com, Inc. (JD)

- Alibaba Group Holding Limited (BABA)

- PDD Holdings Inc. Sponsored ADR (PDD)

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein belong solely to the author and do not necessarily reflect those of Nasdaq, Inc.