JP Morgan Downgrades Cooper Companies to Neutral Outlook

JP Morgan Changes Rating

On May 30, 2025, JP Morgan downgraded Cooper Companies (LSE: 0I3I) from Overweight to Neutral.

Analyst Price Forecast

The average one-year price target for Cooper Companies is projected at 108.68 GBX/share as of April 24, 2025. The estimates range from 91.84 GBX to 125.91 GBX, indicating a potential upside of 35.86% from the current closing price of 79.99 GBX/share.

Projected Revenue and EPS

Cooper Companies’ projected annual revenue stands at 4,014MM, reflecting a 0.65% increase. The expected annual non-GAAP EPS is 16.17.

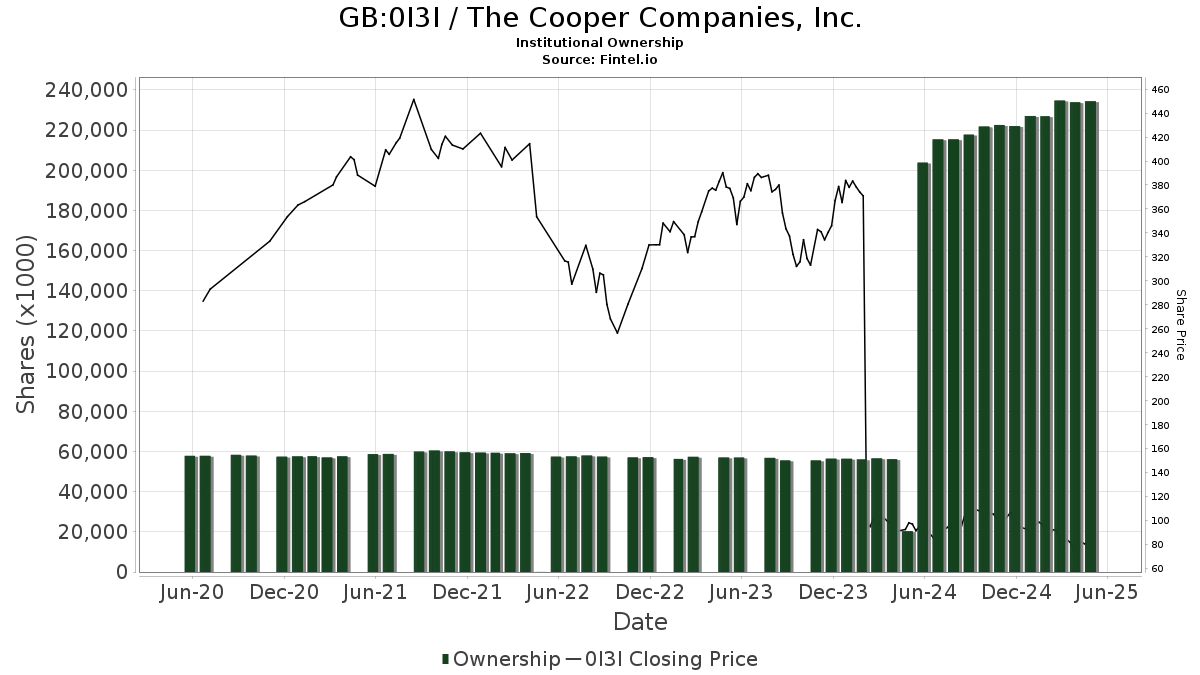

Fund Sentiment Analysis

Currently, 1,283 funds report positions in Cooper Companies, down by 4.61% or 62 owners from the last quarter. The average portfolio weight for these funds is 0.22%, up by 4.60%. Total institutional shares rose by 0.35% over the last three months to 235,521K shares.

Shareholder Actions

Kayne Anderson Rudnick Investment Management owns 7,985K shares, representing 3.99% ownership. This marks a decrease from 8,083K shares, a reduction of 1.22%. The firm lowered its allocation in 0I3I by 3.54% last quarter.

Capital World Investors holds 7,747K shares, indicating 3.87% ownership. Previously owning 4,189K shares, this is an increase of 45.93%. The firm’s allocation in 0I3I rose by 81.11% over the last quarter.

T. Rowe Price Investment Management reduced its holdings to 7,273K shares, or 3.64% ownership, down from 7,679K shares, a decline of 5.58%. The firm’s allocation in 0I3I decreased by 6.81% last quarter.

Vanguard Total Stock Market Index Fund Investor Shares owns 6,314K shares, representing 3.16% ownership, an increase from 6,256K shares, up by 0.92%. The firm decreased its allocation in 0I3I by 3.40% last quarter.

Vanguard 500 Index Fund Investor Shares has 5,545K shares, reflecting 2.77% ownership, growing from 5,391K shares, up by 2.78%. The firm lowered its allocation in 0I3I by 3.63% last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.