JP Morgan Downgrades Wolfspeed Outlook, Predicts Significant Price Drop

Fintel reports that on May 9, 2025, JP Morgan downgraded their outlook for Wolfspeed (LSE:0I4Q) from Neutral to Underweight.

Analyst Price Forecast Indicates 77.26% Downside

As of May 7, 2025, the average one-year price target for Wolfspeed is 6.39 GBX/share. This forecasted figure varies, ranging from a low of 2.12 GBX to a high of 13.98 GBX. The average price target suggests a decline of 77.26% from its most recent closing price, which was 28.08 GBX/share.

The projected annual revenue for Wolfspeed stands at 1,343 million GBP, marking an increase of 76.41%. Additionally, the expected annual non-GAAP EPS is 0.54.

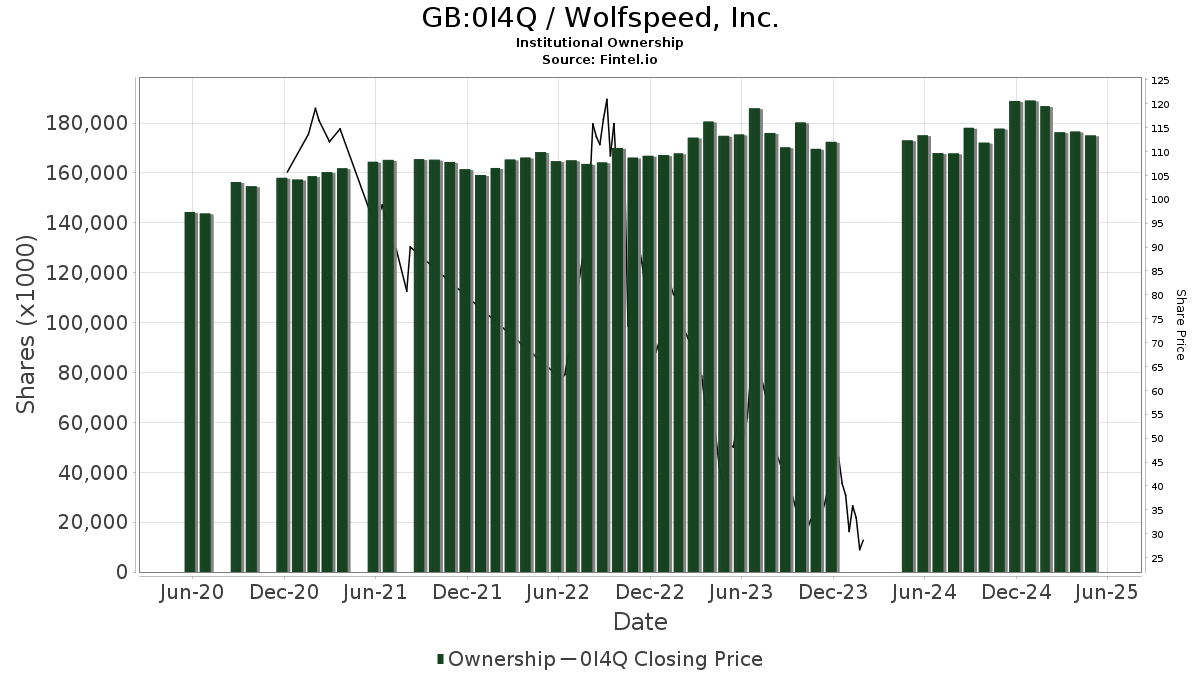

Current Fund Sentiment

There are currently 562 funds or institutions reporting positions in Wolfspeed. This represents a decrease of 44 owners, or 7.26%, compared to the previous quarter. The average portfolio weight of all funds dedicated to 0I4Q is 0.05%, reflecting a 26.58% increase. Over the last three months, total shares owned by institutions has fallen by 4.25% to 179,135K shares.

Movements Among Major Shareholders

UBS Group holds 17,106K shares, accounting for 11.00% ownership of the company. This marks an increase from their prior filing, which reported ownership of 6,353K shares—an increase of 62.86%. UBS also raised its portfolio allocation in 0I4Q by 56.84% last quarter.

Price T Rowe Associates owns 12,528K shares, equal to 8.05% ownership in the firm. Their previous filing indicated ownership of 8,004K shares, showcasing a 36.11% increase. They have raised their portfolio allocation in 0I4Q by 7.60% during the last quarter.

IJR – iShares Core S&P Small-Cap ETF holds 8,221K shares, amounting to 5.28% ownership. This is an increase from their prior holding of 7,999K shares, showing a rise of 2.69%. However, their portfolio allocation in 0I4Q has decreased by 30.57% over the last quarter.

TRMCX – T. Rowe Price Mid-Cap Value Fund holds 7,216K shares, representing 4.64% ownership. Previously reported ownership was 4,565K shares, reflecting a 36.74% increase. They also increased their portfolio allocation in 0I4Q by 10.04% over the last quarter.

Primecap Management possesses 6,665K shares, equating to 4.28% ownership. Their prior filing listed 6,519K shares, indicating a minor increase of 2.19%. However, their portfolio allocation in 0I4Q has decreased significantly, by 49.86%, over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.