Jefferies Upgrades Mercury Systems: What You Need to Know

Analysts Predict Price Decline Ahead

On November 11, 2024, Jefferies upgraded its rating on Mercury Systems (NasdaqGS:MRCY) from Underperform to Hold. Despite this upgrade, the average one-year price target for Mercury Systems stands at $30.98 per share as of October 22, 2024. This target suggests a potential decline of 29.44% from the current price of $43.91 per share, with estimates ranging from a low of $20.20 to a high of $42.00.

Strong Revenue Growth Forecasted

Mercury Systems anticipates projected annual revenue of $1.205 billion, marking an impressive increase of 40.33%. Additionally, the predicted non-GAAP EPS is expected to reach $2.79.

Fund Sentiment Levels Increase

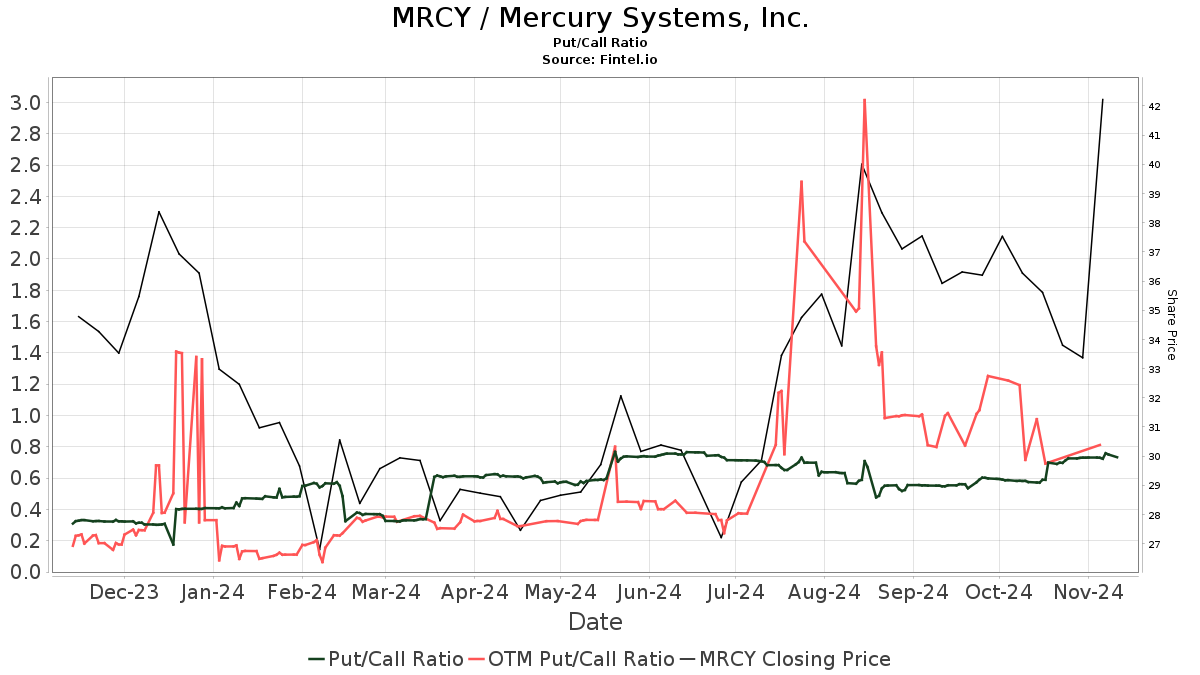

Current data shows that 519 funds or institutions hold positions in Mercury Systems, reflecting a minor increase of 15 owners or 2.98% in the last quarter. The average portfolio weight allocated to MRCY is now 0.17%, up by 12.72%. Over the past three months, the total institutional shares have risen by 4.23% to 77.297 million shares. A put/call ratio of 0.73 suggests a generally bullish sentiment toward the stock.

Activity Among Key Shareholders

William Blair Investment Management has notably increased its stake, now holding 7.3 million shares, which accounts for 12.24% of the company. This is an increase of 12.10% from their previous holding of 6.416 million shares. They have raised their portfolio allocation to MRCY by 46.67% in the last quarter.

On the other hand, JANA Partners Management maintains its 11.61% ownership with 6.925 million shares, showing no changes within the last quarter. Meanwhile, IJR – iShares Core S&P Small-Cap ETF holds 3.377 million shares, a 5.66% ownership stake, but has decreased its holdings by 4.88% after previously owning 3.542 million shares.

Starboard Value has reduced its shares to 2.294 million, reflecting a reduction of 16.13%, while Victory Capital Management has slightly decreased its holding from 1.814 million to 1.765 million shares, marking a 2.74% decline. However, it increased its portfolio allocation for MRCY by 16.20%.

About Mercury Systems

(Company Overview)

Mercury Systems is a prominent technology provider in the aerospace and defense sectors. Based in Andover, Massachusetts, the company offers innovative solutions designed to meet the complex needs of both industry and government clients. With a focus on high-tech developments dedicated to mission success, Mercury Systems continually works to ensure optimal performance even under demanding conditions.

Fintel is a comprehensive investing research platform for individual investors, financial advisors, and hedge funds. It provides insights on analytics, ownership data, fund sentiments, and other critical market information.

Learn more by visiting our website.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.