JP Morgan Initiates Neutral Coverage of Commercial Metals

On May 30, 2025, JP Morgan began coverage of Commercial Metals (BMV:CMC1) with a Neutral rating.

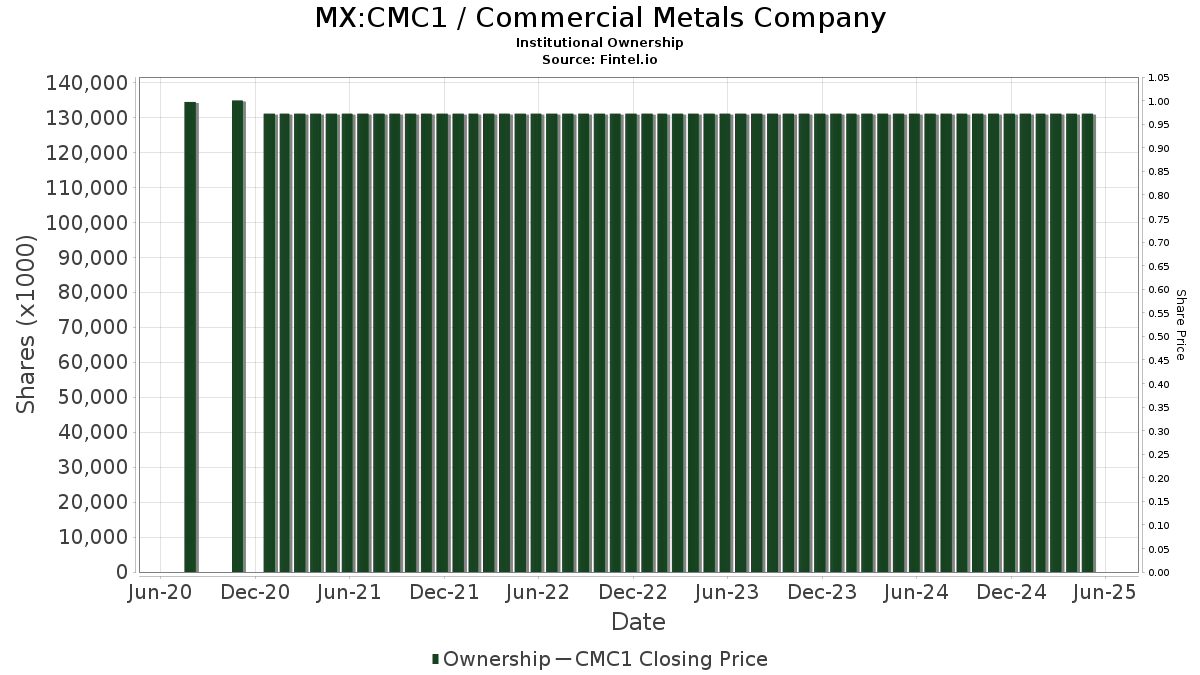

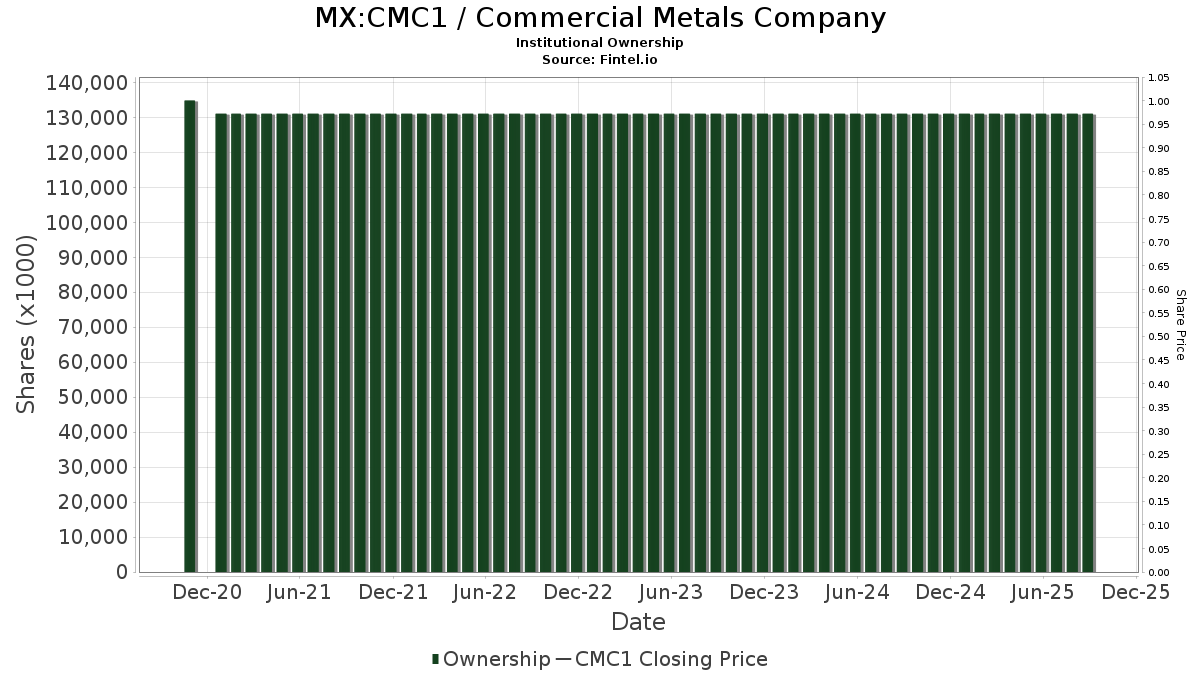

Fund Sentiment Analysis

A total of 720 funds report positions in Commercial Metals, marking an increase of 9 funds or 1.27% since last quarter. The average portfolio weight of all funds in CMC1 is 0.25%, a rise of 9.19%. However, institutional ownership declined by 2.94% over the past three months, bringing total shares owned down to 131,032K shares.

Changes Among Major Shareholders

Fuller & Thaler Asset Management now holds 4,161K shares, representing 3.47% ownership, up from 3,622K shares—a 12.96% increase. Its portfolio allocation in CMC1 increased by 9.31% last quarter.

FTHNX – Fuller & Thaler Behavioral Small-Cap Equity Fund Investor Shares holds 3,948K shares, or 3.29% ownership, up from 3,438K shares, reflecting a 12.91% increase, with a 12.94% rise in its portfolio allocation.

IJH – iShares Core S&P Mid-Cap ETF has 3,705K shares, representing 3.09% ownership, only slightly up by 0.21% from 3,697K shares, though its allocation decreased by 1.53% over the last quarter.

Boston Partners holds 3,605K shares, reflecting a decrease of 12.47% from 4,055K shares, resulting in a 65.86% reduction in its CMC1 portfolio allocation.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now has 3,604K shares, holding 3.00% ownership, increased from 3,539K shares by 1.81%, but with a 1.45% drop in portfolio allocation.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.