JP Morgan Lowers Estée Lauder’s Outlook Amid Institutional Shake-Up

On November 1, 2024, JP Morgan revised its outlook for Estée Lauder Companies (WBAG:ESLA), changing the rating from Overweight to Neutral.

Current Fund Sentiment Analysis

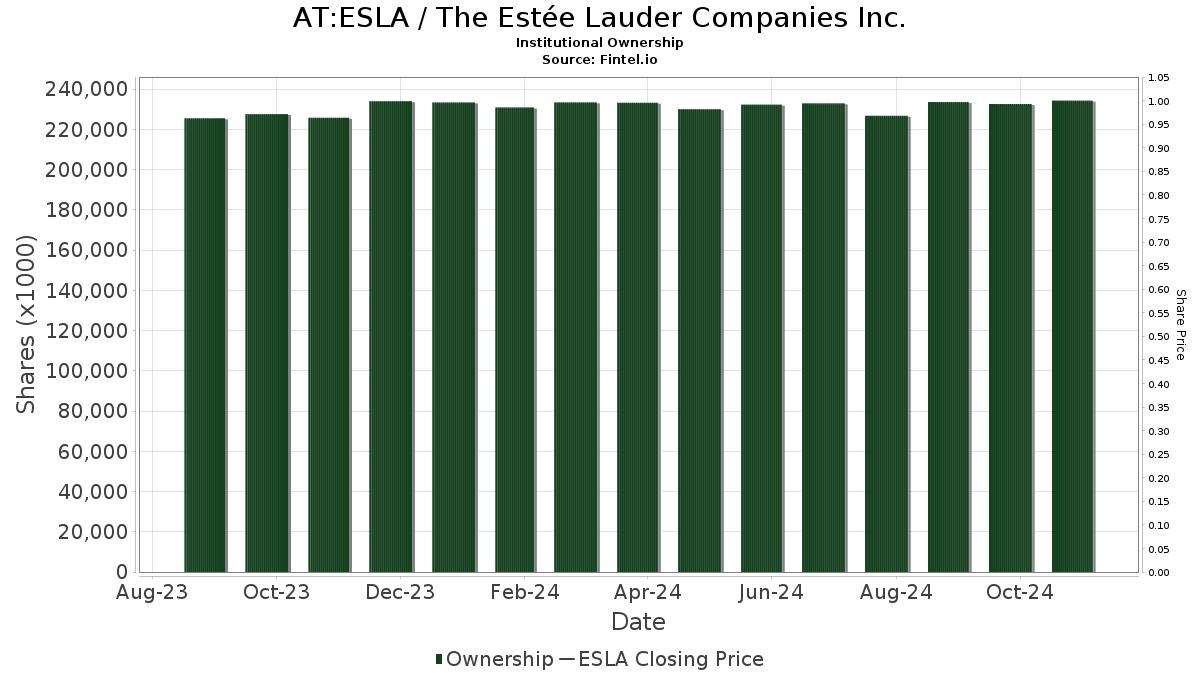

Estée Lauder Companies currently has 1,682 funds and institutions reporting positions in the stock. This marks a decline of 82 fund owners, or approximately 4.65%, in the last quarter. The average portfolio weight of all funds in ESLA now stands at 0.20%, reflecting an increase of 17.21%. Over the past three months, total shares held by institutions grew by 3.33% to reach 234,345K shares.

Changes in Major Shareholder Holdings

Edgewood Management owns 7,923K shares, equating to roughly 3.40% of the company. Previously, the firm reported 8,000K shares, indicating a decrease of 0.98%. Their overall allocation in ESLA has dropped by 31.01% in the last quarter.

Wellington Management Group LLP, on the other hand, has significantly increased its stake to 7,583K shares, or 3.25% ownership. This is a substantial rise from its last report of 2,448K shares, which translates to an increase of 67.72%. Their portfolio allocation in ESLA surged by 115.47% last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now holds 6,977K shares, representing 2.99% ownership. This marks a slight increase from the previous total of 6,946K shares, up by 0.44%. However, VTSMX has cut its allocation in ESLA by 32.58% over the same period.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 5,982K shares, which corresponds to 2.57% ownership. Previously, it had 5,870K shares, reflecting an increase of 1.87%. Yet, the total portfolio allocation in ESLA decreased by 33.41% in the last quarter.

Goldman Sachs Group owns 5,267K shares for a 2.26% company stake. Its previous holdings of 5,505K shares denote a decrease of 4.52%. Goldman Sachs has reduced its portfolio allocation in ESLA by 37.00% over the last quarter.

Fintel offers one of the most extensive investing research platforms available for individual investors, traders, financial advisors, and small hedge funds. Their comprehensive data spans across research, ownership statistics, and fund sentiments, ensuring informed investment decisions.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.