Subscription-Based Tech Companies Show Resilience in Market Downturn

Technology firms utilizing subscription-based business models are better positioned to withstand economic challenges, particularly during ongoing selloffs in the tech sector, as reported by CNBC’s Jim Cramer. Analyzing market data, he noted bullish trends for both Netflix Inc. NFLX and Spotify Technology SA SPOT based on information from Benzinga Pro.

Recent Market Insights

According to technical analysis by chartist Bob Lang, which Cramer reviewed, there is a favorable outlook for Spotify and Netflix, with Roku Inc. ROKU also potentially gaining traction. Cramer emphasized the strength of their subscription models amidst fluctuating economic conditions.

“If I were to invest, I would purchase common stock of Spotify, I would buy common stock of Netflix, and consider call options on Roku to mitigate risk,” Cramer suggested during his Mad Money show this past Monday.

Netflix Analysis

Year-to-date, Netflix is up 9.62%, outperforming many of its technology counterparts, as noted by Cramer. Recent daily charts reflect a rebound in share prices accompanied by increased trading volume. The MACD indicator illustrates a bullish crossover, which is considered a positive signal for potential investors.

As of Monday’s market close, Netflix’s share price was $971.99, trading above both its short- and long-term averages. Its relative strength index (RSI) sits at 54, indicating a neutral trading zone.

Despite this, the MACD reveals a bearish trend, reporting a score of -2.52. This suggests the 12-period exponential moving average (EMA) is below the 26-period EMA. However, the histogram indicates a positive figure of 6.14, signifying that the MACD line is rising toward the signal line, suggesting a potential reduction in bearish momentum.

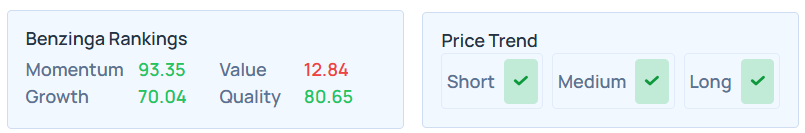

Benzinga’s Edge Rankings reflect strong price performance over various time frames. The momentum ranks in the 93.35th percentile, while historical earnings and revenue growth is also solid at the 70.04th percentile. For further valuation and fundamental information, refer to the source.

Spotify Overview

Cramer noted that Spotify, which surged by 32.09% in 2025, is capitalizing on the increasing popularity of music streaming. He pointed out that its MACD is positive and indicates a robust subscription model.

Spotify’s stock price is also above its eight-, 20-, 50-, and 200-day moving averages, further signifying a bullish trend. The RSI stands at a neutral 57.19.

Similarly, its MACD indicator confirms bullish momentum, with a positive MACD score of 4.48, showing that its 12-period EMA is above the 26-period EMA.

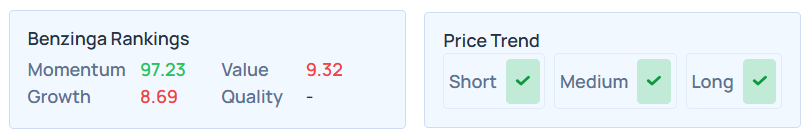

Benzinga’s Edge Rankings for Spotify also demonstrate a strong price trend across short, medium, and long-term horizons. Its momentum ranks high at the 97.23rd percentile. However, other rankings are less favorable, so click here for more details.

Market Price Movements

In premarket trading on Tuesday, NFLX was down 0.047%, and SPOT saw a decrease of 0.12%.

In contrast, the SPDR S&P 500 ETF Trust SPY and the Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and the Nasdaq 100 index, respectively, saw increases in premarket trading. The SPY rose by 0.10%, landing at $574.62, while the QQQ increased by 0.043% to $490.87, according to Benzinga Pro data.

Read Next:

Photo courtesy: Shutterstock