JP Morgan Boosts Cisco Systems Rating: A Deep Dive into Recent Financial Trends

JP Morgan Upgrades Cisco Systems

On November 11, 2024, JP Morgan raised its outlook for Cisco Systems (SNSE:CSCOCL) from Neutral to Overweight.

Current Fund Sentiment

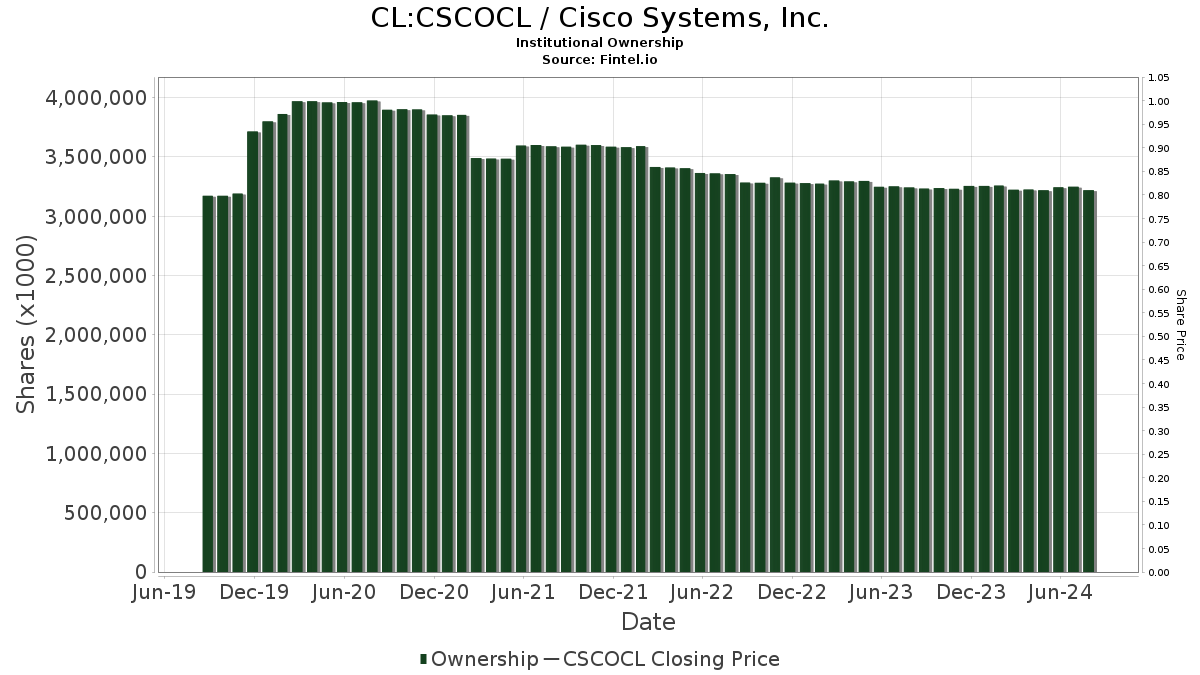

A total of 4,443 funds and institutions are currently reporting positions in Cisco Systems. This marks a slight decrease of 36 owners, or 0.80%, from the last quarter. The average portfolio weight for all funds dedicated to CSCOCL has increased to 0.58%, up by 4.40%. Over the past three months, the total shares owned by institutions rose by 3.10% to reach 3,263,300K shares.

Actions of Other Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 115,085K shares, equivalent to 2.88% of the company’s ownership. This is an increase from 114,484K shares reported previously, reflecting a rise of 0.52%. However, the firm has decreased its portfolio allocation in CSCOCL by 6.95% over the past quarter.

VFINX – Vanguard 500 Index Fund Investor Shares possesses 103,926K shares, which translates to 2.60% ownership. Previously, this firm reported 102,404K shares, marking an increase of 1.46%. They have reduced their portfolio allocation in CSCOCL by 8.55% this quarter.

Geode Capital Management holds a total of 94,368K shares, amounting to 2.36% ownership of Cisco. Their previous holding was 91,886K shares, showing an increase of 2.63%. Nevertheless, they decreased their portfolio allocation in CSCOCL significantly by 51.56% over the last quarter.

Charles Schwab Investment Management currently holds 81,043K shares, representing 2.03% of the company. Previously, this firm possessed 77,850K shares, an increase of 3.94%. Yet, they decreased their portfolio allocation in CSCOCL by 31.05% during the last quarter.

Invesco QQQ Trust, Series 1 holds 77,595K shares, constituting 1.94% ownership. Their prior ownership was 75,900K shares, leading to an increase of 2.18%. Despite this, they have decreased their portfolio allocation in CSCOCL by 12.40% over the last quarter.

Fintel provides one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds. Our extensive data encompasses global fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Furthermore, our exclusive stock picks are based on advanced, backtested quantitative models to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.