Investors navigating the volatile waters of the market are often torn between reaping the benefits of tech stock growth and garnering income through dividend stocks. With a robust portfolio packed with premier tech stocks and a generous 9% dividend yield, the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) stands as a beacon, offering a dual advantage in a single ETF.

My optimism for this sought-after dividend ETF from JPMorgan Chase & Co. (NYSE:JPM) stems from its collection of top-rated tech and growth stocks, monthly dividend disbursement, and above-average dividend yield. Yet, every investment avenue comes laden with risks, and it’s essential to dissect these intricacies.

Delving into JEPQ’s Strategy

JPMorgan elucidates, “JPMorgan Nasdaq Equity Premium Income ETF seeks to deliver monthly distributable income and Nasdaq 100 exposure with less volatility.”

Functioning as an actively managed fund, JEPQ invests in Nasdaq 100 Index (NDX) stocks and engages in covered call options to provide a monthly income stream to its investors. Despite its recent launch in May 2022, the ETF has swiftly amassed $11.6 billion in assets under management (AUM), securing a spot among the market’s largest actively managed ETFs.

JEPQ appeals to both income-oriented and growth-seeking investors. Apart from monthly distributions, it generates income by owning dividend stocks and leveraging covered calls to fortify its revenue streams.

The allure of JEPQ lies not only in its monthly payouts but also in its striking 9% yield, towering above the average returns offered by various U.S. equities, 10-year treasury bonds, global REITs, and high-yield bonds. However, a high yield often comes with its trade-offs.

While JEPQ promises a significant monthly income, investors must be willing to forsake a portion of potential total returns. The fund’s strategy of selling covered calls limits the upside from underlying stock price appreciation, warranting a careful consideration of the risk-reward balance.

For instance, despite a remarkable 36.2% total return in 2023, JEPQ trailed the Invesco QQQ Trust (NASDAQ:QQQ), showcasing the potential trade-off between income and total returns.

Investors embracing JEPQ must comprehend this trade-off, prepared to forego higher total returns for a steady influx of monthly income, making JEPQ a valuable addition to a diversified portfolio.

Furthermore, it’s essential to note that JEPQ may allocate up to 20% of its assets into equity-linked notes (ELNs), adding a layer of complexity to its investment approach.

The Pragmatism of Experience

One compelling facet of JEPQ is the seasoned team steering its complex strategy. Lead portfolio manager Hamilton Reiner boasts over three decades of experience in equities and equity derivatives, backed by an illustrious tenure in the investment domain. Reiner heads a team of two other seasoned managers, ensuring a steady hand at the helm of JEPQ’s investment strategy.

Reiner, spearheading the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) as well, brings a wealth of knowledge to navigate the intricacies of dividend-oriented investing.

Digging into JEPQ’s Portfolio

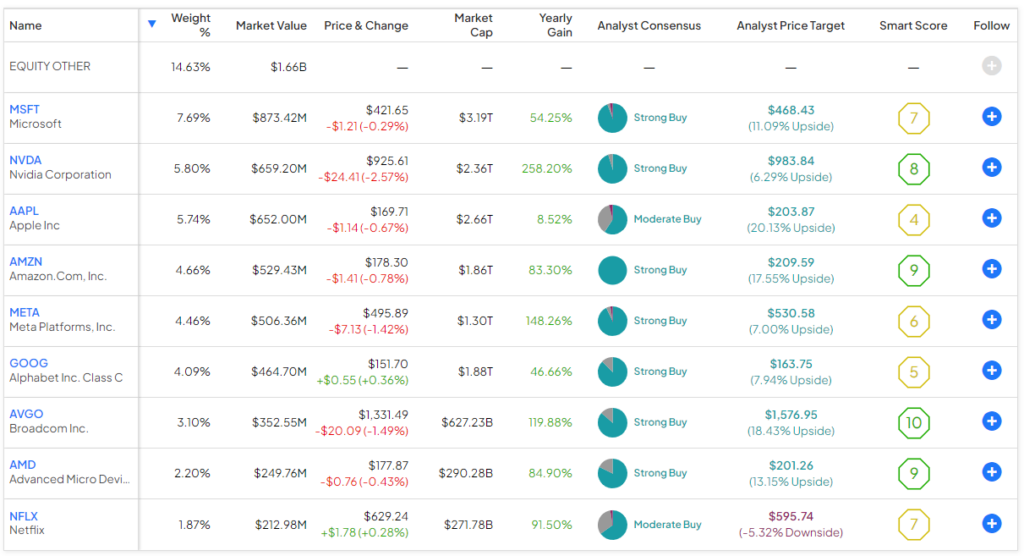

With 88 positions in its arsenal, JEPQ’s top 10 holdings comprise over half of the fund’s total weightage. The fund’s holdings bear a striking resemblance to the Nasdaq’s tech juggernauts such as Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Broadcom (NASDAQ:AVGO), showcasing an explicit tilt towards tech and growth-oriented stocks.

Aside from tech behemoths, JEPQ maintains positions in other prominent Nasdaq entities like Pepsi (NASDAQ:PEP), Costco (NASDAQ:COST), and Mondelez (NASDAQ:MDLZ), reaffirming its commitment to dividend-yielding instruments.

Analyzing JEPQ’s Proposition

Featuring an expense ratio of 0.35%, JEPQ offers investors an opportunity to partake in an active ETF with a meticulous strategy at a reasonable cost. The expense ratio, while not as inexpensive as some broad-market index funds, stands well below the industry’s average, rendering it an attractive proposition for investors.

Expert Insights and Projections

According to Wall Street consensus, JEPQ clinches a Moderate Buy rating, supported by 78 Buys and 10 Holds in the past three months. The average price target of $58.77 underscores an 8.5% upside potential for JEPQ, as per analysts’ projections.

Embracing the Dividend Deluge

For investors willing to forego some upside potential in a bullish market environment, JEPQ presents an enticing avenue to bolster their portfolio with substantial monthly income. The ETF’s 9% yield coupled with exposure to dynamic tech and growth stocks distinguishes it from conventional high-yield ETFs. My optimism for JEPQ is rooted in its robust portfolio, generous dividend yield, and consistent payout schedule.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.