Jefferies Upgrades Apple Rating Amid Positive Forecasts

Fintel reports that on April 9, 2025, Jefferies upgraded their outlook for Apple (NasdaqGS:AAPL) from Underperform to Hold.

Analyst Price Forecast Indicates Significant Upside Potential

As of April 1, 2025, the average one-year price target for Apple stands at $256.14 per share. Predictions vary, with a low estimate of $185.70 and a high of $341.25. This average price target reflects a substantial increase of 48.56% from Apple’s most recent closing price of $172.42 per share.

See our leaderboard of companies with the largest price target upside.

Projected Revenue and Earnings

The projected annual revenue for Apple is $456.34 billion, marking an increase of 15.31%. Additionally, the expected annual non-GAAP earnings per share (EPS) is calculated at 7.28.

Fund Sentiment Analysis

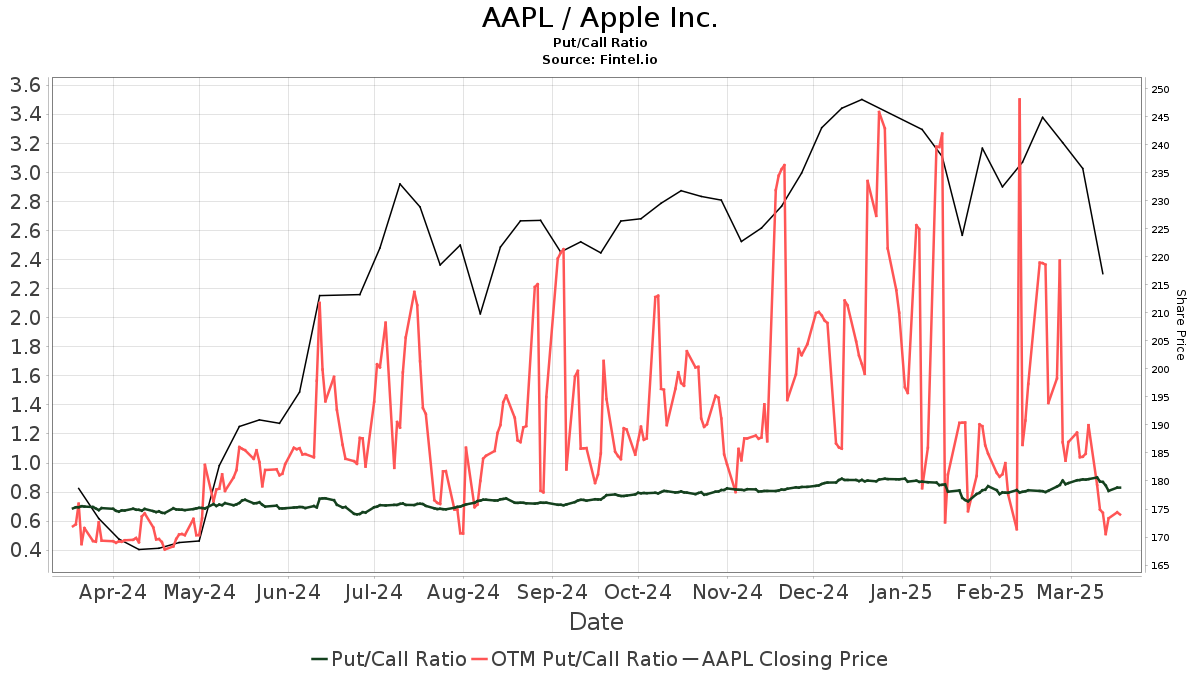

Currently, there are 7,663 funds and institutions reporting positions in Apple. This represents an increase of 554 owners, or 7.79%, in the last quarter. The average portfolio weight across all funds for AAPL is 3.84%, indicating a rise of 15.31%. Institutional ownership rose by 3.85% in the last three months, totalling 10,702,170,000 shares.  The current put/call ratio for AAPL is 0.76, signaling a bullish sentiment among investors.

The current put/call ratio for AAPL is 0.76, signaling a bullish sentiment among investors.

Institutional Shareholder Movements

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 473,592,000 shares, accounting for 3.15% ownership. This marks an increase from its previous holding of 457,849,000 shares, a change of 3.32%. The firm also raised its portfolio allocation in AAPL by 9.56% during the last quarter.

The VFINX – Vanguard 500 Index Fund Investor Shares owns 409,170,000 shares, representing 2.72% ownership. Previously, it reported 398,082,000 shares, illustrating an increase of 2.71%. The firm adjusted its portfolio allocation in AAPL by 4.51% last quarter.

Geode Capital Management holds 340,165,000 shares, which is 2.26% ownership. Their previous filing indicated ownership of 333,858,000 shares, reflecting an increase of 1.85%. The firm’s AAPL portfolio allocation was increased by 4.89% in the past quarter.

Berkshire Hathaway maintains 300,000,000 shares, constituting 2.00% ownership, with no changes reported for the last quarter. Price T Rowe Associates holds 220,108,000 shares, or 1.47% ownership. They noted a decrease from 235,581,000 shares, reflecting a 7.03% downturn, but still increased their AAPL allocation by 0.54% in the last quarter.

Overview of Apple Inc.

(This description is provided by the company.)

Apple Inc. is an American multinational technology company located in Cupertino, California. The company designs, develops, and sells consumer electronics, computer software, and online services. Considered one of the Big Five in the U.S. technology sector—alongside Amazon, Google, Microsoft, and Facebook—Apple’s hardware lineup includes the iPhone, iPad, Mac computers, and other devices. Software offerings include iOS, macOS, and productivity applications such as Final Cut Pro X and Logic Pro. Founded in April 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple quickly evolved from selling its first personal computer to becoming a major player in the tech industry.

Fintel is recognized as one of the most comprehensive investing research platforms available for individual investors, traders, financial advisors, and small hedge funds.

Our data spans global markets and includes fundamentals, analyst reports, ownership data, and fund sentiment, as well as options sentiment and insider trading. We provide advanced, backtested quantitative models to enhance profit potential.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.