JD.com’s food delivery segment is rapidly expanding, aiming to capture a share of China’s online food delivery market, projected to reach $181.43 billion by 2033. In Q3, the company reported revenues of RMB15.6 billion, a 213.7% increase year-over-year, despite facing significant operating losses of 100.9% due to aggressive customer acquisition spending. Marketing expenses surged by 110.5% in the same period, highlighting the high costs associated with scaling.

While JD.com posted an estimated fourth-quarter revenue of $51.61 billion—a year-over-year growth of 8.57%—the company faces intense competition from Alibaba and Grab, both of which are also scaling their food delivery services amid margin pressures. JD emphasizes supply chain innovation as a unique differentiator, compared to its competitors’ strategies focused on ecosystem monetization and user engagement.

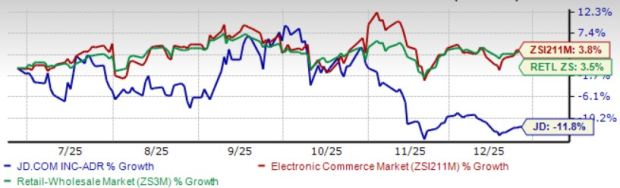

JD.com shares have declined 11.8% over the past six months, contrasting with the Zacks Internet-Commerce industry and Retail-Wholesale sector’s increases of 3.8% and 3.5%, respectively. The company is currently trading at a forward price-to-earnings ratio of 9.38X, significantly lower than the industry average of 24.4X.