JD.com Stock Soars: Is It Time to Invest or Hold Back?

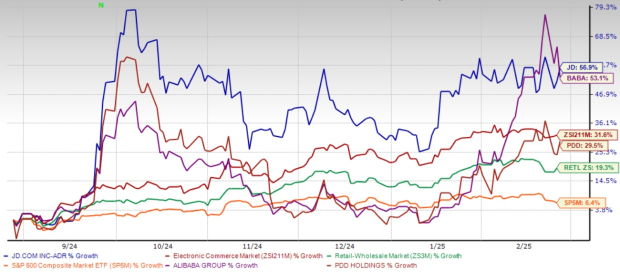

JD.com‘s stock has gained significant attention as its shares soared 56.9% over the past six months. In comparison, the Zacks Retail-Wholesale sector recorded a 31.6% return, while the S&P 500 achieved a 6.4% increase. JD outperformed its key competitors — Alibaba (BABA) and PDD Holdings (PDD) — with BABA’s shares rising 53.1%, and PDD’s increasing by 29.5% during this same period.

Analyzing 6-Month Performance

Image Source: Zacks Investment Research

This remarkable growth stems from JD.com’s efforts to strengthen its market position through enhanced services, strategic investments, and a focus on profitability, which matches the improving consumer sentiment in China. However, after such a rapid rise, investors must now consider whether JD stock is still a smart buy or if they should wait for a better opportunity.

Strong Q3 Results Highlight JD’s Growth

In its third-quarter 2024 earnings report, JD.com displayed impressive growth across essential financial metrics. Net revenues rose by 5.1% year over year to RMB260.4 billion (US$37.1 billion), surpassing analyst predictions. The company also improved its profitability, with non-GAAP net income attributed to ordinary shareholders increasing by 23.9% to RMB13.2 billion (US$1.9 billion), resulting in a net margin of 5.1%, an increase from 4.3% a year prior.

JD’s strong financial position is illustrated by its robust share repurchase program. The company completed a $3 billion share buyback initiated in March 2024 and announced a new $5 billion program set to continue through August 2027. In the first nine months of 2024, JD repurchased around 8.1% of its outstanding shares, reflecting management’s belief in its true value.

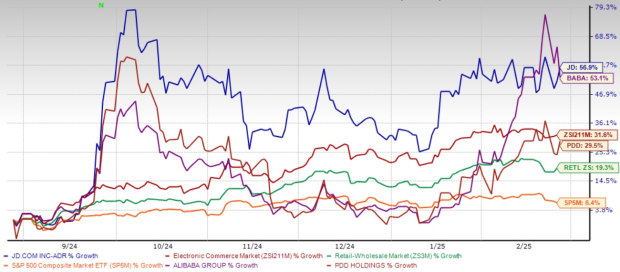

The Zacks Consensus Estimate for 2025 revenues stands at $166.43 billion, indicating a 6.22% year-over-year growth, while earnings are expected to grow by 7.73%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Supply Chain Excellence Fuels JD’s Performance

During the third-quarter earnings call, CEO Sandy Xu highlighted that JD.com’s success originates from a “relentless focus on building supply chain capabilities and logistics infrastructure.” This strategy proved beneficial as JD played a crucial role in China’s trade-in program for home appliances, backed by its strong brand loyalty and comprehensive services that include delivery, installation, and dismantling.

The general merchandise segment, especially in supermarkets, has experienced notable growth, with an 8% year-over-year increase in revenues. Additionally, JD’s user engagement looks promising, with quarterly active customers rising at double-digit rates for four consecutive quarters and shopping frequency maintaining a double-digit year-over-year growth in Q3.

Innovations and User Engagement Strengthen JD.com

JD.com is focused on expanding its user ecosystem with new features that promote customer loyalty. Ahead of the Chinese New Year, the company introduced a gift-giving feature and significantly upgraded its JD PLUS membership program, which now includes lifestyle services, improved free shipping, and premium replacement policies. Notably, JD PLUS members spend an average of 10 times more than non-members per year and increase their spending by 150% after subscribing.

JD’s Stock Valuation Amidst Competition

Assessing JD.com’s valuation reveals an interesting prospect; it is currently trading at a forward 12-month P/E of 8.9X, in stark contrast to the industry average of 24.13X. This valuation discount stems from concerns regarding China’s economic growth and regulatory factors, even as recent government stimulus appears to uplift consumer sentiment.

Valuation Insights: JD’s Discounted P/E Ratio

Image Source: Zacks Investment Research

JD is well-equipped to exploit China’s burgeoning e-commerce landscape, as management expresses cautious optimism regarding economic trends. Despite facing stiff competition from Alibaba, PDD Holdings, and newer players in specialized markets, JD’s expansion into fashion and beauty sectors, supported by investments of RMB3 billion and RMB1 billion respectively, signals its commitment to thrive in higher-margin areas where it previously lagged behind Alibaba’s Tmall. The company is bolstering both its direct sales (1P) and marketplace (3P) offerings to combat competitive pressures.

Recently, JD Logistics partnered with Alibaba’s Taobao and Tmall platforms, allowing merchants on these platforms to utilize JD’s logistics services. This strategic partnership could enhance JD’s logistics revenues while demonstrating its robust infrastructure even amid competition.

Investment Outlook: Hold or Wait for a Better Value

Even with JD.com’s strong recent performance and attractive valuation, a careful approach may be prudent for near-term investors. The sharp rise in stock prices over the last six months implies that much of the positive news might already be factored in.

While government stimulus brings promising momentum, uncertainties about the sustainability of China’s economic recovery and potential regulatory changes remain. Executives at JD have described their outlook as “cautiously optimistic.”

For existing investors, holding the stock is valid given JD’s strong fundamentals, ongoing share repurchasing, and continuous operational improvement. However, potential new investors may wish to wait for a more opportune entry point, possibly during anticipated market fluctuations in 2025, when the impacts of government stimulus and the company’s strategic plans become more visible.

In conclusion, JD.com stands as a formidable entity in China’s e-commerce space, showcasing impressive financial discipline and growth strategies. However, timing one’s investment requires thoughtful evaluation given recent performance and overall market conditions. JD.com currently holds a Zacks Rank #3 (Hold). A complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Discover Zacks’ Top Stock Pick for Future Gains

Our research team has identified five stocks with the highest potential for a gain of +100% or more in the coming months. Notably, the Director of Research, Sheraz Mian, highlights one stock as the leading choice.

This standout pick is part of an innovative financial firm with a rapidly expanding customer base (over 50 million) and a range of cutting-edge solutions, positioning itself for significant increases. While not all our elite selections are guaranteed winners, this one holds the potential to significantly outperform previous Zacks picks like Nano-X Imaging, which soared by +129.6% in just over nine months.

Free: See Our Top Stock and Additional Recommendations

If you’re interested in Zacks Investment Research’s latest stock recommendations, you can download the report titled “7 Best Stocks for the Next 30 Days” for free.

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.