“`html

On November 14, 2025, JP Morgan initiated coverage of Enanta Pharmaceuticals (NasdaqGS:ENTA) with an Overweight recommendation, predicting a potential price increase of 62.04%. The average one-year price target is set at $19.53 per share, with estimates ranging from $9.09 to $29.40, based on the closing price of $12.05 per share as of November 9, 2025.

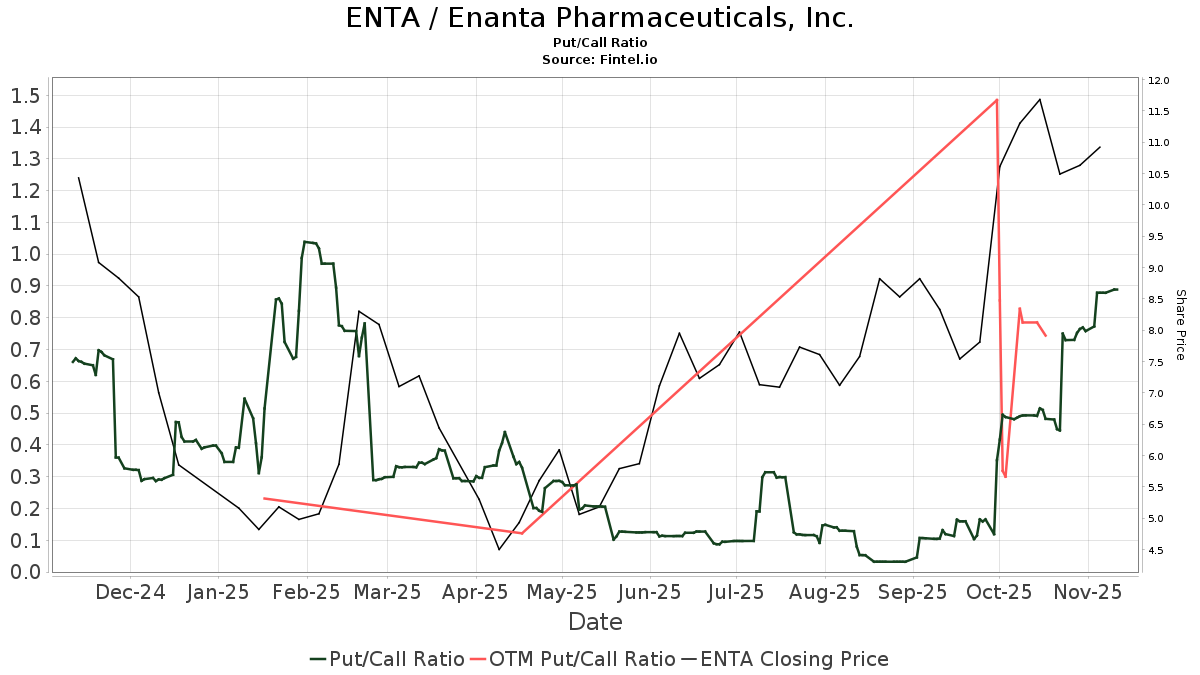

Enanta Pharmaceuticals is projected to generate annual revenue of $834 million, marking a significant increase of 1,186.29%. There are currently 275 funds reporting positions in the company, representing an increase of 7 funds (2.61%) in the last quarter, with total shares owned by institutions rising by 1.16% to 20,591K shares. The put/call ratio stands at 0.86, indicating a bullish outlook.

Notable shareholders include Farallon Capital Management with 2,122K shares (7.36% ownership), and Janus Henderson Group, which increased its stake from 524K to 1,947K shares (6.75% ownership), an increase of 73.10% over the last quarter.

“`