JP Morgan Initiates Overweight Coverage for Xylem, Projects 13.35% Upside

On May 30, 2025, JP Morgan began coverage of Xylem (LSE:0M29) with an Overweight recommendation.

Analyst Price Forecast Indicates Growth Potential

As of May 7, 2025, the average one-year price target for Xylem is 142.76 GBX/share. This target ranges from a low of 116.40 GBX to a high of 174.09 GBX. It reflects a potential increase of 13.35% from the last closing price of 125.94 GBX/share.

Xylem’s Financial Projections

The projected annual revenue for Xylem is 6,497MM, marking a decrease of 24.44%. The expected annual non-GAAP EPS stands at 4.17.

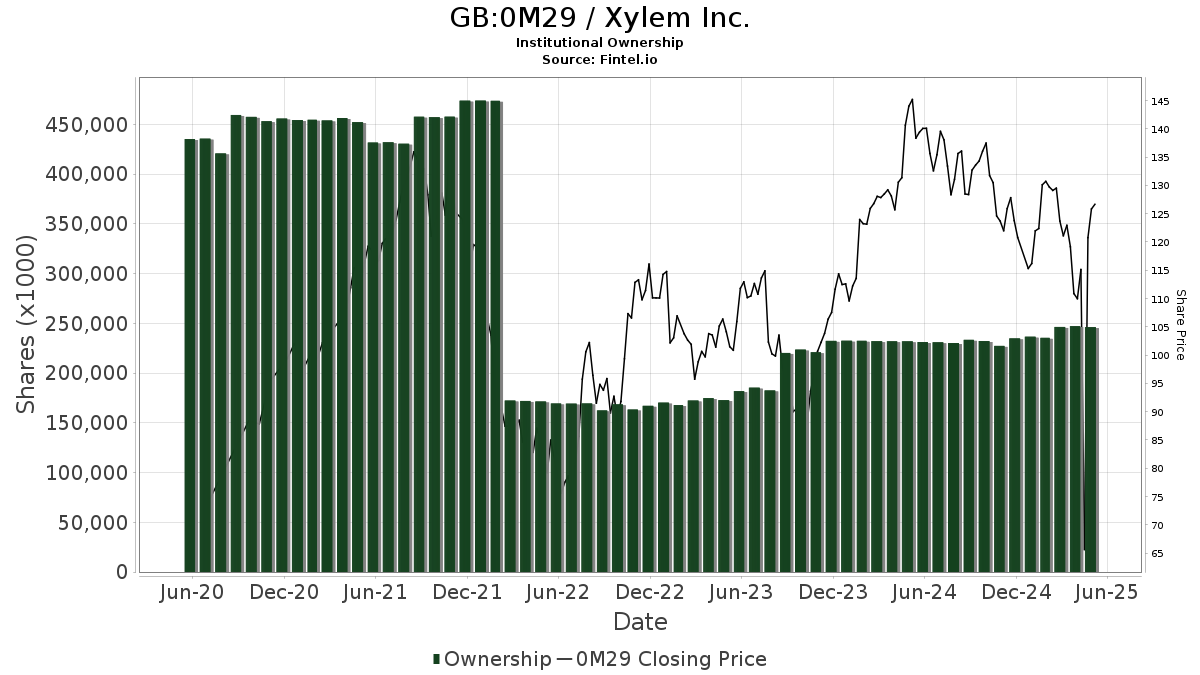

Fund Sentiment Overview

Currently, 1,738 funds or institutions hold positions in Xylem. This figure represents an increase of 13 owners, or 0.75%, in the past quarter. The average portfolio weight for all funds invested in 0M29 is 0.30%, up by 1.22%. However, total shares owned by institutions fell by 0.08% over the last three months to 246,195K shares.

Institutional Shareholder Activity

Aristotle Capital Management holds 7,946K shares, equating to 3.27% ownership, down from 8,272K shares, a decrease of 4.10%. The firm’s allocation in 0M29 increased by 2.26% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares owns 7,679K shares, or 3.16% of the company, an increase from 7,605K shares, representing a 0.97% rise. Their allocation in 0M29 grew by 8.46% last quarter.

Vanguard 500 Index Fund Investor Shares holds 6,749K shares, equating to 2.77% ownership, which is an increase from 6,576K shares, up by 2.57%. Their allocation in 0M29 rose by 7.91%.

Geode Capital Management possesses 6,005K shares, or 2.47% ownership, up from 5,804K shares, marking a 3.34% increase. However, their portfolio allocation in 0M29 decreased by 42.85%.

Vanguard Mid-Cap Index Fund Investor Shares owns 5,232K shares, representing 2.15% ownership, slightly up from 5,220K shares with a 0.22% increase. Their allocation increased by 4.17% last quarter.