Jones Trading Adjusts Equillium Outlook to Hold Amid Institutional Changes

Date: November 1, 2024

Funding Sentiment Shifts

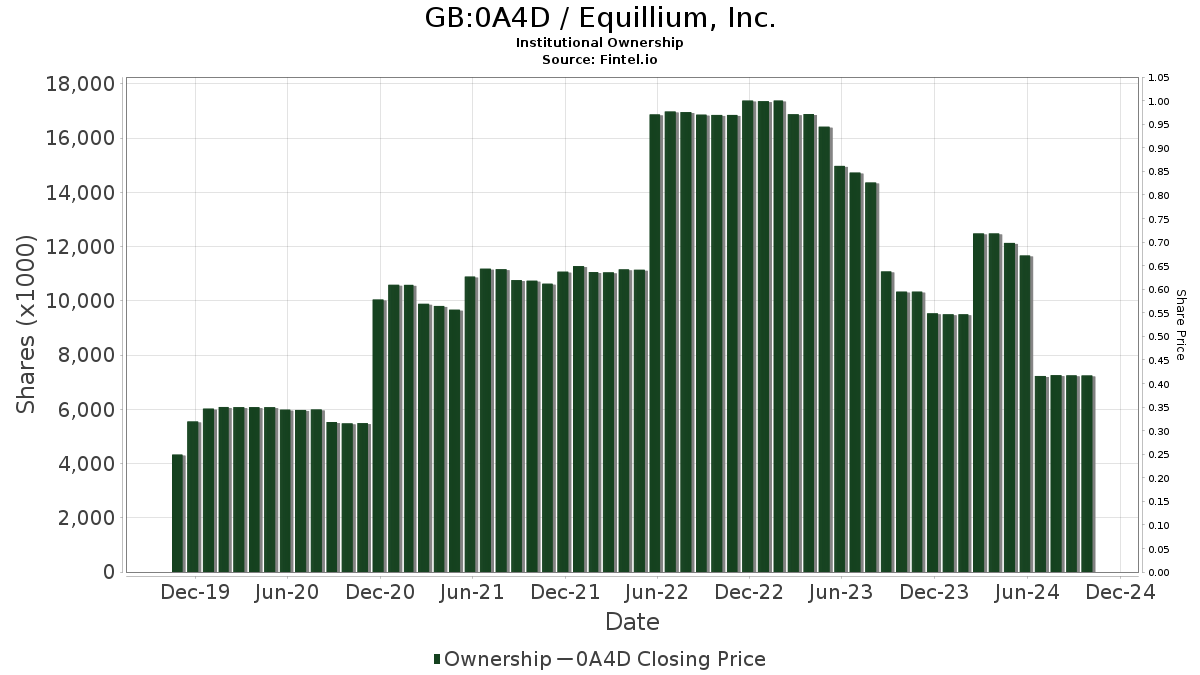

Fintel reports that Jones Trading has reduced its outlook on Equillium (LSE:0A4D) from Buy to Hold. Currently, 30 funds or institutions hold positions in Equillium, reflecting a decrease of 7 owners, or 18.92%, over the last quarter. The average portfolio weight for all funds in 0A4D is now 0.06%, which marks an increase of 41.05%. Meanwhile, total shares owned by institutions have slightly declined by 0.16%, totaling 7,247K shares.

Institutional Shareholding Trends

Among the notable shareholders, Decheng Capital continues to hold 4,447K shares, representing 12.55% of the company, with no changes over the last quarter. VTSMX – Vanguard Total Stock Market Index Fund Investor Shares possesses 571K shares, amounting to 1.61% ownership, also unchanged since last quarter. Similarly, Cota Capital Management maintains 562K shares for a 1.59% stake, while Renaissance Technologies increased its holdings to 300K shares, reflecting an impressive 30.36% rise from the previous reporting of 209K shares. However, it’s important to note that the firm has reduced its portfolio allocation in 0A4D by 53.48% in the last quarter.

Additionally, VEXMX – Vanguard Extended Market Index Fund Investor Shares holds steady at 247K shares, which equates to a 0.70% ownership, unchanged from the previous quarter.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, unusual options trades, and much more. Fintel’s exclusive stock picks are supported by advanced, backtested quantitative models that aim to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.