Jefferies Boosts Xcel Energy to ‘Buy’ Amid Fund Shifts

Institutional Investment in Xcel Energy Sees Mixed Changes

On November 1, 2024, Jefferies elevated its rating for Xcel Energy (WBAG:XCEL) from Hold to Buy.

What Does the Fund Sentiment Look Like?

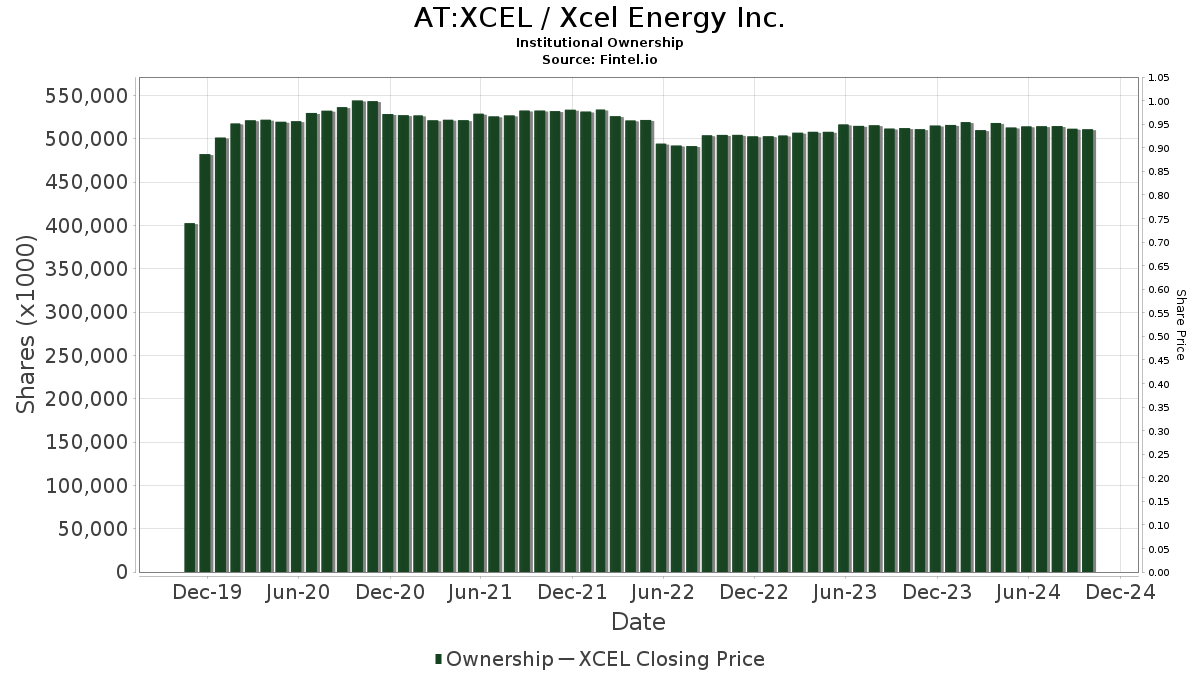

A total of 1,849 funds or institutions have reported holdings in Xcel Energy, marking an increase of 14 investors or 0.76% from the previous quarter. The average portfolio weight of all funds in XCEL is now 0.26%, reflecting a rise of 4.35%. However, total shares owned by institutions fell by 1.18% over the last three months, amounting to 508,454K shares.

Recent Moves by Other Shareholders

JPMorgan Chase currently holds 19,615K shares, which represents 3.52% ownership of Xcel Energy. This is an increase from 19,422K shares reported in the prior filing, showing a growth of 0.99%. Yet, its portfolio allocation for XCEL has decreased by 2.54% in the last quarter.

Another significant holder, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, owns 17,558K shares, translating to 3.15% ownership. The previous reporting indicated 17,488K shares, which constitutes a 0.40% rise, though its allocation for XCEL has dropped by 2.98% recently.

Geode Capital Management’s stake now stands at 14,300K shares or 2.57% of the company. They previously reported 13,847K shares, marking a notable increase of 3.16%, but made a considerable reduction in their allocation for XCEL by 49.11% last quarter.

Massachusetts Financial Services owns 14,298K shares, reflecting 2.56% ownership. Their previous allocation was 17,206K shares, representing a significant decrease of 20.34%. This firm has significantly lowered its holdings in XCEL, with a staggering 86.96% decrease in its portfolio allocation.

Lastly, VFINX – Vanguard 500 Index Fund Investor Shares holds 14,261K shares or 2.56% of Xcel Energy. This is an increase from the 13,907K shares they reported earlier, equating to a growth of 2.49%. Still, their allocation for XCEL has decreased by 3.54% in the last quarter.

Fintel is a significant platform for investment research, catering to individual investors, financial advisors, and small hedge funds.

Our data spans global fundamentals, analyst reports, ownership details, and much more, aiding investors in making informed decisions. Exclusive stock recommendations are driven by advanced quantitative models designed for increased profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.