Fintel reported that on February 28, 2024, JMP Securities began covering Gritstone bio (NasdaqGS:GRTS) with a remarkable Market Outperform commendation.

Analyst Projections Indicate 258.52% Upside

By February 24, 2024, Gritstone bio’s average one-year price target was set at 10.20. Estimates varied from a low of 6.06 to a high of $21.00. This average target represents a massive 258.52% surge from the latest closing price of 2.84.

See our list of companies with the most significant upsurge in price targets.

Gritstone bio is estimated to generate annual revenue of 6MM, reflecting a 40.43% decline. The projected annual non-GAAP EPS stands at -1.46.

Digging Deeper: Fund Sentiment Exploration

Currently, 194 funds or institutions hold positions in Gritstone bio. This marks a reduction of 8 owners or 3.96% from the previous quarter. The average portfolio weight among all funds targeting GRTS is 0.06%, demonstrating an 83.51% increase. Institutional shares decreased by 12.64% over the last three months, now totaling 43,829K shares.

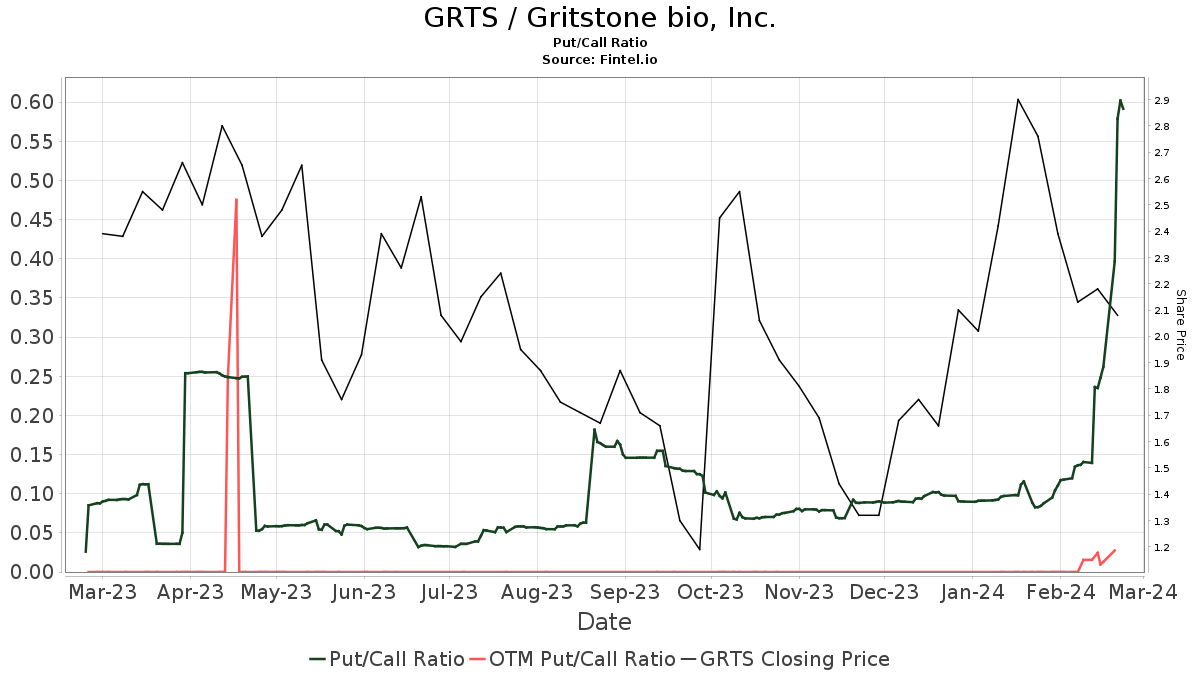

The put/call ratio for GRTS stands at 0.80, signaling an optimistic outlook.

Insights on Shareholder Actions

The Redmile Group retains 5,873K shares, equivalent to 6.16% ownership of the company. In the prior filing, the group disclosed ownership of 8,509K shares, indicating a decrease of 44.90%. They lessened their portfolio allocation in GRTS by 38.47% in the last quarter.

Point72 Asset Management holds 3,975K shares, amounting to 4.17% ownership. Previously, they owned 5,925K shares, showing a decrease of 49.06%. Their portfolio allocation in GRTS reduced by 34.05% in the recent quarter.

Versant Venture Management retains 3,561K shares, representing 3.74% ownership with no changes in the last quarter. VTSMX – Vanguard Total Stock Market Index Fund Investor Shares hold 2,489K shares, equivalent to 2.61% ownership, with no changes reported recently.

IWM – iShares Russell 2000 ETF holds 1,999K shares, representing 2.10% ownership. In the past filing, they owned 1,974K shares, indicating an increase of 1.29%. Nevertheless, they decreased their portfolio allocation in GRTS by 6.52% in the last three months.

Background Info on Gritstone Bio

Gritstone Bio: Changing the Narrative

Gritstone Oncology, Inc., a progressive biotech firm, is revolutionizing immunotherapies against various cancers and infectious diseases. Their cutting-edge products are developed using two critical pillars – the proprietary Gritstone EDGETM machine learning platform and the capability to manufacture potent immunotherapies. This approach aims to stimulate the patient’s immune system to selectively target and eliminate disease-causing cells. Gritstone’s lead oncology programs, GRANITE and SLATE, focus on personalized neoantigen-based immunotherapy, and their infectious disease pipeline includes the COVID-19 program, CORAL. Furthermore, Gritstone has engaged in a global collaboration with Gilead Sciences for the development of a therapeutic HIV vaccine.

Fintel stands as a leading investment research platform catering to individual investors, traders, financial advisors, and small hedge funds. Our comprehensive data includes fundamentals, analyst reports, ownership insights, fund sentiment, options sentiment, insider trading data, unusual options trades, and more. Furthermore, our exclusive stock picks are driven by sophisticated, backtested quantitative models to enhance profitability.

Discover more with Fintel

This article was originally published on Fintel.

The opinions stated here are those of the author and do not necessarily mirror those of Nasdaq, Inc.