In a customer-friendly move, JetBlue Airways JBLU recently announced plans to expand its network in Puerto Rico. The low-cost carrier also revealed plans to introduce the highly popular Mint service — JBLU’s take on premium travel — to three cities. As part of its expansion move, it also intends to start flying to three more Caribbean destinations.

Let’s delve deeper.

To boost its presence in Puerto Rico, management announced that from October, it will add flights to six new destinations from its capital city, San Juan. The new destinations include Providence, Santiago, St. Croix and Westchester County. Flights to these places will operate on a daily basis. Flights on the San Juan- Medellín, Colombia route will operate four times a week and those on the San Juan- Cancún, Mexico route will operate thrice a week.

Moreover, to boost the flying experience of passengers, JBLU will offer its Mint service on a daily basis between San Juan and New York’s John F. Kennedy International Airport from July.

Management has also decided to make its Mint service available on more flights, including those to Phoenix and Vancouver. Under the huge expansion plan, the carrier announced that it will double its service from New York and Boston to Phoenix, apart from reintroducing service from Fort Lauderdale to Phoenix.

JetBlue, currently carrying a Zacks Rank #3 (Hold), has also decided to introduce Mint service on its daily flights between New York and Vancouver, British Columbia. It also intends to start flights on the New York – St. Vincent and New York – Bonaire routes. Finally, it has decided to reintroduce daily flights on the San Juan – St. Croix route from December.

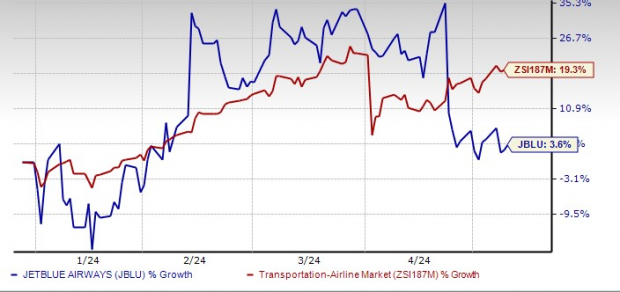

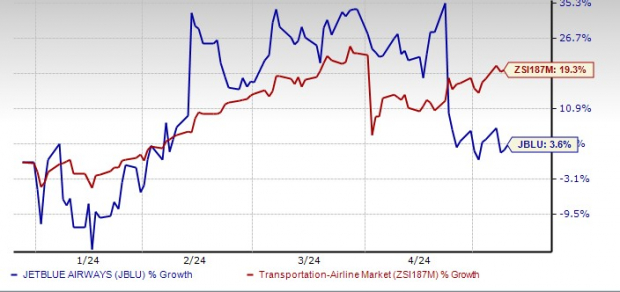

With buoyant air-travel demand scenario, the huge expansion plan is undoubtedly a prudent move by management and may boost JBLU shares, which have gained only 3.6% year to date compared with its industry’s 19.3% growth.

Image Source: Zacks Investment Research

Airline Stocks to Consider

Investors interested in the airline industry may consider SkyWest SKYW and Ryanair RYAAY. SkyWest presently sports a Zacks Rank #1 (Strong Buy) while Ryanair carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SkyWest’s fleet modernization efforts are commendable. Upbeat air-travel demand also supports the company. The Zacks Consensus Estimate for SKYW’s 2024 earnings has improved 6.6% over the past 60 days. The stock has surged 204% in the past year.

SKYW has an expected earnings growth rate of more than 100% for 2024. The company delivered a trailing four-quarter earnings surprise of 128.09%, on average.

RYAAY is benefiting from buoyant air-traffic scenario post Covid. Traffic grew 10% during the first nine months of fiscal 2024. Management expects fiscal 2024 traffic to be 183.5 million. On the back of buoyant traffic scenario, its profit after tax also showed year-over-year improvement during the first nine months of fiscal 2024.

Load factor (percentage of seats filled by passengers) was a healthy 94% in the first nine months of fiscal 2024. The carrier’s measures to expand its fleet, to cater to the rising travel demand, also look encouraging.

Free Report – The Bitcoin Profit Phenomenon

Zacks Investment Research has released a Special Report to help you pursue massive profits from the world’s first and largest decentralized form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts another significant surge. Click below for Bitcoin: A Tumultuous Yet Resilient History.

Download Now – Today It’s FREE >>

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.