JMP Securities Lowers Outlook for Iovance Biotherapeutics to Market Perform

Fintel reports that on May 9, 2025, JMP Securities downgraded their outlook for Iovance Biotherapeutics (BIT:1IOVA) from Market Outperform to Market Perform.

Overview of Fund Sentiment

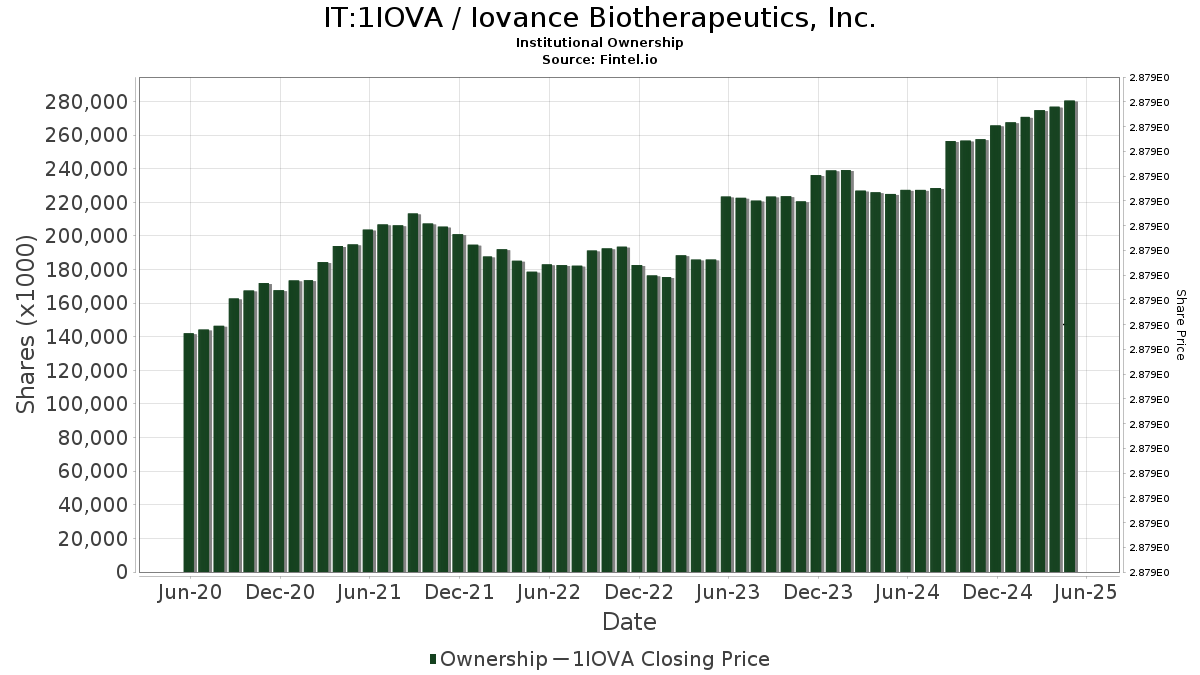

A total of 523 funds or institutions currently report positions in Iovance Biotherapeutics, marking an increase of 10 owner(s) or 1.95% in the last quarter. The average portfolio weight for all funds invested in 1IOVA is 0.16%, reflecting a rise of 15.99%. Additionally, the total number of shares owned by institutions grew by 2.93% over the last three months, amounting to 280,557K shares.

Shareholder Activity Analysis

Mhr Fund Management holds 24,417K shares, representing 7.45% of the company. Previously, they reported ownership of 23,997K shares, indicating a 1.72% increase. However, Mhr Fund Management has decreased its allocation to 1IOVA by 18.70% in the last quarter.

Perceptive Advisors owns 22,112K shares, constituting 6.74% of the company. Their earlier report showed ownership of 26,618K shares, which indicates a 20.38% decrease. The firm has also reduced its portfolio allocation to 1IOVA by 14.72% during the past quarter.

Hood River Capital Management maintains 8,992K shares, equating to 2.74% ownership. They previously held 8,145K shares, marking a 9.42% increase in ownership. Nonetheless, Hood River has decreased its portfolio allocation in 1IOVA by 20.44% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) owns 8,609K shares, representing 2.63% of Iovance Biotherapeutics. In its prior filing, the fund reported owning 8,718K shares, which is a 1.27% decrease. Furthermore, VTSMX has decreased its portfolio allocation in 1IOVA by 23.31% in the last quarter.

The iShares Russell 2000 ETF (IWM) holds 7,382K shares, representing 2.25% of the company. Previously, they reported ownership of 6,599K shares, showing a 10.61% increase. However, IWM has decreased its allocation to 1IOVA by 15.05% this quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.