Jefferies Sees Promise in RxSight with New Buy Rating

Analysts Predict Significant Growth

On October 29, 2024, Jefferies began coverage of RxSight (NasdaqGM:RXST) with a Buy recommendation. According to data from October 22, 2024, the average one-year price target for RxSight stands at $66.15 per share. Currently, forecasts vary between a low of $54.54 and a high of $78.75, suggesting a potential increase of 26.83% from its most recent closing price of $52.16 per share.

For insights into companies with promising price target upside, see our leaderboard.

Financial Outlook for RxSight

Projected annual revenue for RxSight is set at $112 million, reflecting a slight decline of 3.11%. The anticipated annual non-GAAP earnings per share (EPS) sits at -1.72.

Current Fund Sentiment

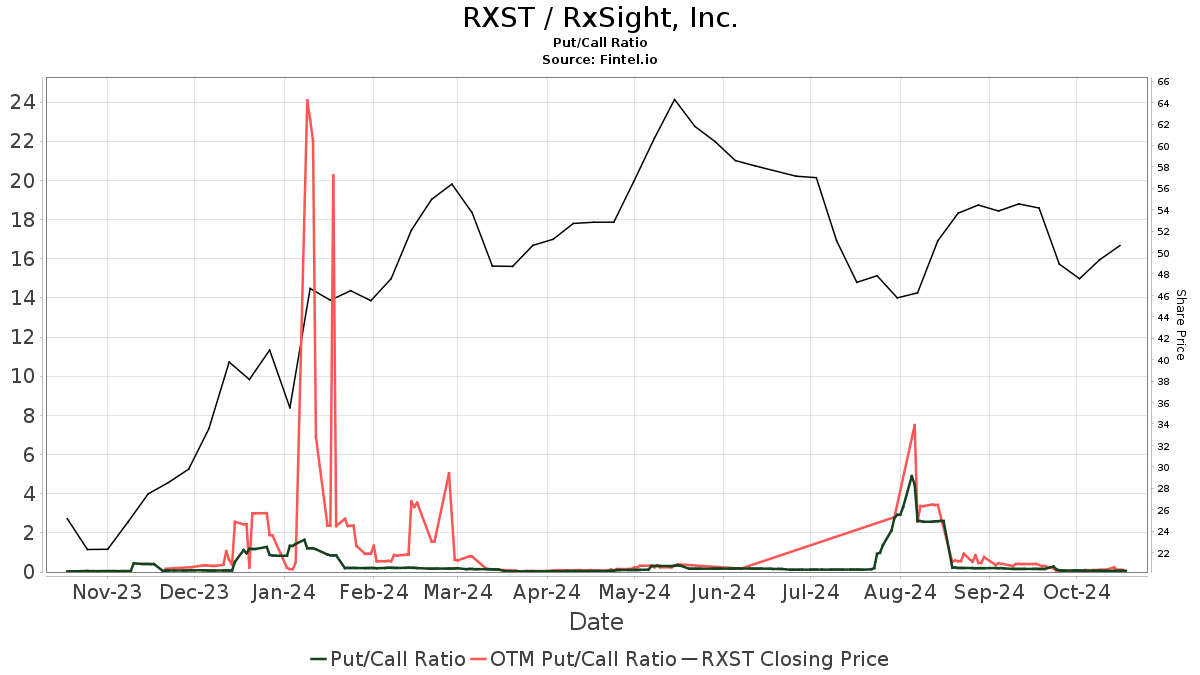

RxSight is attracting attention from 458 funds and institutions, an increase of 31 owners or 7.26% compared to the previous quarter. The average portfolio weight dedicated to RxSight by these funds is currently 0.22%, an increase of 2.66%. In total, institutional ownership rose by 3.46% over the last three months, reaching 38,315K shares. Notably, the put/call ratio for RXST is 0.13, indicating a generally bullish sentiment.

Institutional Shareholding Patterns

Ra Capital Management is the largest stakeholder, holding 3,695K shares, which is 9.31% of the company. Their latest filing shows a 6.82% increase from a previous 3,443K shares. Over the last quarter, they boosted their allocation in RxSight by 29.13%.

Lord, Abbett & Co. holds 1,735K shares, accounting for 4.37% ownership. However, they reported a decrease of 2.14% from their previous holding of 1,772K shares. They did increase their overall portfolio allocation in RxSight by 17.10% during the quarter.

Artisan Partners Limited Partnership owns 1,334K shares, which is 3.36% of the company. This reflects a significant decrease of 42.11% from their prior holding of 1,896K shares. Their allocation dropped by 14.90% over the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) has increased its position to 1,107K shares, signifying 2.79% ownership. This is a rise of 27.83% from the previously reported 799K shares, resulting in a 57.19% increase in allocation.

Invesco also added to its holdings, now owning 1,054K shares, or 2.66% of the company, up 27.06% from 769K shares. This marks a 57.46% increase in their portfolio allocation.

Fintel serves as a robust research platform providing insights for individual investors, traders, financial advisors, and small hedge funds. Our data spans global fundamentals, analyst reports, ownership trends, fund sentiment, and much more to enhance investment strategies.

To learn more, click here.

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.